Stablecoins, a class of cryptocurrencies pegged to real world assets like fiat currencies have gained significant traction in crypto space over the years. Tether (USDT) with a market cap of over $80 billion and and Circle (USDC) with over $26 billion cap have firmly established themselves as major players, holding a substantial portion of the total crypto market capitalization with a market valuation of over $100 billion. They have over the years provided a bridge between the volatility of cryptocurrencies and the stability of traditional fiat currencies, making them an attractive option for investors and users alike.

PYUSD a new player in the game

Amidst increasing competition among stablecoin issuers there seems to be yet another big player harnessing the use blockchain technology to compete in the stablecoin issuing market, as some crypto enthusiasts have eagerly anticipated the roll out of PayPal's new stablecoin, PYUSD. Which was announced by the online payment company having over 430 million users on Monday via their official Twitter (X) page PayPal announcement from it official announcement PYUSD is highly secured and backed by liquid asset design to give millions of users access to hold, buy and sell perform transactions using its stablecoin via PayPal payments app it is design using ethereum smart compatible contracts which gives it a blockchain compatibility feature.

Censorship concerns

The introduction of PYUSD by PayPal has stirred both excitement and skepticism among users, crypto market have recently reacted to this news spark, with bitcoin and other altcoins having responding positively with their price action bitcoin which have been below 29k rose over 2% lately there seem to be some green in the market which have not been seen for couple of days as the market have remained stagnant which seem to be revived with this news.

Taking a closer look reveals a unique aspect of PYUSD it is limited to centralized use within the PayPal payments platform. While the company's website mentions that users who purchase PYUSD can send them to Ethereum addresses with a few steps, there isn't any official announcement of exchang listing or decentralized exchange where it stablecoin can be accessed by users willing to swapped it for alternative cryptocurrencies this according to expert defeat the idea of cypto based stablecoin it's therefore evident that the scope of PYUSD's use is not as expansive as other stablecoins.

PYUSD has all the censorship capabilities of a CBDC, yet it is launched by big tech instead of the government at the same time.

Source

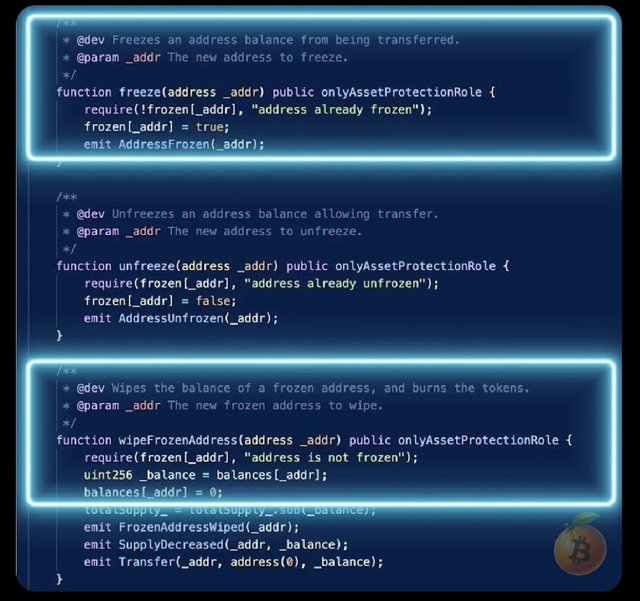

Twitter users have voiced their concerns over PYUSD, drawing comparison between the new stablecoin and Central Bank Digital Currencies (CBDCs). The apprehension revolves around the potential for PYUSD to function as a tool for transaction reversal, akin to how financial systems can control CBDCs. PYUSD's features mirror those of a CBDC, implying a level of total surveillance on users' transactions. This aspect has ignited a debate about the implications of PYUSD's controlled nature and its compatibility with the values of decentralization that underpin the broader crypto ecosystem.

Another user also expressed the new stablecoin has two main features one which is asset protection which can erase a user transaction and second asset freez a user asset can be held by the company all this feature raised concern about PYUSD credibility for crypto users as it mainly doesn't give users control over their funds.

The question now remains will PYUSD find widespread adoption among crypto users who prioritize privacy and resist government surveillance? I doubt any privacy cautions user will bother holding of these stablecoin. While the introduction of PYUSD marks a significant milestone for mainstream financial institutions entering the crypto space, it also highlights the importance of user sovereignty and autonomy that cryptocurrencies originally aimed to champion. PYUSD totally defeats crypto privacy, and doesn't serve the purpose of decentralization.