Hello everyone, I want to make out the investment opportunities of various exchanges and wallets.

Investment programs of exchanges and various cryptocurrency wallets. You just buy cryptocurrency and put it in storage on the stock exchange or wallet, for this you get a certain percentage per annum (different depending on the token). Here you should understand that for major cryptocurrencies this is a small percentage of 5-15% on average on all platforms, and with market volatility, you may well not get any profit in a short time period. Also, your assets are located on third-party platforms, and not on your personal wallets.

The main attraction of staking for crypto investors is the ability to receive passive income. Users can receive a reward for the obtained blocks without receiving the status of a validator. The specific percentage of profit from staking depends on the coin and the validator site.

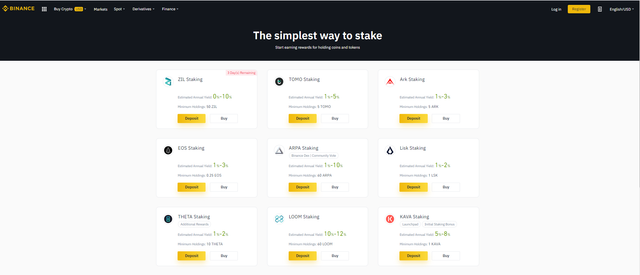

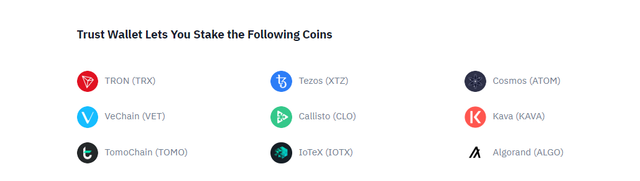

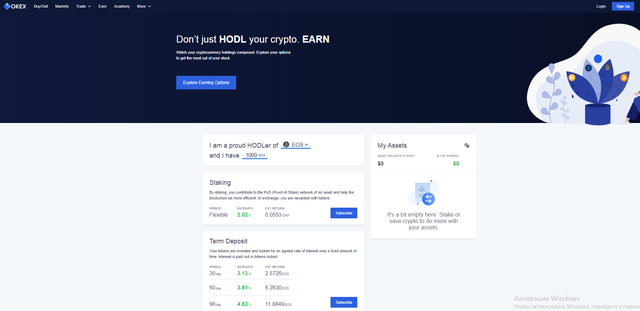

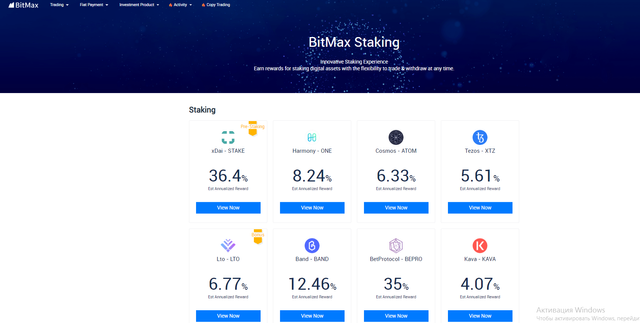

Today, all popular exchanges offer staking: Binance, Coinbase, Huobi, OKEX. It is beneficial for both exchanges and crypto-investors: both parties earn money. At the same time, PoS projects have long been known on the market and have already proven their worth when used in a number of coins, and exchanges can offer their users more liquidity than pools.

Now a very large amount of user funds is stored on exchange wallets just like that, without bringing any income to either users or the exchange itself. During flat periods, the number of active users trading decreases, while altcoins trading are generally negligible. With staking, exchanges are able to safely use these funds in the interests of the user, while receiving a percentage for this and additionally participating in increasing the stability of the network.

Purchase and storage of exchange tokens. In this direction, there are exchanges that distribute part of their profits between holders of the exchange token on your accounts. Accordingly, the more you have more exchange tokens on the balance sheet, the more funds you receive when distributing profit on the exchange. But you must understand that for a good profit you must buy a large number of exchange tokens, and therefore you invest most of your funds in one financial instrument.

You also have the opportunity to participate in trading contests of exchanges. Exchanges hold various contests with different cryptocurrency pairs. In my opinion, this is a very interesting direction, especially on not very liquid exchanges, where there are not many professional traders.

Also, exchanges sometimes hold Airdrop for holders of certain tokens on exchange wallets, that is, you can simply store a certain token in your wallets and on a certain date you will receive similar tokens or tokens of another project.

Examples:

https://atomicwallet.io/staking

https://trustwallet.com/staking/

https://bitmax.io/#/staking/investment-product

https://www.binance.com/en/staking

https://pool-x.io/staking/soft

You can see the full range of investments in cryptocurrency here.