After rising to $42.5k, Bitcoin could not hold its momentum and dropped back below 50 DMA. In my post from last week, I had mentioned that the charts look bearish despite the rise in price. However, I am pleasantly surprised by the lower volatility of Bitcoin prices. As of now, Bitcoin is trading below 50 DMA around $38k. The de-risking continues in other markets and Bitcoin will most likely continue to see a price decline.

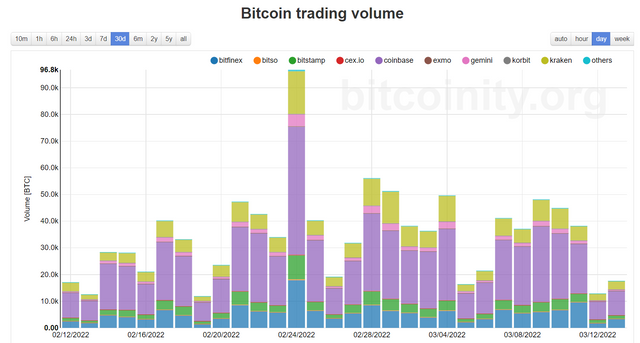

As mentioned above, Bitcoin failed to stay above 50 DMA. Volumes, as shown in the chart below have also declined considerably. In fact over the weekend, Volumes were the lowest in a month. RSI hasn't budged from a week ago and Price-Volume continues to imply a bearish future for the crypto-asset.

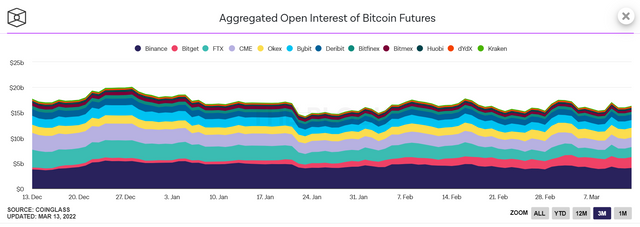

Open Interest has surprisingly risen during the last week, contrary to price. Traders seem to be betting on a potential breakout above 50 DMA that should get confirmed. I think the reason for this bullishness in OI is Bitcoin's decentralized nature.

A Credit Suisse analyst confirmed my analogy in this post - "Near-Zero credit risk of US Debt has been replaced by a very real confiscation risk". Countries in the Middle-East and specially China must be discussing the seizure of Russian foreign reserves, making a strong case for a system that can act as an alternative to US Dollar.

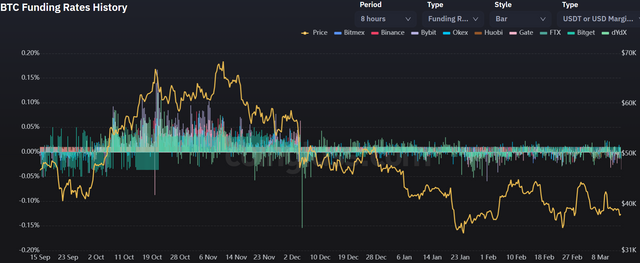

The funding rate has moved in the opposite direction of OI in the last couple of days. Funding rates are getting closer to all-time lows acting as a deterrent for further downside. However, I do not think that there is a lower bound here. If the world can wake up to see Oil Futures trading for a negative price, then anything is possible with the funding rates.

The US Central Bank begins its 2-day meeting tomorrow and is expected to raise rates. Clearly, inflation is not as transitory as they had expected. However, the transitory argument has a new twist added to the tale - The Russia-Ukraine conflict. This conflict has the potential to make inflation sticky and last for a longer period than one would hope. I doubt that the Fed will be too aggressive. 2y-10y US treasury rate difference was about to flip indicating an impending recession. The quantum of the rate hike has the potential to create havoc in the markets. The Fed has already confirmed that it will raise rates in the upcoming meeting. This week's Bitcoin price action will again largely be impacted by Fed's action and the ongoing crisis. Technically too, Bitcoin is most likely poised to head to $30k and below. Fundamentally, things are much more bullish but fundamentals take a longer time to play out.

Hi @karamyog Greetings, I have been reading recently that it is possible that traditional financial institutions and large technology companies may want to introduce their own virtual currency systems. In order for these systems to achieve widespread acceptance, they will need to have some of the main virtues of bitcoin and generate enough confidence for the exchange rate against legal tender to maintain stability. These systems, potentially more secure, in terms of lower energy consumption or computer memory and which would inspire more confidence, could take hold and cause the value of bitcoins to plummet, which is a cause for concern. They will be a litmus test for bitcoins, whether they trade at $1,000 or $100.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit