In my post from last week, I had mentioned that Bitcoin had enough fuel to get to 200 DMA but breaking that level will be difficult.

Bitcoin rose to $43k yesterday and is showing positive signs that can take it closer to the $50k mark. Volume wasn't exceptional during the whole of last week. RSI is inching up slowly and may rise to overbought levels around the 200 DMA level, from where a retreat is very likely.

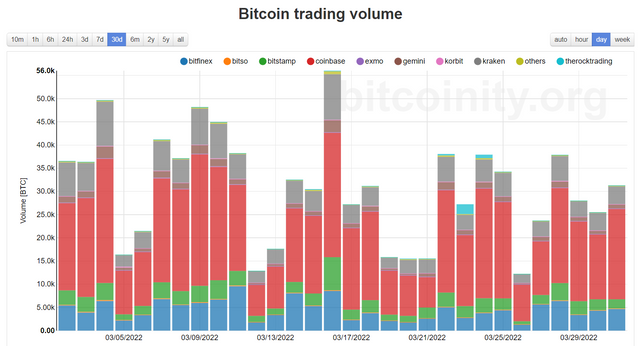

Bitcoin did exactly that. It made a high of $48,250 two days ago when RSI hit the 70 mark. Post that, it started its retreat from the level. Volumes dropped slightly across different exchanges when compared to last week.

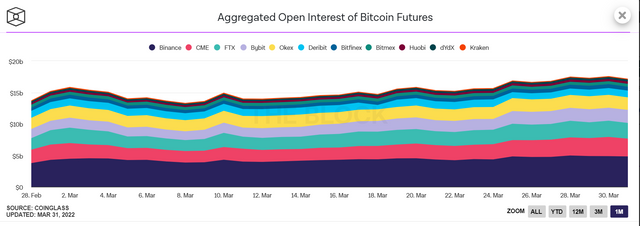

Open Interest continued to rise before dipping slightly towards the end of this week, indicating improving and healthy institutional interest in the cryptocurrency.

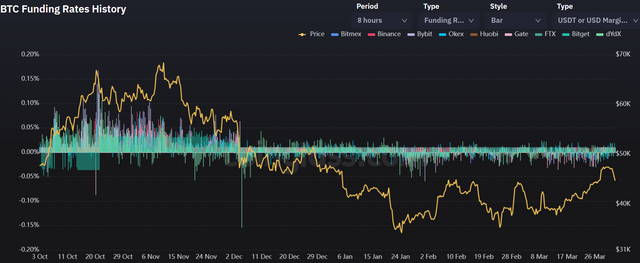

Funding rates almost reached neutral territory and the trend is clearly positive. There is clearly a momentum here that can take funding rates higher, implying that traders and investors are happy to add Bitcoin risk to their portfolios.

Equities have resumed their trend upwards, except for a small correction during the last two days. Rising inflation is a good thing for the markets, it seems, and will probably continue to be a good thing till data starts coming in that high inflation and high rates have really dented demand to cause a recession. Then we may have money being poured into people's bank accounts and further rounds of liquidity infusion in the markets. I see fundamental reasons for a sharp correction in equities but I don't know if a long-duration correction in markets will ever happen. Sharper, shorter-lived corrections seem to be becoming the norm now.

There will be short-duration bouts of volatility every now and then because the Fed is ready to push the economy towards a slowdown. However, I expect that we will continue to see what we are seeing in risk markets right now. Buy-the-dips will be a very useful strategy for Bitcoin going forwards.

Good job! You just got yourself a 100% upvote from ACOM. Enjoy!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello @karamyog,

we are coming out of a bull run for months and many people are already waiting for a new bull run, in my view the market has not made the necessary correction to bring the price of cryptocurrencies back to record highs. This means that cryptocurrencies are likely to lose value very quickly, but when a price floor is established they will rise back to record highs.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In my opinion, the correction was enough. more than 50%. the increased risk in the markets is what has prolonged this correction i feel.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit