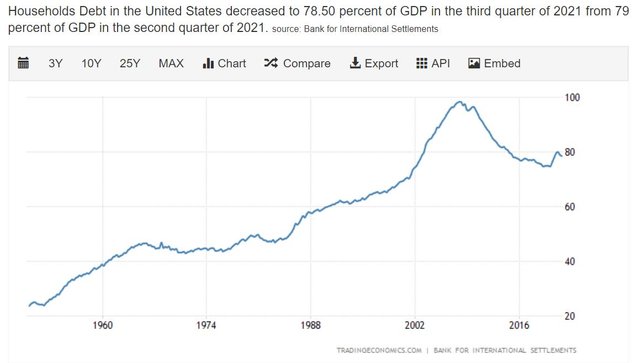

“In 1946, gross household debt stood at 15 percent of U.S. gross domestic product. It peaked at close to 100 percent on the eve of the 2008 financial crisis and has fallen slightly since then.”

It sits at approximately 80% today. source

Easier Borrowing

Being the world's reserve currency allows a nation to borrow money easier because other nations, institutions, corporations and households want to hold the reserve currency in the form of its currency denominated debt.

Being a reserve currency, a significant portion of global transactions (plus FX reserves) is done in US Dollars…60% when we include “international reserves, as a currency anchor, and in transactions.”

But investors, corporations and nation states do not hold the currency in cash, they exchange it for the currency’s denominated debt, treasury bonds, so they can benefit from an interest rate, to help protect from inflation.

So essentially, because people want to hold the reserve currency for trade and a store of wealth…and most of that currency is held in the currency’s denominated debt…there is a demand for that nation’s debt.

Path of least resistance

And since people, individually or collectively as an institution, choose the path of least resistance in a lot of cases, debt is an easier path to money than earning it by other means.

So this encourages a nation collectively to incur more debt, because other people want to give them that money.

Granted, like with all things, there's not just one reason why nations and institutions want to buy other nation’s debt. Other reasons might include, buying and selling foreign exchange reserves to affect the relative value of the local currency, interest rates, balance of trade and other things.

Anyway, stay frosty people.

35% allocated to ph-fund