An investor once said to me, “if you want to know how much an investment will bring in as profit with compound interest, use the Rule of 72”. What is the rule of 72, do people need 72 rules to get their investment profit value in the future? In this post, I will be talking about the Rule of 72.

Compound Interest is the continuous addition of interest in a capital over a period of time. At the point it becomes a rollover of both previous interest and capital to form a new interest thereby increasing the entire investment over a period. If a person invest $100 in a year and the interest rate is 10% to give $10 interest thereby making the investment grow to become $110, the interest for the next year will be calculated at $110 at 10% and not $100 which was the initial investment.

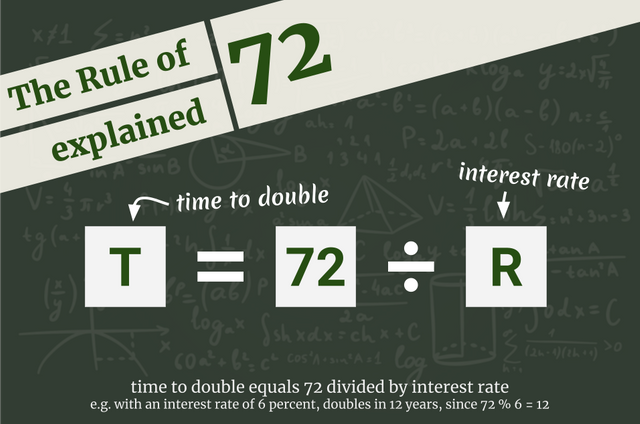

Simple, the rule of 72 is the mathematical determinant of how long it will take for an investment to double in its investment depending on the compound rate. This often applies to fixed investments and investments people already know how much they will possibly rake in as interest. If the S&P 500 is said to bring in an average of 10% annually, then the rule of 72 will mean that 72 will divide 10 to give 7.2 years to double the initial investment.

This formula is good for investment with fixed returns but it becomes inaccurate when the investment starts to have varying interest rates. It is often useful for compound interest rates and not responsible for different interest rate value. Also, when calculating with the rule of 72, people calculate interest rates above 12 using 72 + 2 and also when it is below 8%, some investors calculate with 71 so as to get the number of years the a compound interest rate will double the initial investment capital.

The rule of 72 is a very good mathematical determinant that allows investors to know if an investment is worth the try or not and how long they will be expecting to reach double their capital. With the rule of 72, people can determine when an investment will be reaching maturity.

Thanks for reading through my post, you can learn more about the rule of 72 by reading books, articles and posts. Also you check on the links below to understand more on the rule of 72.

Links

https://www.investopedia.com/terms/r/ruleof72.asp

https://www.cnbc.com/2020/01/28/what-the-rule-of-72-is-and-how-it-works.html

This is actually the first time I will be hearing about this rule of 72 anyways I cannot claim to be a good investor but I am happy to learn.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, I am happy you learnt something.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit