Summary

- The compound interest has little effect in short term or by lower interest rates.

- But compound interest can make you rich in decades or by high yearly returns.

- The dark side of compound interest is: You must pay it. In case of high debt or negative real interest rates.

- Learn how works compound interest and stand on the right side.

There are so many posts and articles on the Internet promising so many wonderful things based on compound interest. Even memes are circulating like this quote by Albert Einstein. Although some sources are questioning its originality.

Compound interest is the most powerful force in the universe. Or, in another version: Compound interest is the eighth wonder of the world.

The Small Side of Compound Interest

Compound interest, also called interests on interests, is very useful in finances. But it isn’t a wonder potion either. It’s meaning is simple. After every year, the actual interest amount is added to the original capital. From that on, interests will be also paid on this amount in all the following years. That creates an effect called exponential growth. Your money won’t increase linear (line shape curve). But exponentially, on a parabolic shaped, acceleratedly rising curve.

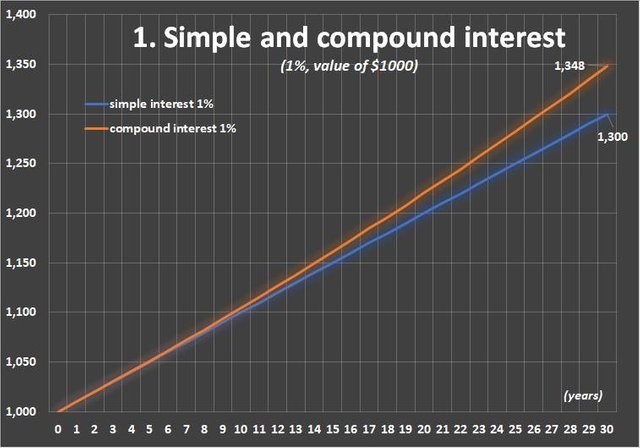

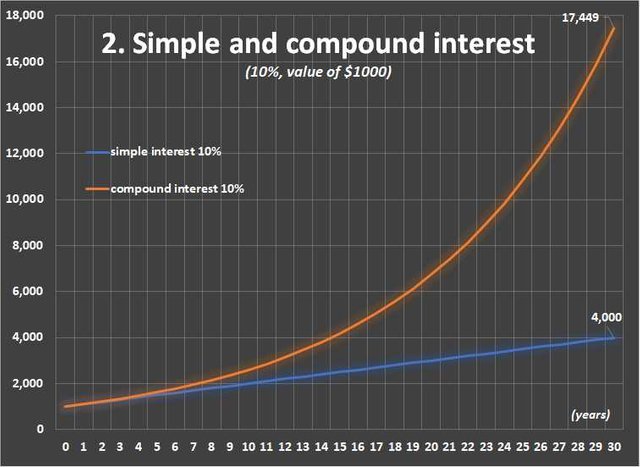

For example, if you put $1,000 in the bank for two percent interests. In two years you have $1,040.0 without, and $1,040.4 with the compound interest calculation method. (1,000*1.02*1.02.) The difference is small in this case. But it is growing with time, and higher interest rates make the curve steeper. Compare the next charts with one percent and ten percent compound interests (Chart 1. and 2.).

Chart 1: Simple and compound interest, one percent

Chart 2: Simple and compound interest, ten percent

As you see on the charts, your money grows very slowly with only a one percent rate. Even in 30 years, your $1,000 will grow only to 1,300 with simple and to $1348 with compound interests. Moreover, interests are very low in many countries today. Why should you know the compound interest, then, if it has a so small effect on the short term?

- In the short or middle term, because all banks, companies, institutions and most people are using this calculation method. In fact by all investments with more than one year of maturity. That is the standard, the usual method. If you don’t get your interest payments based on the compound method, you should claim, demand it.

- In the long term, because it can make a big difference in your investment returns. And in this modern and uncertain world, yes, you should invest in the long term. For various reasons. (Also read: Which Is Your Best Source of Money? Investing, Saving or Earning?)

How Works Compound Interest on the Bright Side

By ten percent interest and ten years, the picture is much sunnier. In this case, your initial $1,000 grow to 2,000 even with simple interest, but to almost 2,600 with the compound method. In 20 years, the difference is much higher: 3,000 versus 6,727. Here, you can already feel the real power of compound interest.

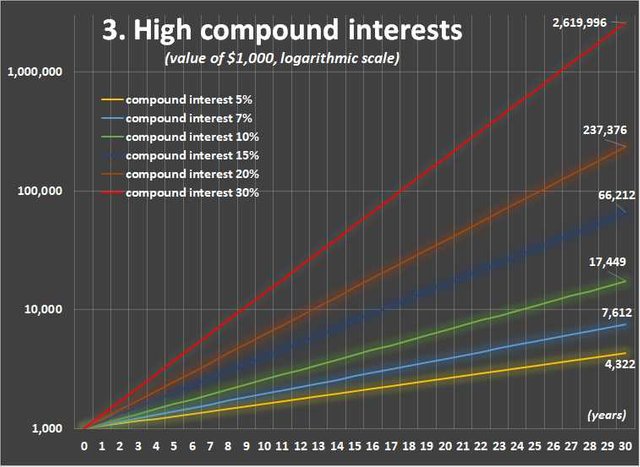

Some of the data on the third chart may be unrealistic, unlikely to achieve, but dreaming is not forbidden. After decades of investment and double-digit investment returns, our capital would multiply. The original thousand dollars (euros, renminbi, etc.) can grow to tens of thousands or hundreds of thousands, Or, a few million.

Chart 3: Higher interest rates and compound interest (logarithmic scale)

Continue Reading on Agelessfinance.com

More Important Readings About Your Money

- Eight Ways How Inflation Threatens Your Income and 13 Ways to Fight It

- Which Is Your Best Source of Money? Investing, Saving or Earning?

- Is It A Myth? – The Genuine Truth About Passive Income

- Why Do You Need Ageless Finance? Priceless Lessons of Our Ancestors

References:

Disclaimer

I’m not a certified financial advisor nor a certified financial analyst, accountant nor lawyer. The contents on my site and in my posts are for informational and entertainment purposes and reflecting my collection of data, ideas, opinions. Please, make your proper research, or consult your advisors before making any investment or financial or legal decisions.

Dear @deathcross

Interesting choice of topic. I must admit that I've never heard about 'Compound Interest' and I found your article very informative and refreshing.

I always thought that most powerful force is love and our urge to have sex :P (mostly man :)

Solid read. Upvoted already :)

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Compound interest

Is the most powerful force

In the universe.

- crypto.piotr

I'm a bot. I detect haiku.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi again @haikubot

Can I ask you for little favour? I joined contest called "Community of the week" with project I manage and I would be grateful if you could RESTEEM it and help me get some exposure and drop some encouraging comment :)

Link to my post: on steemit or on steempeak

Thanks :)

Yours, Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"Maslow's hierarchy of needs". But money is useful on all levels...

see here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have always loved interests both in compound and simple but i have learnt never to leave my money at the bank for a compound interest. I did this sometime back and i also placed the same amount of money into a small business. I realized that i was making a loss on the compound interest compared to compound reinvesting :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Businesses are also risky, many of them declare bankruptcy. Many countries apply an insurance of deposits/savings to secure people's money. But it has only a sense if real interest rate is indeed positive.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interests can work in your favour but behold if they work against you... whenever possible we should avoid to take a dept that forces us to go tothe dark side...

Great post!

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting topic. Usually, this kind of financial knowledge is Chinese to me. But you explained it in the simplest way I could understand. However, the compound interest against you, i.e. in a debt, is very harmful apparently. A double-edged sword.

Thanks for sharing :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The best investment is, often, if you can avoid, or repay debt.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's right

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I had heard and read about it, it is a logical thing although in general many people do not apply it, I think a little for thinking in the short term. But you are very right, you have to think about the future because it comes at every moment, and time passes very quickly.

Good data @deathcross

Thank you for sharing them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Once again, your knowledge of Economics comes into the scene to excellently explain the basics of compound interest. Good job!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit