INTRODUCTION

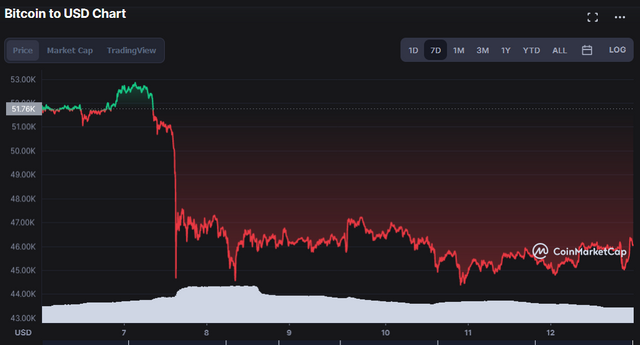

The recent week has brought quite a lot of emotions for all of those, who are involved in the crypto space. Exactly 7 days ago, we've all witnessed huge FLASH CRASH. One that brought the price of bitcoin down from 51k USD all the way to around 43k in just a matter of "minutes".

This massive drop has been very rapid and brutal. And it left so many over-leveraged investors with their positions being liquidated. Which is quite a painful experience.

It is estimated that $4 billion was liquidated within several hours. THAT IS HUGE!

I've spent some time trying to understand what could cause this flash-crash and figure out what to expect in the nearest future. Allow me to share my view with all of you and if anyone thinks I'm wrong - please do not hesitate to share your own view with me in the comment section below.

Most valuable feedbacks will be rewarded with JUICY UPVOTE :).

So please, continue reading.

WHAT HAPPENED on 7th of September?

I presume, that by now pretty much everyone is well aware of El Salvador accepting bitcoin as a legal tender. They are the very first country, which decided to go full-on against the current world monetary system by bringing those friendly crypto regulations into life. And for many investors, this sounded like a piece of amazing news.

And yet, the crypto market crashed the very same day. Which doesn't really look like a coincidence. Rather, it seems to be a very well-planned and executed "dump".

Many people seem to believe, that "EVIL" governments together with central banks were behind this flash-crash and they timed it well to bring attention away from El Salvador on its big day. And to some degree, I would agree with that theory. But ... obviously, there must be "but".

PAINFUL LIQUIDATIONS

Analyzing different data (which are available since Bitcoin is a transparent ledger) and listening number of youtube podcasts allowed me to understand the scale of HYPE which was associated with recent El Salvador friendly crypto regulations coming into space. I honestly don't remember when was the last time I've seen so much optimism in that market.

And it seems that many investors decided to over-leverage themselves. Betting heavily that the price of bitcoin will "go to the moon" once mass media will pick on that news related to Salvador. At the same time, it created an enormous opportunity for some "whales" to earn those few billions - simply by rapidly dumping their bitcoin and other major altcoins.

They achieve it by creating instant rapid selling pressure. One that caused many BULLS to have their over-leveraged positions automatically liquidated. Before they even had a chance to react. And the number of over-leveraged and super optimistic investors seemed to be higher than ever before.

And we can see how it all ended for them.

DeFi and LEVERAGING OUR POSITIONS - how does it work?

It's becoming clear to me, that more people must educate themselves in that area. I strongly believe, that everything has changed since DeFi became a thing and traders need to take into consideration that similar flash-crashes will continue to be happening in the future.

I'm myself still trying to wrap my head around it, but the way I see it (correct me if I'm wrong) is as follow:

If I'm an investor who purchased some Bitcoin, then I can use DeFi to get more stable coins while using my Bitcoin as a collateral. In a way, I'm "borrowing" more stable coins, which then I use again to purchase Bitcoin. Just to do it over again and again.

Simple, right?

And I could use this newly purchased bitcoin (which I bought using "borrowed" stable coins) again to borrow more stable coins and to purchase even more BTC. Over-leveraging positions, while assuming that I will GET RICH QUICK if the price of bitcoin will indeed grow.

Am I making sense so far? Is that the correct way of looking at those things?

So ... what would happen is I'm wrong? If the price of Bitcoin would plummet?

In that case - my positions would be simply liquidated. I would lose ALL my invested and leveraged funds. All of it. Which would mean, that regardless of my optimism towards the future of bitcoin - I would no longer have money to invest. I would become a USELESS BULL.

And millions of BULLS across the globe end up in similar positions. After all, 4 billion USD which belonged to those BULLS were wiped out. And it will obviously take some time to recover that loss. This buying pressure will not come back anytime soon. It's simple as that.

WEAK HANDS vs STRONG HANDS

Let's focus on more positive aspects for a moment.

According to Anthony Pompliano(one of my favorite market and crypto commentator), 93% of BITCOIN has not moved in a month. This is massive!

Supply held by long-term holders (so-called STRONG HANDS) is pretty much at All-Time High. If we look at this metric within the past 2 years, we would come to a simple conclusion: never before more investors with long-term HODLing timeframe would HODL bitcoin.

It's simple as that: currently, pretty much NOONE IS SELLING.

So why is the market currently not moving up? Are we stuck in another long-term "consolidation mode"? Allow me to share my view:

THIS TIME IT'S DIFFERENT - SUMMARY

In the past, we've seen a number of rapid crashes, followed by solid bounce-back (most of the time). However, if you look at the graph above you will notice that this time it's different. And one can wonder: why we didn't witness typical heavy bounce-back since selling pressure is almost non-existent ?

Hopefully, you've read part "DeFi and leveraging our positions" where I've explained my view and understanding on how over-leveraging and massive liquidation can affect the market and investors.

I strongly believe, that it's crucial to understand the major difference between flash-crashes which were happening in the past and the one we're witnessing now. Back then we would mostly experience the wave of PANIC SELL caused by so called FUD (which would start with some awful negative news). Back then, investors simply had a chance to move their funds either into stable coins or withdraw to FIAT. Without losing those resources. Knowing that they can re-invest them in the future.

Back then, DeFi didn't exist yet. Investors couldn't leverage their positions, while creating extra buying pressure since the large amount of Bitcoin is being purchased with those borrowed stable coins.

In other words:

currently, a huge part of buying is happening only thanks to investors, who use DeFi to leverage themselves (using their BTC as collateral). And to get more stable coins which would be then used to buy more Bitcoin. How simple and dangerous it is?

Once such a huge liquidation happens - all that buying pressure is completely wiped out. At it may take some time (or some massive positive news) to recover trust of those who lost their entire investments.

Therfore, I would expect long accumulation phase now and market movings sideways for upcoming weeks. At the same time I do not think price of Bitcoin has potential to move much lower below current price levels. So all we need is PATIENCE.

RESTEEM and COMMENT

Hopefully, I'm making sense. Share your view with me and let me know if you agree with my line of thinking or not. I read and appreciate all your valuable comments (juicy upvotes awaiting)

Yours, @crypto.piotr

Founder of Project.hope community

Important lessons from this:

Don't Leverage Trades. Debt doesn't hurt you in the good times, it kills you in the bad.

Also, finance is about relativity. Everything is relative to something else. Crypto is relative to the amount of fiat and fiat credit/debt that's in the system....just like any other capital asset.

Even though crypto is taking a larger market share of total global capital assets, it is still a guppie in shark infested waters (these numbers need updated, but the lesson is the same).

And the reason crypto gets knocked around so hard, is because it is only around a 2 trillion dollar market cap, in a system that is notionally worth at least 1 quadrillion dollars.

What is going to have the biggest influence on crypto, including DeFi, is how central banks influence global money supply and credit.

Even though we all think that crypto is the coolest thing since the internet...the global fractional reserve banking system has incredible influence on what direction crypto goes...both in policy and money supply.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've been hoping to see your comment @fijimermaid :)

It's however shorter than I expect. Usually your comments are 2 pages long ;)

It's hard not to agree. I found it very tempting to use DeFi to actually get more stable coins and purchase more BTC. But I resisted this temptation. And I'm glad I did.

ps. thanks for sharing this link. I wonder what "derivatives" are. I actually never heard this term before. How strange is that ....

Appreciate your feedback buddy,

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

LOL...2 pages long...that is so funny and true.

Derivatives are assets that derive their value from some other asset or income...like mortgage-backed securities. The vast majority of derivative assets are peer-to-peer (created and traded between institutions) and not transparent.

Crypto has derivatives as well. Technically, stablecoins are derivatives..because they’re value derives from fiat value...and hopefully secured with collateral protected from volatility.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey whats up Ive been day trading for my main income source the past 3 years and i have learned a lot but obviously noone can know everything. Heres my thoughts and it goes along with some of the topics you touched upon...

The main point of my thoughts on crypto is the idea of onboarding new users. Imagine up until the day you bought your first crypto... you never cared about crypto. But after you bought it you were laser focused.

Now crypto needs to go down after it goes up. this isnt just a get rich scheme people see crypto as a tool that is supposed to get them rich when thats not the case. thats just a byproduct of investing at the right time, but you cant say you got rich on crypto if you never withdrew any of your earnings... So you need to understand that people need to withdraw their money at somepoint...

Everyone rushes to try to blame the inherant forces of darkness anytime the market doesnt go in it's favor...

The trick is to realize that cryto always goes up and it always goes down. I try to sell crytp every week, but i usually set the money aside for the pure purpose of rebuying at specific points.

One crypto goes down its a great time to sell another thats up and buy that one, as long as you have researched and feel internally that its the time to buy.

the problem today is everyone wants to copy everyone else. so when one person says things like stonks and stuff on instagram, they just will instantly buy dodge and say theyre crytpo masters,

These are almost always the same people who will lose 10 bucks and cash out.

So when the price is up 95 percent every 10 days for a month straight, you need to realize that it takes time to convice NEW people to invest. so if everyone stops buying dodge at 50cents and says im not selling till 10 dollar moon, then the price will not moon cause everyone stopped.

Idk this is probably a crazy rant but just my two cents....

if 60 - 50 in minuits scares u... then u NEED to sell. and hold that money, beccause it is gaurenteed imo that it will be happening again soon.

Its not an evil force screwing ppl over. its people taking their profit and waiting to buy back later.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello, @crypto.piotr,

this is an interesting topic, I think that although "el salvador" managed to approve a regulation, the truth of the matter is that this country does not have the technological infrastructure to make BTC a legal tender, also international bodies do not approve this decision of "el salvador", I remember seeing in the media that a street food sale accepted BTC, my question when I saw this was how do they pay the network fees that are more than $ 20? I think this kind of actions only seeks to inflate prices and then leave thousands of investors without their money, I personally believe that if BTC fails to scale further in the digital economy (buying and selling products), other currencies will gain more and more ground and eventually, BTC will become a sentimental reserve currency, in other words only those who love the project will have BTC, they will under no circumstances sell their btc no matter if its value reaches zero.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @trabajosdelsiglo

Infrastructure can be build, once there is some clarity in regulations. I would say that it's better to make a bitcoin a legal tender and then work on building infrastructure than doing it other way around (infrastructure first and then regulations).

Based on my understanding, they are using second layer to do that. Which makes transfers cheap and fast. Correct me if Im wrong.

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello @crypto.piotr,

As I understand it, in that country less than half of the population has access to a good Internet, on the other hand the purchase of equipment such as smartphones or computers is not something that the common citizen can afford, from my point of view if a country wants to implement a serious regulation the first thing to do is to lower taxes on imports of technology, this will allow citizens to access technological resources that allow them to create the necessary infrastructure for the currencies to be implemented as legal tender, In short, if a country allows the free convertibility of currencies into fiat money, without first massifying access to the technology, it will only serve to allow the mafias present in the country to launder money without any control, I imagine that this is the fear of the big central banks that are not willing to accept this decision of the "saviour".

I hope my answer makes sense, best regards

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi @trabajosdelsiglo

I appreciate your comment. However, perhaps you could consider using some "enters" to separate different parts of this message. Reading such a long block of text is just ... not easy. Especially since you didn't even use "." and it's all like one super long sentence.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for the suggestion my friend, I wanted to transmit a lot but I think I still don't have that level with English.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @joshh71390

I don't think we had a chance to get to know each other and it may be my very first time I'm reading your comment.

When you mentioned that you've been daytrading - I expected to see some content related to it being published by you. However, it seem that you don't post about those kind of topics?

You've nailed it. It's hard to claim that we've earned anything, until we learn to take profits. I've learned it hard way in 2018.

I don't think "blaming" is what everyone does. Based on my experience, many investors are focusing their efforts on understanding possible reasons for pumps or dumps happening. And they are doing their best to adapt their strategy to those events.

I enjoyed your crazy rant :)

Let me also add: those few years (since I joined crypto space) touch me that whenever greed is sky rocketing and confidence towards future price (either it's trend upwards or future drop) would be very strong -> that is the time when some large players would go against it. Knowing that many investors over-leveraged themselfs. Knowing that by triggering those liquidations they will transfer enormous amount of wealth from over-leveraged people to their own pockets.

Hope I'm making sense.

Have a great weekend ahead of you,

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for your response I dont really talk to much about trading openly for a few reasons.

One if someone isnt directly asking you something about crypto trading then people arent very happy to take your advice ive learned.

and 2. i think i might have tried a few times back in the day to make some posts and I was blacklisted by markymark so i nevver posted about it again.

but long story short heres the type of trading Ill do. Tron compared to last week is up. I bought a good ammt back when it dipped to 0.07 cents because i had sold some at 0.09.

I was waiting and lastnight i saw tron hit 0.118 on poloniex.org which is one of the tron dexs.

So i sold 10k trx for 1180 and sure. the price will probably go up before it goes down. but from my previous experiences ive learned to not get so one track minded that it has to go one direction right now and I can wait for it to go back down to the 0.09s or 0.08s . for a quick easy 20 / 30% gain and while I wait for that to happen i do other things like this post. work on my javascript skills all of that good stuff but the trick is just to not have that ohh im gonna be rich / ohh the illuminauty is trying to bankrupt me. just have that I know the price will go up and down eventually mentality and wait for it.

long story short always just make your next move off the last one dont keep making a new strategy every day because u didnt get rich in one day ppl find a method that works for you not just some youtube video that you saw and need to emulate. Do things because you personally understand the logic behind your ideas and if you were a 10 year bull on btc dont let 60 minuites of priceaction change your ten year outlook on the currency

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've learnt a lot from your post thanks much.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @joshh71390 for being so responsive

I appreciate it greatly.

I'm sorry to hear that. Themarkymark is a very unique and aggressive user. Best is to avoid him at all cost.

Are you a programmer yourself?

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

well its been my main focus Im a jack of all trades but i think ive been skating around the idea of JS development for so long... I have always been able to get stuff running and make little changes. but ive been trying to put atleast 3 hours a day just to javascript tutorials. I actually run -> steemegg which was my first little project.

I have noticed you have been rebuilding some of the old infastructure and I want to make some big moves its just hard when theres such little other development.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A fantastic reflection and now I'm going to make you reflect on one more:

1- Bitcoin started with a price of $ 0.05 and nobody was betting on it and now it is at 47 thousand (and that nobody was betting on it)

2- Who controls the price of btc (no government or bank)

3- What is the nation that likes to control everything (China)

4-Who controls the price of all raw materials (china)

5-Who is interested by all means to sink everything that he cannot control (china)

6-What bank was not harmed by the covid-19 and also it has become even stronger (China)

7- Who can make the price plummet with a simple ad on the internet (elon musk and his friends for having the most btc)

With all this, I tell you that the fall of the btc was planned for a long time and that they were even more apprehensive to buy even more btc. I also take advantage of why I bought even more btc ahahaha

I am dedicated to advising people how to invest their money in the most profitable way and for now everyone is winning.

The btc is not an action of a company that can manipulate the company itself, the btc is something ... that everyone wants to control but no one can and will always continue to do so.

Now I'm going to tell you my prediction between now and December of this year. The btc will go up to 100,000 euros in the month of December and will be at that price for 2 days to 3 days it will go down 50%, after that everyone will say many things to keep it going down but it will stay and go up gradually, time to time. weather.

I hope you remember me or this comment that I put in your post and start to trust me a little more, NOW YOU JUST HAVE TO WAIT AND BECAUSE I SEE RIGHT NOW, THE PRICE IS GOING UP

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's me again @apoloo1

I'm not sure what do you mean. Learn to trust you a little more? Did I ever show any sign of distrust towards your views? Even if I disagree sometimes, I value and respect your opinion.

Once again, thanks for dropping by. Have a great weekend ahead of you,

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @crypto.piotr first of all I want to tell you that I'm really happy for your change of life.

It's a brave choice especially in this period of chaos both because of the pandemic and the general situation related to cryptocurrencies.

WoW, well done!!!

As for your post it's really a lucid view of the whole situation and I finally understood better the btc crash.

I love DeFi and all the opportunities it gives to invest and grow our earnings.

However, I think that even if we have the opportunity to invest by borrowing through the guarantee of the btc we hold by going into debt as you explained, to buy more btc, it's not said that we have to expose ourselves to the point of having to lose everything.

We can also invest in crypto more safely or we will have to learn to live with these violent btc crashes.

And then, there has also been a hand of institutional investors who have been trying to manipulate the crypto industry through FUD since they started investing in this market.

I think they tried to create problems for El Salvador and all cryptocurrency supporters.

Maybe they wanted to give a warning to discourage other countries to follow suit.

Certainly everything that's been going on these past few weeks is making me realize that the cryptocurrency sector is stronger than ever, and bitcoin is proving that it deserves all the space it's getting in the financial industry.

Thanks so much for sharing your thoughts on this situation with all of us.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @mikitaly

Great to see that you're still around. Thank you for taking the time to share your thoughts with me.

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @crypto.piotr,

Thank you for your inspiring reviews on the crypto market.

I think the flash crash was related to technical reasons. Let me explain my views on the topic.

Fibonacci retracements are used to measure how far the price will retrace after a trend. Prices usually retrieve 50% or 61.8% of the level at which they rose or fell. 61.8% is also known as the golden ratio.

Bitcoin entered an upward trend when it was at the level of 10k in October 2020 and reached 63k levels on April 14, 2021. This uptrend resulted in a 61.8% pullback as seen in the chart below.

As a result of the downward trend between April 14, 2021, and July 20, 2021, the price of Bitcoin decreased to 29k levels. The price rose again with a 61.8% correction, to 53k.

We have been in a consolidation period since September 7 and we wonder how much the correction can be. If the price corrections by 61.8% continue the Bitcoin price regress to the level of 38,5k. However, after the two Fibonacci corrections, a third major correction may not be needed as the prices approached the fair value.

Conclusion: I suppose September 7 crash was the beginning of the third Fibonacci correction in a row, but we don't need to pull back to 37,5k. I think that the upward trend that started on June 21th will continue.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @muratkbesiroglu

Wow. I love that comment. Thanks for taking the time to read and share your thoughts. Upvote on the way :)

Im not much into TA, however I do watch several channels where people smarter than me are talking about it. And TA (in my opinion) did not allow to predict such a rapid flash-crash.

TA do not do well when we face massive market manipulation. That's obviously just my own little opinion.

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello friend @crypto.piotr

Without a doubt, the past three weeks have been very marked by emotions within the market of the criptomonedas, many may have taken advantage of the recent high volatility, which has been developing specifically the BTC, in relation to the Flash Crash you mention is something that repeatedly tends to make the Bitcoin, and that is one of the reasons why our trading capital should be at a high percentage in stable currencies in my case I use USDT, also don't go buy when the price is in the areas of distribution (sales area) as a matter of fact was the BTC in the 53K, the price was expected to collapse to the more solid previous support.

I agree with you with those of planned and executed, the market is highly manipulated, so I think that when large corrections come, or upward exits in a strange way they coincide with news such as those of El Salvador.

Best regards, good luck.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Appreciate your comment @lupafilotaxia

What is "criptomonedas"? Im not sure what does it mean ...

Flash crashes (or pumps) are natural part of bitcoin behaviour, however it is important to understand that reaction to those flash-crashes may be very different now. Comparing to old days. Because of those over-leveraged investors and mass liquidations which are happening.

That's something quite new.

Have a great weekend ahead of you,

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @crypto.piotr if there are important points i've got from your post i would say its leveraging i guess you have been making emphasis on over leverage for quite a while now and its very important.

One thing that has always been certain in the crypto space is market moves in either up or down direction but a sudden crash always takes investors by surprise.

Its quite obvious to note that the sudden crash has been from strong hands who wanted to take advantage of the bull most people are driven by greed in the market and with the long awaited news of El Salvador most investors decided to open a trade with high leverage betting price will go up.

This was capitalize on and turn out those with strong hands sold out just to buy back while others are waiting for price pump.

Thanks for sharing with us stay bless.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by and sharing your thoughts with me @mccoy02

Appreciate it :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Świetny post!

Niedzielni inwestorzy kupowali bitcoina jak szaleni, bo newsy o Salvadorze trafiły do mainstreamowych mediów. Nawet znajomi mojego ojca, którzy jeszcze miesiąc temu nie wiedzieli co to kryptowaluta, kupili jakąś ilość bitcoinów z nadzieją, że się szybko wzbogacą.

Po tym jak Bitcoin gwałtownie spadł, jak mówisz "nikt teraz nie sprzedaje", ale odnosi się to do doświadczonych osób. Jestem przekonany, że dziesiątki tysięcy niedzielnych inwestorów sprzedaje nadal swoje drobne bitcoiny w panice i to może być jedna z przyczyn dlaczego cena nie wzrasta zbyt szybko.

Bitcoin, jak i crypto ogólnie, im bardziej popularne, tym bardziej są sabotowane i nie ma w tym nic zaskakującego. W czasach kiedy BTC spadało, nie tylko Salvador protestował, że nie chce kryptowaluty, ale w UK prezesi banków mówili w wywiadach, że BTC nigdy nie będzie na tyle stabilny by był uznany za normalny środek płatniczy, a w Szwecji premier porównał kupowanie bitcoinów do kupowania kolekcjonerskich znaczków pocztowych. Do tego doszło jeszcze zamknięcie kilku kopalni w Chinach, które już od dłuższego czasu przymierzają się do stworzenia swojej państwowej kryptowaluty i kto tam wie co jeszcze...

Ataków będzie coraz więcej, ale myślę, że BTC będzie miał się doskonale, mimo wszystko. Jasne, jak mówisz - z tąpnięciami (przypuszczam, że największe będzie jak BTC osiągnie pułap 100k), ale będzie dobrze.To znaczy, przynajmniej do momentu wynalezienia komputerów kwantowych albo do jakichś większych obostrzeń podatkowych, wynikających z jego nieekologiczności.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Czesc @papi.mati

Rzadko mam okazje przeczytac komentarz w jezyku polskim. Fajna odmiana :)

Dzieki za poswiecony mi czas i wartoscowy feedback.

Pozdrowka, Piotrek

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi @papi.mati

To jeszcze raz ja.

Jeszcze pozwol ze dodam (juz takie troche copy+paste po angielsku):

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello my dear @cryto.piotr One of the important points you make is the relationship between the news that in Salvador the Bitcoin is an official currency and the collapse of it, in my opinion these news certainly affect either positively or negatively, in this case the news was outlined as an investment opportunity, however, something that perhaps investors did not know and only people living in El Salvador or Central American countries is that this measure generates more poverty and a collapse of the domestic economy of these small countries which is reflected in these market declines.

It turns out that on the first day that it was announced that in El Salvador Bitcoin could be officially used, the government also mentioned that citizens could download mobile bitcoin wallets on their phones and pay in establishments, however, that day the wallet was not available to be downloaded to phones and small traders and people who do not have large incomes began a series of protests against this measure because according to them very few are those who know and understand the world of cryptocurrencies. Even from that same day in the central bank of El Salvador is announced on its home page the registration for Bitcoin service providers, but still many do not know how to do it or do not understand it, from there then it is not surprising that this measure that seemed at first to be encouraging for investors who decided to leverage and even use more Defi to acquire Bitcoin has generated a slight stagnation and subsequent collapse in the market. I differ with you friend @cryto.piotr regarding that "At the same time I do not think price of Bitcoin has potential to move much lower below current price levels." On the contrary I think that if there is a possibility that it reaches a lower level than the current one precisely caused by the pressure that at this time Salvadorans are exerting through protests to the government so that this measure is reversed and that creates distrust and panic in investors. Being positive, waiting is surely an option, but at this moment the pressure on the value and the rejection of Bitcoin generates chaos.

I tell you that in my country Venezuela is conducting a campaign by the government for education in Bitcoin in the country there is a digital currency or cryptocurrency that circulates internally and that the government has tried to implement officially called "Petro" but this is not accepted even in government entities even though public employees already receive payments in that cryptocurrency and in addition to that we were automatically created a wallet in an internal exchange platform of the country that can not connect with other wallets on other platforms and much less with state banks, here is a real chaos although the government tries to make us all adapt to the world of cryptoassets, however, more than 80% of the population does not have access to cryptocurrencies because there is no purchasing power for it and much less understand them, now do you think that what is happening in the countries of Central America and Latin America regarding the implementation of cryptoassets as official currencies will have a positive impact on investments in Bitcoins? Because I don't think so.By the way, I really like these interaction initiatives. You should consider having a weekly session with us just to discuss this and other community issues. Best regards

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the contribution i read an article recently about El Salvador crypto adoption the author was emphasizing on early crypto adoption he pointed out making bitcoin a legal tender in el Salvador was too early i think i agree with his points because majority are yet to understand how crypto currency works what is need now is crypto mass education.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for this lengthy feedback @emimoron

Just please, try to use "enter" more often. IT's very difficult to read such a long blocks of text.

It surely is going to take some time for poor country as Salvador (with little resources) to solve those issues. Let's keep fingers crossed for them.

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I completely agree with your approach

Thing is that LEVERAGING has made such a volatile market even more volatile and unpredictable. the main kicker is GREED...

And to be a bit blunt, I think this type of massive shakeouts may be so healthy for the long-term future of Bitcoin, simply because it flushes out everyone who was greedy- everyone who over-borrowed and over-invested in crypto, thinking everything would instantly go to the moon.

Having that much greed in the market makes it impossible for the long-term upward trend to carry on, and now that all those greedy weak hands have been ripped out, I hope the crypto market is ready to continue its gradual uptrend

Nice piece buddy, very informative...

Resteemed already

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @qsyal

Yep. Greed vs fear :) And you're right. Such a corrections are flashing out weak hands and greedy players. Very healthy (long term) for the markets.

Thanks for always being so responsive :) Have a great day ahead of you buddy

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @crypto.piotr I find it interesting to analyze the diversity of thought we may have regarding crypto market volatility in general.

As you rightly mention in your writing the news about the use of legal circulation from the Salvadoran space allowed us to think about a rapid rise in the market, similar to the market when Elon Mosk mentioned that he would accept BTC in the purchases of his vehicles, the price shot up dramatically and this is where many fell into the error product of the excitement of the moment.

So it seems to be a well executed plan, so much so, that the liquidation percentage was overwhelming and you can see it in the graph you share with us. Now, with this we realize that the technical analysis that we can perform, is useless, since the manipulation of the market is influenced by the fundamentals and at this point the credibility of such a changing market overwhelms us and more those who have lost so much money in these sudden bearish climbs.

Entering the stablecoin in theory is good but in a way we would miss the growth of cryptos, in one scenario or another in these changing times caution is the best solution to panic. Good analysis you share with us. Regards

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by and sharing your thoughts with me @madridbg

Appreciate it :)

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend @crypto.piotr

It is true that both events had coincidence, what happened in El Salvador, where they accept the BTC as legal tender, and despite the large amount of BTC that this nation buys the price plummets, that seeing the picture from a perspective, now making a small overview of what happened, the BTC had a time in just increasing its price, It went from 28k to reach almost 53k, increasing its price more than 90%, and was facing a strong resistance for which it needs to grab oxygen, in the cycle that corresponds to the normal market should correct, and in my particular criterion the market manipulation managed to lower its price according to the news of the Savior, interesting article that you share with us.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by and sharing your thoughts with me @chucho27

Appreciate it :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I do trading in Bitcoin but I never did never stayed in the cause I think it's a kind of gambling where we we can win Big or loose big I am because of such moments in the market probably the percentage of loosing is much higher. Talking about the current market situation and the recent dump I believe there it was very much planned and people made good money out of 8 over behind this plan however at the same time many people using the leverage trading have got liquidated and had to go through bigger losses.

Bitcoin and cryptocurrency is here to stay so I think having a long term strategy without leverage trading is helpful and yes we need to have strong hands specially when market slips down because it is the time when we need to hold our holdings strongly.

The recent time since I did not trade so haven't got any loss. It is a very nice topic and thanks to you for touching it.

Have a great weekend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @alokkumar121 for always being so responsive. I appreciate your comment greatly :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much, @crypto.piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @crypto.piotr 💕😊

From what I've read so far, it simply explains the fact that you're are highly updated with the crypto market which also includes your analytical concepts such as the weak hand vs strong hands and the leverage whale dumps. There's actually no doubt that the El Salvador news about accepting Bitcoin as a legal tender was actually meant to boost the price of BTC since it's actually a great news that could attract more investors but unfortunately we experienced a flash crash in the price of BTC which led to high liquidation for leverage traders.

I think the reason for the flash crash might actually be due to three reasons and I'm glad you've actually explained some of my thoughts in your write up. I think one of the reasons for the flash crash in price has to do with massive dumping by Whales. Some whales might have actually bought the dip and they had to dump to take profit by utilizing the El Salvador news.

Also, it may also be due to the fact that FUD was created by Fudders. I heard some rumors about IMF and some other financial bodies claiming to investigate BTC. This might have actually instilled fear in the heart of most holders causing them to panic sell.

Some analyst also claimed that BTC was trying to correct itself and I'm quite sure that you can observe the market today that ever since that rapid flash crash, BTC hasn't drop or fall to that exact value. This is also where the concept of Diamond or strong hands come into play because there are still more people who believe in BTC and they tend to buy more Bitcoins irrespective of the dip or crash. A good example is Micheal Saylor the CEO of MicroStrategy.

I am very optimistic and bullish about the price of Bitcoin exceeding $50,000. We just need to keep observing what happens as time goes on.

Thanks for sharing this great post with love from @hardaeborla and I hope you have a great day ahead ❤️💕😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @hardaeborla

Wow. I love that comment. Thanks for taking the time to read and share your thoughts. Upvote on the way :)

Thank you for your kind words.

I surely love to listen to podcasts talking about psychology of investing, current market situation etc. So every evening I like to sit at the balcony and "switch off" my brain by listening for 1-2hours of what other smart people have to say :) And Im trying to make my own financial decisions based on those people knowledge.

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! That's really great and I think I'll also adopt that type of lifestyle too 😊

Cheers and take care of yourself with love from @hardaeborla ❤️👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good morning and thank you for your extremely interesting post!

It's true, the usual bunch-back that follows the sudden crypto crashes didn't occur at this round.

As you observe, surely the news of September the 7 linked to El Salvador provided an excellent moment to create - certainly for the benefit of some - a completely unexpected crash, where a bull phase was instead expected.

However, I also want to add another element. It is known that by now Bitcoin and the rest of the altcoins are investments significantly controlled by central banks, and on 7th September another key passage in the world markets took place, linked to an important Chinese real estate company: Evergrande Group was downgraded from "CC”to“CCC+”after declaring a probable imminent default, which would have a major impact on Chinese and world finance (Evergrande's liabilities involve over 128 banks and bond defaults could trigger cross-bankruptcies.).

The main problem, linked to a lack of liquidity, could have led many large investors to have to close some positions in cryptocurrencies.

As for the next days... it seems to me that at the moment the crypto market is stalled, but I am sure it will slowly resume a bullish phase.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @ribbly

Thanks for your kind words.

Glad to see you here. I don't think we've ever had a chance to "chat" yet. And mostly: thanks for this amazing comment. Upvoted already.

I've never read one data which would actually confirm that central banks were purchasing BTC. I'm not really sure if that's the case. Correct me please if I'm wrong.

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! You sure got a lot of responses. There isn't much more that I can add.

There is a good chance that the whales dumped, knowing that people were highly leveraged and would lose their holdings. That gave them the opportunity to do a transfer of wealth by buying up all that cheap BTC. We saw a small rebound as people were buying the dip. The whales know what they are doing and have the power to move the market. They play the crypto game the same way the big players play the fiat markets and the rich get richer on the backs of the little people. Nothing has changed, has it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @happyme

I indeed got quite a lot of valuable replies :)

Great to see that you're still around. Thank you for taking the time to share your thoughts with me.

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank-you for the link. It could be a game-changer.

I'm happy to hear you, your wife and Happy made it safely back to Malaysia. I imagine that in order to fly, you had to get the experimental jabs that are harming more people than the illness they are supposed to protect you from. I pray that your household does not suffer any adverse after-effects.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I totally agree with all you have said.

My advice to most investors would be to partition their portfolio.

50% stable

40% moderate risk investments

10% in high risk.

Well, I feel you are talking about speculators not really imvestors.

Overleveraging is never good in my opinion tho but your points are valid

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @bhoa

Great to see that you're still around. Thank you for taking the time to share your thoughts with me.

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Checking them out right away

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings Friend @crypto.piotr, certainly we all were taken by surprise by this brutal fall of cryptocurrencies especially the BTC, personally I still do not really understand what caused it and reading your article opens some answers to what could have caused this collapse, I think people who lost a lot of money with this Flash Crash must be patient to recover.

Surely there will come better times for BTC where they will be able to take better advantage of its market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by @carlir

Those few years (since I joined crypto space) touch me that whenever greed is sky rocketing and confidence towards future price (either it's trend upwards or future drop) would be very strong -> that is the time when some large players would go against it. Knowing that many investors over-leveraged themselfs. Knowing that by triggering those liquidations they will transfer enormous amount of wealth from over-leveraged people to their own pockets.

Hope I'm making sense.

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @crypto.piotr 💕😊

From what I've read so far, it simply explains the fact that you're are highly updated with the crypto market which also includes your analytical concepts such as the weak hand vs strong hands and the leverage whale dumps. There's actually no doubt that the El Salvador news about accepting Bitcoin as a legal tender was actually meant to boost the price of BTC since it's actually a great news that could attract more investors but unfortunately we experienced a flash crash in the price of BTC which led to high liquidation for leverage traders.

I think the reason for the flash crash might actually be due to three reasons and I'm glad you've actually explained some of my thoughts in your write up. I think one of the reasons for the flash crash in price has to do with massive dumping by Whales. Some whales might have actually bought the dip and they had to dump to take profit by utilizing the El Salvador news.

Also, it may also be due to the fact that FUD was created by Fudders. I heard some rumors about IMF and some other financial bodies claiming to investigate BTC. This might have actually instilled fear in the heart of most holders causing them to panic sell.

Some analyst also claimed that BTC was trying to correct itself and I'm quite sure that you can observe the market today that ever since that rapid flash crash, BTC hasn't drop or fall to that exact value. This is also where the concept of Diamond or strong hands come into play because there are still more people who believe in BTC and they tend to buy more Bitcoins irrespective of the dip or crash. A good example is Micheal Saylor the CEO of MicroStrategy.

I am very optimistic and bullish about the price of Bitcoin exceeding $50,000. We just need to keep observing what happens as time goes on.

Thanks for sharing this great post with love from @hardaeborla and I hope you have a great day ahead ❤️💕😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

comment duplicated :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello dear friend @crypto.piotr, without a doubt the fall of the bitcoin price a week ago took us all by surprise, I observed how a lot of investors lost a lot of money, something terrible but that can be corrected with patience, currently as you mention there is the defi which is a safe way to earn and continue buying bitcoin, I think it will continue to attract many investors who want to leave for a safe way after what happened.

See you later, thanks for sharing your opinion on this matter with us, have a great week.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I liked this plainly-explained post which reflects the basic truth - BTC is here to decentralize/circulaye capital in the world. Those oportunist day-traders who only wish to make a quick profit - much like they used to do in the FOREX markets - need to think again.

Piotr, this paragraph has at least two typos:

**Back then we would mostly experience the wave of PANIC SELL caused buy so called FUD (which would ontel start with some awful negative news). **

Thanks for your informative post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @nomad-magus for taking the time to share your view. It's great to know that you're still around :)

Stay safe buddy,

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And thanks for spotting those typos

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

$4 billion is a huge amount of money and the reason I believe is that many trader are scare of fear of missing out and have greed. I stand to be corrected, that we heard a news about a country accepting Bitcoin as legal tender does not mean we should over leverage our position, just the same way you are thinking of making large profit from it when the price goes up that the same way some are thinking how will they make profit too, they know because of greed or some will hide under I want to be smart and wise will over-leverage their position and invest greatly they will start thinking of how to make the price fall so that they can make more profit too. My advice is that as a trader we should not allow greed to control our actions. Both the whales and bull are in the market to make profit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @jennyvic09 for dropping by and sharing your thoughts with me

Appreciate it :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The crypto space is heavily unpredictable and what happened last week proved it. When I heard that El Salvador will be making Bitcoin a legal tender, I expected the price to moon, but the reverse was the case. At this point, I think this is not just a coincidence but I think some actors are trying to manipulate the market.

In my opinion, the plummet in price which was experienced was not organic. However, I still have a feeling that we are going to witness another bull run before the end of the year. I wouldn't be surprised if BTC hits $100k by the end of the year.

Nice piece buddy. Thanks for sharing.

Resteemed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @samminator for your resteem

And I also expect 100k sooner than later :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

First of all I agree with this point , big investor are buying Bitcoin at low , 2 days before microstrategy buy Around 5000+ bitcoin with is huge, that's because price is low around 40-45k range. But it's a good signal that big institutional investors are bullish on bitcoin.

Now regarding the crash, I can say that it's a hype of the news because one country make bitcoin as legal tender and the when the hype is over it's a crash.

I also agree with the defi liquidity factor, currently defi is playing a huge role in the market bitcoin dominace slid to 40% which means people are investing in other coin also which is also good for the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! you have simply summarized the curent crypto market in one presentation. Thanks for sharing, I have found this useful hence, I am resteeming

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Technically yes as long as you are buying low and selling high or of you can see a correction coming and can spot the right technical indicators to enter the market at the top and sell your BTC or whichever crypto you are dealing with at a high and get stable coins /fiat and when the crypto has ended correction you buy it again.

You need to be watching your chats as a hawk and be nimble footed to say the least.

A common temptation is to enter leveraged trades and enter 5X , 10X or what ever leveraged position your exchange allows.

This may look to be a very smart thing to do when you are right in spotting the trend.

However if there is a sudden trend reversal which is often the case with crypto then one may end up losing the entire capital.

So leveraged trading is like a double edged sword which can make you a profit as well is cut you up.

When it does Oh boy ! it hurts real bad .

I hope you get my point ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @thetimetravelerz

Great to see that you're still around. Thank you for taking the time to share your thoughts with me.

That is exactly the problem I've noticed. To many people thinking that they are very smart because they leveraged their positions and for the time being they did well. And they ended up building up their confidence and risking even more. Until some flash crash will wipe out their entire capital.

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

resteemed to spread the word my view follow

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for resteem Alok,

I would surely like to hear what is your own view on discussed topic

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @crypto.Piotr a very nicely written and thought provoking post I must say.

In my own experience with these markets which I have been following since 2012

I feel that when it falls it is a domino effect.

and when it is stable it is like a stack of apples on an apple card with multiple pressure points.

Which pressure point would trigger which apple to roll and cause a fall is a complex process with multiple trigger points.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Actually the Bitcoin price dump a week ago took everyone by surprise and I really believe you on the fact that the flash crash is different from others to that has massive bounce back in a short while but by patiently holding it will definitely . So I really think you're are right on this @crypto.piotr and thanks alot for sharing your knowledge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @obiwoke

Glad to see you here. I don't think we've ever had a chance to "chat" yet.

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's really as simply as a lot of the futures markets and options markets (as well as some overseas spot exchanges that allow leverage) were overwhelmingly positioned to the long side. Once everyone is on the same side, with leverage, it doesn't take much of a push to get everyone going the other direction...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @jondoe

Great to see that you're still around. Thank you for taking the time to share your thoughts with me.

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I received your Memo... Your post is very long with a lot to say, but to get straight to the Point I want to make, the Trouble I find with most of the Crypto's is that they "Fluctuate" in Value... I can't see anything "Unstable" competing with "We the Peoples" Electronic Coinage,which will be backed by our Corrected Silver and Gold Coinage...

I actually believe our "Common U.S. Coinage" will out-perform Silver, Gold and all the Crypto Currencies, including Bitcoin...

September 16, 2021... 17.6 Hollywood Time...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post is manually rewarded by the

World of Xpilar Community Curation Trail

Join the World of Xpilar Curation Trail

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with what you have described, and I agree with the possibilities like the description you mentioned.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My current observation is that the DeFi is something being misguided on in the market. Like basically the CeFi version that have the regulations are being forced on the people who want to invest in DeFi. What do you think?

#affable #india

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by and sharing your thoughts with me @skysnap

Appreciate it :)

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I would never buy Crypto with margin. Just buy the dips with other crypto. The best way to earn crypto is blogging right here on Steemit, As well as https://Blurt.blog. I have earned almost 1 Million Blurt ( worth about $5,000 USD) from blogging on Blurt. There is a New Blurt token offering 30% APR called the Blurt Yield token BYT on Hive-Engine.com … they also have a new project coming out on the Cosmos blockchain called Dig and anyone with Blurt Power gets a #dig airdrop. Https://Digchain.org.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by and sharing your thoughts with me @offgridlife

ps. did you really manage to earn 5k USD from blogging on Blurt? That's quite an amazing result. Congratz! :)

Appreciate it :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep… I earned almost 800,000 blurt there and converted a lot to Bitcoin, Ethereum and Dogecoin on Ionomy.com… the total I earned is actually a lot more when you factor in the gains from Bitcoin etc.. I also sold some to buy a new car. https://Blurt.blog is awesome. The idea to remove the downvote feature has eliminated all the ugly downvote wars you see on places like hive.

Ionomy: https://exchange.ionomy.com/en/aff/f7862c1aeae8e0399176a908fcecbcfe

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

800k BLURT ? just by blogging and curating? that sounds like insane number

how much is BLURT worth right now? according to coinmarket cap it's 0.003$

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It’s at .004 …. About 1/2 a cent…. I trade my Blurt every day on Ionomy and Hive-Engine.com ….

They also have a BYT (Blurt Yield token) with 40% APR

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One more thing offgridlife @offgridlife

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome…. Will check them out. Hope to you you on blurt too. They have an exciting NFT project coming on the Cosmos network .. along with an airdrop of cosmos - blockchain Dig tokens https://digchain.org

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi again @offgridlife

I was wondering .... how can you access Steemit if you're off-grid? :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Satellite.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

so you do life off grid? amazing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

1/2 the year off grid on Lake Superior… I spend the winters in a house on the grid. Too cold and would need to burn too much wood and propane in Canadian winter

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think https://Nutbox.io is another awesome project on Steemit. .. I am earning 83+ % APR delegating some SteemPower to nutbox… earning PNUT I can swap for TRX or Bitcoin etc on Just.swap

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi @offgridlife

thanks for being so responsive

83%? Doesn't it ring any bells? I'm not sure what Nutbox is about and I've no idea how do they make revenue to be able to provide such a huge returns. But it does sounds ... to good to be true.

Didn't you ever wonder - how is it possible that they could manage to offer such a huge returns. I only know one way: ponzi scheme.

Im not saying that Nutbox is one. But it surely sounds dangerous to me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well I get my PNUt every day and sell for TRX and Bitcoin. So… not sure how it’s a Ponzi scheme when I just delegate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's a good point. I'm even more curious: how do they manage to provide such a high returns. I don't know any other way than following ponzi scheme and constant flow of new money/investors. But as you pointed it out - that doesn't seem to be the case here ....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend @crypto.piotr.e

This new strategy you raise is undoubtedly an excellent option in the world of cryptocurrencies, since with the use of a decentralized finance, it seeks the elimination of intermediaries in the transactions between the platform and the user during blockchain operations.

The importance of this new platform lies in the fact that with the use of it, all the people who are immersed in the world of cryptocurrencies can increase their investments, taking into account the great amount of liquidity that exists in the Bitcoin market.

In the same way, the use of (Defi) is indispensable, since with its use a successful revolution in the world economy can be achieved, in this way investors have great possibilities to enter this Blockchain field and significantly increase the value of cryptocurrencies.

In general terms, the Defi will allow great leverage that can leave you a great slice in your financial investments as long as they do not decline in the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate your valuable feedback @sidalim88

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings dear friend, these weeks there has been a lot of volatility in the market, although I think we should be used to it, in the case of Bitcoin movements like this are constantly repeated, usually the market is very manipulated, especially when we see news like the one in El Salvador, which to me are attempts to boycott the implementation of cryptocurrencies and discourage other countries to follow suit, I remember how in the TV news the reports were more about the rejection of the people and how banks and other international organizations did not support the measure, so it is not surprising that there have been movements to overshadow the decision of that country.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings Piotr,

There is no doubt that what happened in the crypto market on September 7, is a producer of market manipulations by large investors in order to make profits, it is true that many lost or were trapped waiting now for a recovery or correction of the price .

I also believe that when there are these unexpected movements for some, such as sudden price drops, many small investors choose to sell to protect their investment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A lot of this words and information crashes my mind to mentally think how can I fully equipped myself in understanding the crypto market the so called cryptocurrency. Upon reading I've its way more that what I expected it to be! The good side though is that I am learning something, hopefully this learning will help me in my quest of conquering cryptocurrency!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think it was an important correction of the market, just like in traditional markets also crypto markets need a correction after some time and it always happened. Especially when there was a big "bull run". Some want to take profits and close their positions.. and others came in late and don't want to loose money so they close their positions or have a stop loss, whatever.

Since bitcoin, and also Ethereum? is already tradable via ETF more instituional investors could be interested in the Crypto Market. I think that is something that could also have a potential to initiate high corrections.

On the other hand the possibility to laverage positions on bitcoins can be interesting and profitable but also very dangerous if it goes in the wrong direction.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by and sharing your thoughts with me @florian-glechner

Appreciate it :)

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @crypto.piotr Like any innovation, the bitcoin process in El Salvador has a learning curve, which will cost us all. I agree with you that this action was planned, the market is manipulated, that is why I am sure that the rise will continue.

Much success and best wishes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, dear friend @crypto.piotr, for inviting me to take part in your discussion. Unfortunately, I am responding to you with a delay.

But I agree with the opinion of professor CryptoSteemAcademy @sapwood that by the end of the year we will see big surprises from the IOS price. It remains to be patient a little. What was the reason for the sharp growth and the same sharp decline, of course, I do not know. But I don't think something related it to the news from El Salvador. Although who knows? As soon as we see a clearly formed uptrend in the autumn from October to December, then there will be no such "surprises". In the meantime, yes, the price can be very high or go down sharply, because the volatility in the market is high.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by and sharing your thoughts with me @vipnata

Appreciate it :)

It seem that we have some common friends :)

ps.

Allow me to introduce you to our recent partnership with small korean team of developers. I'm helping them to get some exposure to their upcoming project.

Check it out here: https://steemit.com/hive-175254/@crypto.piotr/finally-i-m-safely-back-to-malaysia-with-new-ideas-and-partnerships-coming-must-read

Cheers, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings my dear @crypto.piotr , I have learned a lot of information with your publication because I must admit that I really don't know how the financial market of cryptos moves. However, from several peers I have already learned that it is clearly manipulable by eventualities occurring globally, even a simple tweet from Elon Musk. Thanks for this analysis that will surely be of interest to all the guys who move in the financial area of the community. Good vibes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This gives me a far more clearer point of view on what's actually happening in the crypto market. So far, i've been almost clueless but your post is enlightening and leads me to a more understanding position. My regards and my upvote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes i also believe it was a bankers coup.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @crypto.piotr, I firmly believe that the actions taken by El Salvador to finish adjusting the legal course of cryptocurrencies and especially BTC within its economy and daily life are greatly influencing the behavior of BTC, the market is moving on the basis of to "rumors and news", which seems illogical to me, but if in the stock market the shares "skyrocket" with just rumors, we can expect the same in the crypto market, as part of the lessons learned we can include: "pay attention to rumors and news that may affect the crypto market."

In Venzuela we say "listen to the ambor".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@tipu curate 5

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit