Making the decision to begin living on a budget does not necessarily mean giving up all of the things you love. You can eat your favorite foods, go out to dinner once in a while and buy that cute pair of shoes. Going on a budget simply means that you are making the decision to keep track of where your money is going and to spend it more wisely. You can create a budget for your family in just a few easy steps – why not get started right now?

5 Steps to Create a Budget

Review Your Monthly Expenses

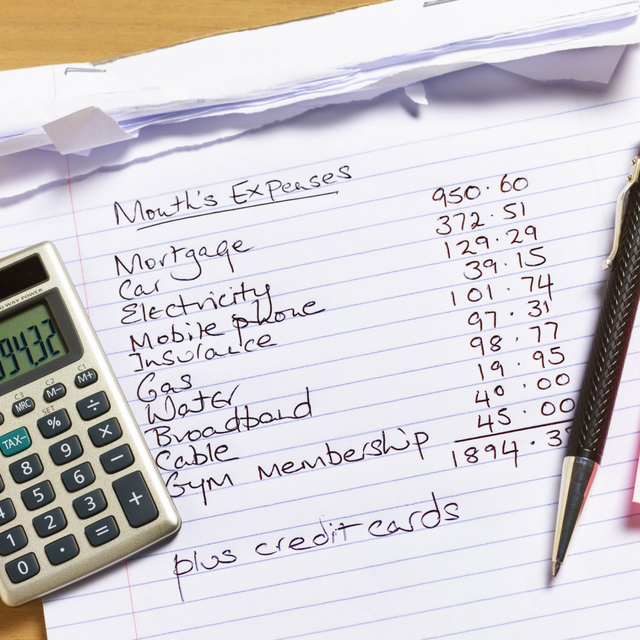

In order to create a budget for yourself or your family you will first need to see how much you are spending on various things each month. To determine this you will need to keep track of every cent you spend for a period between one week and one month. Your average will be more accurate if you lean closer to the one month end of the spectrum. Create a spreadsheet or some kind of document on which to record the amount you spend and which category the expense belongs to (examples: groceries, rent, utilities, clothes). Then, once you have recorded all of your expenses find the total for each category and the total for the month.

Set Spending Goals

Once you are able to see how much you are spending in each category you will be able to take a look at them and decide what is reasonable. Start with the necessities, things that you must pay each month. Things like rent, utilities, car or loan payments, insurance, and groceries should be at the top of this list.

Once you have set aside a certain spending goal for these categories you can begin to think about non-necessities, things like cable subscriptions, gym memberships, dining out. For each category decide whether it is something you really need. If it isn't, cut it from your budget but if it is something you think is important then create a monthly allowance for that category.

Once you have finished assigning spending goals you can add up the totals. Find the total for necessary and unnecessary expenses in addition to your total monthly spending allowance.

Compare Your Spending with Your Income

The next step to make a budget is to compare your income to your expenditures. You should have a basic idea of how much income you have every month but, if you need to, review your bank statements to determine the most accurate number. Then, compare your income to your total monthly expenditures (this number should include both necessary and unnecessary expenses). If your income is higher than your expenses then you are in a good position but if your expenses are higher than you may need to tweak your numbers a bit to find a balance.

Cut Expenses to Balance Your Budget

If your expenses are more than your monthly income (or if you want to be able to set aside some money for savings each month) then you will need to revisit your expenditures and make a few changes. First, scan your list of necessary and unnecessary expenses and see if there aren't one or two that you can cut completely. If you feel like you simply can't do without your cable subscription perhaps you can at least save a few dollars by canceling your premium channels. If you can't give up eating out then at least limit your spending to a reasonable amount, say two dinners out per month.

Recalculate Your Totals

Once you have made the necessary cuts and cut-backs you can recalculate your totals to see if your budget becomes more balanced. If you do find that, after your changes, you will have some money left over each month you can consider putting that money into savings toward your retirement or into a college fund for your kids. If, however, your expenses still exceed your income you may need to consider taking a second job or commit to making more radical cuts to your expenses.

Commit to Following Your Budget

Taking the time to create a budget will do you no good unless you actually follow it. Make a commitment to yourself and to your family to stick to the spending allowances you have determined. If it helps, remind yourself of the reasons you have created your budget. Did you want to cut back on your expenses so you would have more money to put into your savings? Did you want to learn how to spend your money more wisely? Whatever your reasons may be, reminding yourself of your motivation will help you to stick to your budget.

Well said. I always say it that some family are suffering in financial crises because they lack to create a family Budget

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit