Hello, welcome back to the Project Hope community, how are you all, I hope you are always doing well and getting better, of course.

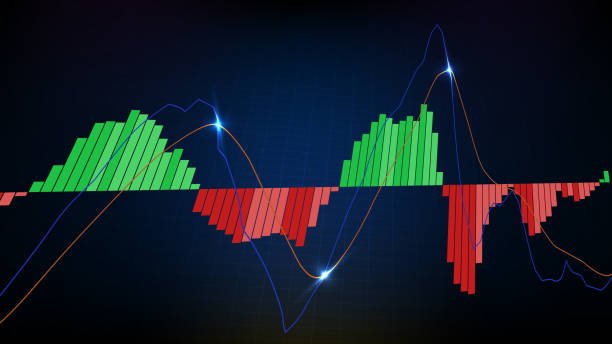

Have you ever thought about why the price of crypto assets like Bitcoin can go up and down and what are the factors that affect the ups and downs of crypto asset prices.

This time I will try to process one by one the factors that affect the price of crypto assets.

Basically any trade refers to the law of the market, namely supply and demand or more commonly known as supply and demand, for example if the demand for Bitcoin purchases in a crypto market is increasing beyond the seller's supply, the Bitcoin price will increase on the contrary when the number of sellers is increasing. There are more Bitcoins than buyers, the Bitcoin price will decrease to the point where the number of sellers and buyers is equal or balanced.

The phenomenon of increasing crypto prices can also be caused by a condition where the asset is widely used and vice versa will decrease if the asset starts to decrease in users, we can take the example of Project Defi or decentralized Finance which is built on the Ethereum Blockchain. All transactions above broken Ethereum require Ethereum as gas fees or fees to pay the cost of solving the algorithm.

Of course, for Ethereum miners, the increasing use and transaction volume on Defi projects causes the Ethereum price to rise in the market because the need to purchase Ethereum for gas or fees has increased.

In addition to examples from the defi Ethereum project, there are also examples of news that are still hot to date, namely Project Defi which was built on the Binance Smartfren network or BSC or bnb had experienced an increase of more than 100% in December 2020 to February 2020, which is what this also happened because the need for bnb tokens has increased.

Along with the increasing interest of users due to the innovation and development of the BSC Project, the psychological factors of traders as if they cannot be separated from trading activities in the market are naturally divided into two factors, namely fear and the greedy nature of the public which greatly affects the price of crypto assets.

For example, after a long time there was no strong price movement the price of bnb began to move up drastically this would trigger a lot of traders to be greedy and buy more bnb in the hope that the price of the bnb asset will rise even further, the more you buy bnb the price will go up and this phenomenon will lure more people to buy bnb.

When the price starts to touch the peak, many traders want to take profits by selling their bnb tokens, the more traders who sell bnb, the more the price of bnb will go down, prices moving down cause fear or fire in most traders, as a result more and more people are selling his bnb.

In fact this factor also plays a major role in the movement of crypto prices as in the case of a very, very long time ago, when Ellen Mask CEO of the Tesla company and species uploaded a post on Twitter about Dogecoin which caused the price of Doge at that time to rise very high in a short period of time. short.

So many of my posts at this meeting may be useful and look forward to my next post.

THANK YOU

By

@dani0661

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit