https://www.flickr.com/photos/86530412@N02/8231671430

Easy Debt.

If anybody reads my posts, they know I have an adversarial relationship with debt. I hate debt, at least unproductive debt. People often make unwise decisions with debt. Like spending too much on a car, a house, education, a poorly thought out business, or even worse, taking out debt to buy financial assets.

People don't have to earn debt, like they do a paycheck. That makes debt easy. When something is easy, people don't value it as much, therefore they use it on things that usually don’t return the value they borrowed, like take out a home equity loan for over $400,000 over 40 years and then lose their house to foreclosure in the aftermath of the 2008 financial crisis.

This article tells the story of a couple that did just that.

This article could be perceived as a cautionary tale, but the tone is one of sympathy, feeling sorry for the couple that repeatedly took out debt on a home with no “real” intention to pay it off. The couple made poor financial decisions over decades that increased the probability of foreclosure.

I'm going to single out some sections in the article to make my point:

Payments for 40 Years.

“Maria Landi, a 75-year-old retired insurance specialist, and her husband John, had been making payments on their East Brunswick, New Jersey home for 40 years when Wells Fargo foreclosed on it in 2010.”

In the United States, 30 year mortgages are the standard. The fact that the Landi’s still had a mortgage 40 years later, means they extended their mortgage by adding on more debt with a home equity loan (adding debt to their current mortgage).

No Real Intention to Pay Off Debt.

“The home was initially purchased for $49,000 and was later valued at $750,000 after the Landis renovated it and made additions to the home. But after the Landis got the foreclosure notice from Wells Fargo, it was appraised at just $450,000, far below what the Landis owed on their mortgage.”

To add to the first point, they originally purchased their home for $49,000. And the debt that they had by the time it was foreclosed on was over $450,000. Typically, when you borrow for a home, the object is to DECREASE the amount you owe over time. The Landi’s went in the opposite direction, effectively they had no real intention to pay off the mortgage.

Feeling Sorry for Themselves.

“We had graduations, engagements, weddings and, of course, end of life moments. Our blood, sweat and tears went into this structure. Renovations, additions and many accommodating improvements were put into this, what some may call just a building.”

"“Wells Fargo has made a fortune off of the backs of those who would seek to reclaim their dignity,” Maria Landi said.""

This is what I call “feeling sorry for ourselves” statement. I don't like these kinds of statements because they distract from the real problem. When one takes out debt, the intention is to pay it off, so when a recession or depression does happen, one does not lose their home and incur the pain that comes with it. And believe me, recessions and depressions happen more often than people think.

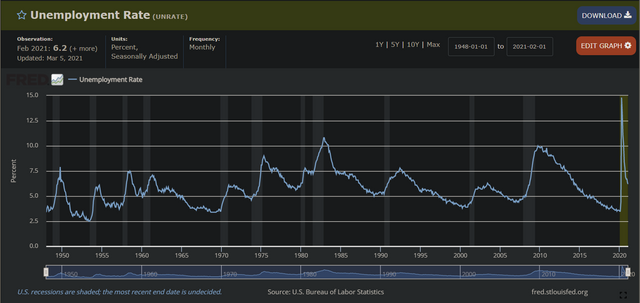

https://fred.stlouisfed.org/series/UNRATE

Recessions and Depressions Happen.

Above is a graph of the unemployment rate in the United States since 1948. There have been 11 economic recessions in this time, not to mention the Great Depression in the 1930s. And the numerous recessions and depressions before. There is always a potential that one could lose their job and income and not be able to pay the minimum debt payments on a home or car, which will lead to foreclosure or repossession.

In Conclusion.

In the Landi’s situation, it wasn't a sudden catalyst, like a medical situation, or other traumatic event, that led them to take out large amounts of debt to pay for the emergency. It was 40 years of debt accumulation to pay for home renovations and additions, where the value of those additions did not offset the debt they took out.

That is why they lost their home. And they lost it when they were most vulnerable, at retirement! And it is a lesson for us all.

Stay frosty people.

50% allocated to ph-fund.

Bad debts seriously causes backwardness at all time, this story shared by you teachus a lesson to focus on paying our debts as soon as we acquire it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well said.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well said. Most times I tend to wonder whether someone can live a life and avoid debt completely

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wonder the same thing. I try to live my life that way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Certainly sometimes the easiest way out of a bad financial situation is debt but that's just a bad decision because if initially you can't maintain an economy that allows you to live within your income a debt will only worsen your situation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Totally agree!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Debts? Treat it like a plague or it will consume you. Nice piece

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like that...a plague...I look at it that way also.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit