I have been away from posting for close to two months now and boy has the world turned around during that time. I was trying to establish new revenue lines for my business and while that happened successfully, supply-side issues meant that I had to wind up everything. Anyway, the post is not about my work but about Bitcoin.

Two months ago, I was posting about Bitcoin ranging between $40k and $50k. Since then, inflation scares around the globe and central bank hawkishness have pushed risk assets and tech stocks lower. In line with tech stocks, Bitcoin has also headed lower and was trading below $30k till two days ago.

What is interesting is that those who call Bitcoin a scam should see the overall drop in tech stocks. ARK Innovation ETF is down 70% from its highs, and during the same time, NASDAQ is down more than 30% and Bitcoin, just about 50% -

Seems like Bitcoin offers better risk-reward compared to the whole of NASDAQ.

What can we expect from Bitcoin going forward? It wouldn't be interesting to look at data such as volume and open interest at the moment to understand the long-term trend in Bitcoin. Even technicals may not be incredibly reliable at this stage to do that. This is more a macro story - global growth, inflation, interest rates - than a fundamental issue with cryptocurrencies. Nonetheless, let us look at some technicals to see if they show us some risk.

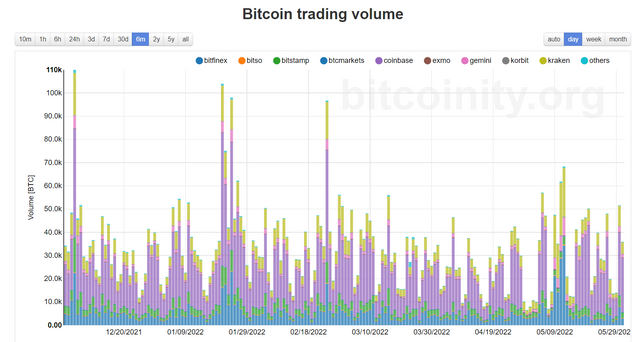

[https://data.bitcoinity.org/markets/volume/6m?c=e&r=day&t=b]

The 6-month volume data shows us that volumes haven't been incredibly high compared to the previous months. This is when the world is panicking and selling equities in large volumes, Bitcoin has sold off but volumes are still not quite high. This means, that Hodlers are holding on to their Bitcoin. To me, this also means that a lot of people who entered this space last year, when money was flowing easily, entered for the long run after understanding the risks in this space.

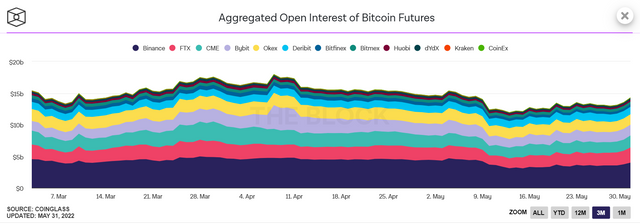

Bitcoin Open Interest paints another interesting story to me. The open interest bottomed out on 09 May and has been slowly picking up from thereon. I do not think institutional traders are going to send Bitcoin lower. We probably have been in a nice phase of consolidation and based on my opinion of global macro, I believe the tide will turn for Bitcoin to the upside in the next couple of months.

Now the global macro situation is interesting. Instead of showing a lot more charts, something that I will reserve for another post, I will summarise what I think will happen.

Inflation isn't sticky. Inflation is relative. Inflation cannot logically stay at 8% for 3 years. Not in today's scenario. All countries globally have witnessed a sharp increase in prices. Forget CPI numbers, those are fudged. Real inflation for most people is around 20% or more - Food prices, rental increases, increase in interest costs on loans, and more. Prices of goods have also gone up sharply. These sharp rises cannot sustain year over year. At some point, the prices will start rising slowly, and while they may stay elevated, inflation will drop because it measures the rate of change.

I think this inflation rhetoric has peaked. There is a reason that US10 year yield has now started to head lower and in the next couple of months, the confusion will be replaced by a common consensus of supportive Fed focussing on growth and unemployment, as opposed to inflation.

The bloodbath in markets, in my opinion, is now short-lived. This means Bitcoin is probably a great buying opportunity here. I feel the consolidation in Bitcoin will continue for a month or two more and as the market narrative shifts from inflation to growth, Bitcoin will rise again. This is an election year in the US. The government will be supportive in case of any "financial stress" to the system.

Stay hopeful, stay invested!

Greetings @karamyog ❤️😊

I just hope Bitcoin will appear very bullish this coming months since it's the major crypto that influences all other alt coins making them appear bullish or bearish. Let's just keep being optimistic about Bitcoin being bullish.

Thanks for sharing this great post with love from @hardaeborla and I hope you have a Great day ahead ❤️😊💞

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As per with Bitcoin I think it is just going to be a stable market and ecosystem. We might not be seeing a big changes but gradually everything will settles properly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting and informative read. I hope your prediction is correct, because I believe we all want to see Bitcoin rise in coming months. Thanks for posting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 0/5) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The height of the Luna debacle was the best point to go into bitcoin, now is a good time too. But somehow, I feel there's still one more crash left before things move up tangibly. But the points you raised here are valid as well. Nevertheless, there could see a tangible drop on the cards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As long as the FED and potentially other central banks keep raising the cost of credit...Bitcoin and pretty much all asset classes, are going to continually decrease in price.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi @karamyog

Thanks for sharing your thoughts.

I also think so. Especially since winter = end of war in Ukraine (most likely). I'm Polish and I know history of this region of the world. Winter is what stopped armies in the past. Including German undefeated army during II World War.

End of war would hopefully means that sanctions will be lifted (right now it's hurting entire world). This could bring more optimism and attract money back into the markets.

cheers,Piotr

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit