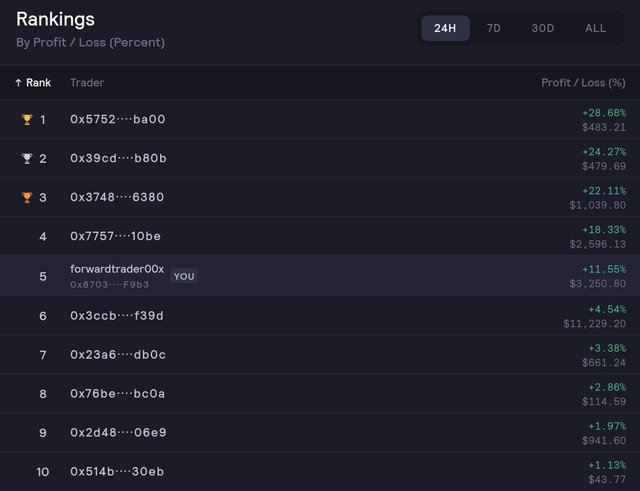

Ranked 5th out of 100+ traders in the intense daily dydx exchange competition. Join my $5/month mentorship program to master the art of crypto trading.

Dydx Trading Competition: https://trade.stage.dydx.exchange/rankings/competition

Forward Traders Mentorship Group: https://signal.group/#CjQKILZqZhzmXQrXE8YfYHN4CrImzNkOapmcha2hmH_tqyCHEhAjU9Bqg9HLjzKDKFSZHPKD

The Bitcoin market has witnessed a significant price rejection from the resistance level at $27,400, in line with the previous day's predictions. Furthermore, market analysts anticipate the occurrence of a substantial price decline, highlighting the current high volatility in the market. This report aims to analyze the recent price action, explore the factors influencing market volatility, and provide insights into the potential implications for Bitcoin investors.

Price Rejection at $27,400 Resistance:

Yesterday's prediction of a price rejection from the resistance level at $27,400 has materialized, indicating strong selling pressure in the market. The resistance level acted as a significant barrier, preventing further upward movement and signaling a potential reversal or consolidation phase. This price rejection is a crucial development that could have significant implications for Bitcoin's short-term price trajectory.

Expectation of a Significant Dump:

The market sentiment suggests an expectation of a significant price decline, commonly referred to as a "dump," in the Bitcoin market. This sentiment is based on several factors, including the price rejection from the resistance level, historical market patterns, and technical indicators. While it is important to exercise caution when predicting market movements, the presence of these factors has increased the likelihood of a notable downturn.

Market Volatility and Its Causes:

Bitcoin's market volatility has been notably high in recent times, characterized by rapid and substantial price fluctuations. Various factors contribute to this volatility, including:

a. Market Sentiment: The sentiment of market participants, influenced by news, regulatory developments, and macroeconomic factors, can drive significant price movements.

b. Trading Volume: Higher trading volumes often lead to increased volatility as large buy or sell orders can swiftly impact prices.

c. Lack of Market Depth: Bitcoin's relatively small market capitalization compared to traditional assets results in less liquidity, making it prone to sharper price swings.

d. Technical Factors: Technical analysis indicators, such as moving averages and trend lines, can generate significant buying or selling activity when certain thresholds are breached, further amplifying volatility.

Potential Implications for Bitcoin Investors:

The heightened market volatility and the anticipation of a significant price decline have important implications for Bitcoin investors:

a. Increased Risk: Higher volatility inherently brings increased risk. Investors should exercise caution and consider implementing risk management strategies to mitigate potential losses.

b. Trading Opportunities: For experienced traders, periods of high volatility can present opportunities for short-term trading strategies, such as scalping or swing trading, to capitalize on price fluctuations.

c. Long-Term Investment Perspective: Investors with a long-term perspective should focus on the fundamental aspects of Bitcoin and its potential as a store of value and hedge against inflation, rather than being swayed solely by short-term price movements.

d. Diversification: Diversifying investment portfolios across different asset classes can help mitigate risk and reduce the impact of Bitcoin's volatility on overall investment performance.

Conclusion:

The Bitcoin market has witnessed a price rejection from the resistance level at $27,400, aligning with previous predictions. Market volatility remains high, with an expectation of a significant price decline. Investors should exercise caution, implement risk management strategies, and consider long-term perspectives while navigating the current market conditions. As with any investment, thorough research and understanding of the factors influencing Bitcoin's price are crucial for making informed decisions.

If you enjoy my works, please consider donating Ethereum to 0x870319E96690e65fcB97aeacc6d1AB585d1FF9b3. Thank you!

Start trading on Dydx Exchange: https://trade.stage.dydx.exchange/r/LFECSJTO