Stablecoins are known for their stability, investors run to them where there is much uncertainty and market turbulence in the crypto space, as the crypto space continues to evolve investors have over time begin to loose their stake on the stable asset this FUD could be said to be attributed to last year's terra UST depegging a market crash like no other in the stablecoin market was recorded with terra UST crash this incident have lead to fall in market capitalization of most stablecoin which are still trying to lick up their wound of past to gain more users trust with algorithm stablecoin failing the test of market volatility and losing it peg with centralized based stablecoin like USDT, USDC and BUSD are all gripped by the strict regulatory policies which are making blockchain based centralized stablecoin unfriendly for most crypto users.

With central bank digital currencies CBDC'S rollout blockchain stablecoin are in constant competition against these centralized digital currencies most investors are standing between the fence on which assets to hold against market volatility with CBDC'S in play there is diversification of asset among most users who might likely be holding their assets on both chains to avoid losing all their investments the uncertainty of most stablecoin deppeging in markets make them not too suitable for investors to hold during these bear market which has also prompted most investors to sell their crypto based stablecoin and convert their holdings to fiat to either buy back when there is certain market moves.

A dire eighteen month

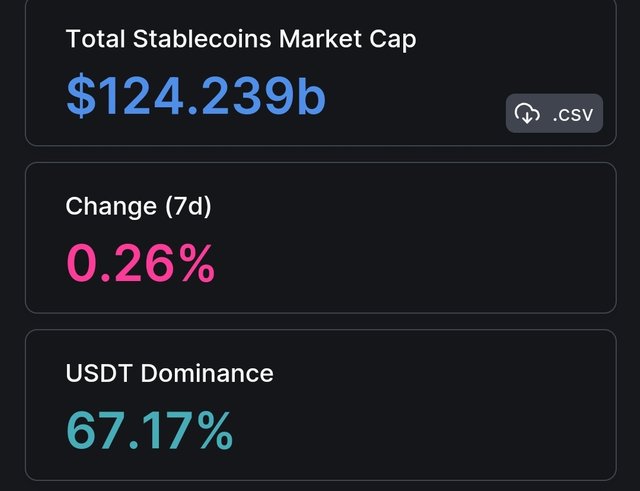

Since the collapse of algorithm stablecoi, stablecoin space have continued to struggle to recover from it's all time peak price it has apparently seen a drop in price with a jaw dropping price of over 36% according to reports from DefiLlama with USDT dominating the stablecoin market with over 67% market dominated with a market capitalization of $83.5 billion followed by USDC having a $24.9 billion market capitalization the total stablecoin market capitalization is valued at $124 billion today where it recorded a previous peak of $189 in May of last year which records an 18 month low in market capitalization.

According to Nic Carter a partner at Castle Island Ventures explained the drop in stablecoin market is associated traditional finance rates exceeding crypto native yield he also added stablecoin market is concentrated on few stablecoins like USDT and USDC which basically comprises of more than 70% of the entire stablecoin market the lack of competitive stablecoin made it a bit less attractive to investors they is need for more competition so investors can basically diversify their stablecoin holding to increase it market trading volume.

Are they still safe?

Stablecoins were once seen as a reliable anchor in the turbulent sea of cryptocurrency investments. They provided a sense of security and predictability, offering investors a place to park their funds during market downturns. However the crypto market is known for its unpredictability the recent regulatory scrutiny has further shaken the stability of stablecoins, they are a means of preserving capital used to cool down market uncertainties, investors who once turned to stablecoins to safeguard their holdings are now reconsidering their options with challenges such as increased reporting requirements and the threat of potential bans, have made some investors nervous about the future of stablecoins in their portfolio.

One of the fundamental promises of stablecoins is their ability to maintain a stable value, often pegged to a specific currency like the U.S. dollar with recent market volatility which has exposed vulnerabilities in this promise at times of extreme market turbulence, some stablecoins have struggled to hold their pegs. This means that investors may experience losses when they were expecting stability.

All these happening challenges leaves us with the question if stablecoin are still a go best option for investor portfolio diversification despite the challenges at hand stablecoins have still shown their resilience in the crypto space they can still be considered as good go option for investor to run to during high market volatilities, crypto space is associated with risk which means there is no guarantee of price stability in any investment we must always careful access risk tolerance associated with any investment assets before buying into any asset overall holding stablecoin depends on any investors long or short holding strategy in the crypto space I believe they are still go option to hold of you're looking to buy into more crypto assets during the bear markets.