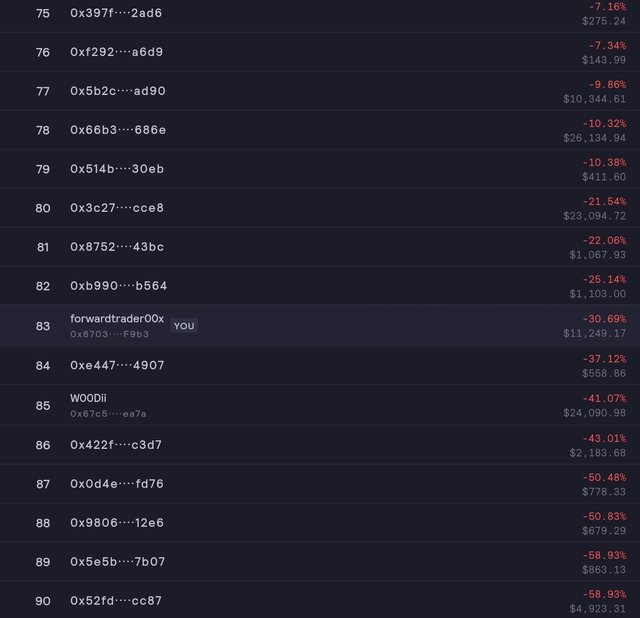

Ranked 83rd out of 100+ traders in the intense daily dydx exchange competition. Join my $5/month mentorship program to master the art of crypto trading.

Image Source: https://trade.stage.dydx.exchange/rankings/pnl-percent

Dydx Trading Competition: https://trade.stage.dydx.exchange/rankings/competition

Forward Traders Mentorship Group: https://signal.group/#CjQKILZqZhzmXQrXE8YfYHN4CrImzNkOapmcha2hmH_tqyCHEhAjU9Bqg9HLjzKDKFSZHPKD

In line with our previous analysis, the Bitcoin market has witnessed a significant dump following a price rejection at the 27400 level. The current market conditions indicate a period of consolidation with low momentum and volatility. As a result, we may expect a relatively dull market today, prompting a cautious approach among traders and investors. In this report, we will delve into the recent price action and highlight the importance of monitoring market developments closely.

Price Analysis:

Bitcoin experienced a notable decline after facing strong resistance at the 27400 level, as predicted in our previous report. This rejection has led to a period of consolidation, with the market lacking a clear direction at present. The price is currently hovering within a tight range, indicating a potential indecisiveness among market participants.

Market Sentiment and Volatility:

The current market sentiment is cautious due to the lack of clear momentum and the dull price action. Traders and investors should exercise patience during this consolidation phase as the market seeks to establish its next move. With low volatility, the likelihood of sudden price swings or major breakouts becomes reduced, warranting a more careful and measured approach to trading decisions.

Monitoring Market Developments:

Given the current market conditions, it is advisable to closely monitor market developments and key support and resistance levels. Traders may opt to engage in scraping or focus on shorter-term trading strategies until the market exhibits a clearer direction. Utilizing technical indicators and tools to identify potential breakouts or shifts in market sentiment can be valuable during these consolidation periods.

Risk Management:

As always, risk management remains crucial during uncertain market phases. Traders should employ appropriate risk management strategies, including setting stop-loss orders and managing position sizes to protect against potential losses. It is essential to remain disciplined and avoid chasing trades in low volatility environments, as the risk of false breakouts or whipsaws may be heightened.

Conclusion:

The Bitcoin market is currently in a consolidation phase, displaying limited momentum and low volatility. Traders should exercise caution and closely monitor the market for signs of a potential breakout or change in market sentiment. Until a clear direction is established, engaging in scraping or adopting shorter-term trading strategies may be prudent. Proper risk management practices should be maintained to mitigate potential losses. As the market evolves, stay informed and adapt your trading approach accordingly.

Disclaimer: This report is based on the analysis and prediction provided by the author. Trading involves risk, and readers are advised to conduct their own research and seek professional advice before making any trading decisions.

Please review the report and make any necessary adjustments based on your analysis and preferences.

If you enjoy my works, please consider donating Ethereum to 0x870319E96690e65fcB97aeacc6d1AB585d1FF9b3. Thank you!

Start trading on Dydx Exchange: https://trade.stage.dydx.exchange/r/LFECSJTO