Retail investors will never get access to life-changing venture capital opportunities in equity ventures.

Venture capital offers unmatched wealth-creation opportunities.

Increasingly, however, by the time the next great company files an IPO, the greatest gains would have already been had.

The 100x to 1,000x gains are in the early stage VC rounds, not the IPO.

Early equity rounds of good companies are not accessible to retail investors.

What retail investors are given access is the pool of early equity rejected by VC funds, major angel investors, and institutional investors. Retail investors like you and I are left with the VC rejects.

The trash.

The trash-quality early equity is given to retail market on equity crowdfunding platforms like SeedInvest, which claims to only accept 1% of applicants. Despite that selectiveness, most of the equity sold on SeedInvest never becomes liquid, causing investors to lose their entire investment.

If this early equity ever becomes liquid, investors should expect a 90% loss, as per current record.

The top 1% of crowdfunded equity will give investors a 90%, in the best case. Imagine how putrid the remaining 99% of equity crowdfunding options must be.

Have Tokens Been a Viable Alternative?

The earliest tokens sales, dating pre-2017, have made their retail investors rich with returns at the scale of 100x to 1,000x, and beyond.

But how?

How come these great opportunities were not gobbled up by VCs, notable angels, and institutions?

These platinum-clad investors largely avoid tokens.

While they used to never participate in tokens, their participation has grown, but still remains insignificant. Therefore, tokens have given retail investors the insane wealth-generating opportunities that they otherwise never had access to.

While retail investors only get to participate in only trash-grade early equity, they get to participate in BOTH good and trash token sales.

This is where the problem surfaces.

Due to the success of early token sales, 2017-18 witnessed a massive surge in absolute trash-grade token sales. Picking good opportunities was equivalent to spotting a needle in a haystack.

Scammers, projects with no product market/fit, or straight-up incompetent teams managed to raise capital. Projects issued monopoly money-like tokens—worthless—while having a free get-out-of-jail card as tokens mandated zero liability to investors.

Most investors were left with nothing, as it the case with equity crowdfunding.

The Dust has Settled

In the current aftermath of the ICO mania of 2017-18, funding for token sales has mostly dried up, yet interest in equity crowdfunding unexplainably continues to surge.

A part of the reason may be that people are unaware of the trash-grade equity offered to them in equity crowdfunding, but the media has all but ensured people recognize cryptocurrencies as snake oil. As a consequence, equity crowdfunding continues to find new victims while even high-quality token offerings go without interest.

The problem is not that people are uninterested in early stage investments, they are.

This is proven by surging interest in equity crowdfunding. The problem is also not that there is insufficient capital in the cryptocurrency market. In fact, the current market cap is close to that of April 2018, which was a record month in which token sales collectively raised over a billion dollars.

The current market valuation is teetering near its mid-2018 level. Source: @Coingecko.

The problem is that the current framework with which token sales are conducted is broken.

ICOs do not work.

- No liability on the team

- No safety measures for investors

This is equally applicable to IEOs, which too place no liability on the team and offer no safety measures for investors.

Regardless, the appetite for early stage token investments should not be overlooked and should instead be encouraged due to the opportunities it offers to retail investors, something they can almost never access in early stage equity rounds.

The market’s disgruntlement with the current token sale framework is justifiable, understandable, and rational.

Equally justifiable, understandable, and rational is the need for a new token sale framework: Dynamical Coin Offerings.

What is a Dynamic Coin Offering (DYCO)

A token sale that succeeds, or else the token buyers get their money back.

A DYCO is the first early stage token investment opportunity that creates a price floor in the secondary market, thereby offering down-side protection to investors without limiting their upside.

It also holds the token issuer liable, without turning the token into a security.

The DYCO framework is the most important development in the timeline of crowdfunding. While it is currently designed for token sales, its implications can be easily extended to even equity crowdfunding.

How Does a DYCO Work?

A Dynamic Coin Offering issues money-backed utility tokens are issued.

80% of the funds raised in a DYCO are set aside to buy-back all holders’ tokens, if they are unhappy with their token purchase.

This gives all DYCO tokens a price floor.

The price floor is at 0.8x of the sale price. This token's speculative value and utility value are added atop this price floor.The token buy-backs are conducted at 9, 12, and 16 months after the token generation event.

- On the 9th month, 25% of the tokens are refunded

- On the 12th month, 37.5% of the tokens are refunded

- On the 16th month, 37.5 of the tokens are refunded

This timeline is of critical importance as it gives the team crucial time to prove the viability of the development. Each buy-back date thus acts as a milestone at which performance must be assessed.

If the team has not done well, holders claim a buy-back.

If the token performs poorly at all 3 milestones, holders claim a buy-back.

If a team is not being transparent, holders claim a buy-back.

Buy-backs can be claimed for all sold tokens, thereby eliminating a project.

On the other hand, if a team performs well, as would be reflected in token appreciation by the time each milestone arrives, holders will not need to claim a refund, and thereby unlocking a portion of the funds set aside for buy-backs to instead be used for scaling the development.

Important Characteristics of a DYCO

A. Token Burns

In a DYCO, only purchased tokens are circulating till the last buy-back date. This means a project goes through 16 months of no inflation.

Instead, each time a buy-back is conducted, the refunded tokens are burned.

This mechanism ensures that any tokens by people who lack faith in the development can exit their position, till eventually the only holders are the true believers of the project.

This means that DYCOs are expected to have a deflationary net supply. It also means that teams that are not transparent, drift away from their roadmap, or simply turn out to be incompetent end up having to buy-back the entire circulating supply, thereby eliminating the token (and the project).

B. Mirror Flip

As every token can be claimed for buy-back at 80% of the money paid for it during the DYCO, each token is supported with a price wall on the secondary market.

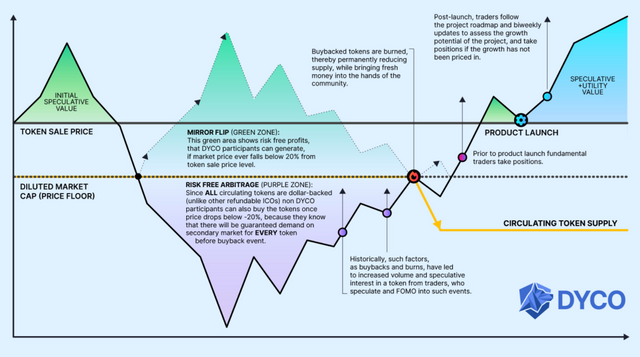

This means if the token price on exchanges ever falls below 0.8x, the tokens can be bought for a buy-back claim for risk-free profit. This is a mirror-flip: DYCO participants can make money if the token up or down.

For example:

Suppose 10 tokens are sold for $1 each. If these tokens start trading on an exchange at $0.5 each, they can be bought and a refund can be claimed for $0.8 per token, allowing an arbitrage opportunity to make $0.3 per token risk-free.

Mirror Flip & Secondary Market Visualized

C. DYCO Participants are Privileged

The one thing that equity crowdsales got right is that participants are given privileges like product discounts. On the other hand, token sale participants are traditionally given no particular advantage that some one who buys tokens on an exchange cannot have.

In a DYCO, the person who participates in the token sale has the sole right to claim a buy-back.

This means that in a DYCO, if token price falls below the price floor, only DYCO participants can make risk-free profit. Other traders may join the market to reduce the amount of arbitrage that DYCO participants can claim.

However, the final right to claim a buy-back is exclusively for DYCO participants who can decide to buy tokens only at, supposedly, 0.7x, thereby ensuring they always make some money on buy-backs.

D. An Incredible Secondary Market

Given that every token has a price floor, secondary market participants have incentives to participate in this token’s liquidity.

The secondary market will include:

- Arbitrage Traders

- FOMO Traders

- DYCO Participants

- Fundamentals-Driven Traders

Arbitrage traders will join in to offer liquidity to tokens that fall deeply below the price floor as they know DYCO participants will eventually want these for risk-free profits.

The DYCO has in-built dates on which tokens can be expected to be bought-back and burned. This reduces supply while putting fresh capital back in the hands of the secondary market. Such events have historically brought in a surge of FOMO-driven traders.

DYCO participants themselves will be ready to claim risk-free profits on mirror flips.

Fundamentals-driven traders who would be interested in the underlying development but were unaware of the project during the DYCO will be drawn to the project particularly close to buy-backs due to the expected volume surge and expected high placements on exchanges’ and data trackers’ charts.

Ushering a New Era of Token Sales

Success or your money back is the token sale framework under Dynamic Coin Offerings.

Retail investors can access the wealth-generating opportunities early stage investments can offer while having down-side protection, without hindering the upside potential. Simultaneously, they are given the right to decide whether or not a development can continue, thereby granting powerful rights to hold teams liable without turning the token into a security.

The first project to utilize a Dynamic Coin Offering will be announced in May.

The first Dynamic Coin Offering is live: https://daomaker.com/dyco/orion

Good Resources by Me

A. DYCO in 300 Words: Read Now

B. DYCO Incentive Theory Unpacked: Read Now

C. Money-Backed Tokens are Necessary: Here

D. Mirror Flip Unpacked: Here

This is a very good way to go about it. Using this, the argument "you can't invest in ICOs for your own protection" will not be as strong.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ICOs have no protection system, never did. IEOs don't as-well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Doesn't matter what initials you use, when you raise money with a coin it's an ICO. Exchange or not, protection or not. Money backed or not.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No, it's a token sale.

Going by your argument, any issuance of equity is an IPO.

Not all equity issuance takes the form of an IPO, which has a designated framework. Similarly, not all token sales have to follow the framework of an ICO.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ICO and IPO are the name of the first (or initial) issuance of tokens/shares. The first token sale is an ICO. The first public shares issuance is an IPO.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@hatu ico are not giving that much return so we have to think about new ways to gain profit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As the article states, ICOs just don't work, but that does not mean tokens have not been successful.

That's why the DYCO is the clear evolution: company will buyback your tokens if you want, till token sale-funded product goes live. Downside protection, while having maximum upside exposure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @hatu, this post is very interesting for me because it is exactly what i would like to do with my new born token but it is really difficult for me make people from steemit understand about this kind of tokens...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

the ico time has passed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi @hatu you have presented detailed thing about DYCO nicely. ICO is the totally wastage i have never invested yet in ICOs.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I actually don't really know why I don't engage in ICOs investments most times due to the great risks involved and the prevalence of scammers dealing with crypto projects. There are times I do hear lots of complaints from the investors about how they got scammed in some particular crypto projects through ICOs investments.

I really love the idea behind DYCO even though I'm just hearing about this for the first time and I really think it's really the best to engage in unlike ICOs investments.

It's really rare to see people backing up their project with DYCO unless they are very sure about the outcome. I'm also concerned about how some crypto project owners will be able to manage their losses if every investors get their investment back.

Thanks for sharing this great post with love from @hardaeborla and I hope you have a great day ahead 💕❤️💕❤️💕❤️💕❤️💕

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ICOs are history. Now IEOs are going down in history.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit