If you remembered very well, when the Pandemic started in China and kept spreading to other part of the world, among the first industries to shutdown operation fully were the aviation industry. People were no longer flying, countries set restrictions to certain airlines coming from certain countries, and then there was the great lockdown which took a very bad turn on the airline business as almost all airlines saw a drastic fall in the price of their stocks in the market within 48 hours to about 90%.

Towards the end of 2019, most airlines spent their cash buying back their stocks as a Christmas bonus to their investors. Most American Airline spent $12 billion on stock buybacks at the end of last year. With the pandemic, airline were out of cash, weren’t getting any revenue and had to still pay to keep their planes in good shape. This left them cashless and their stocks at almost 100% down but as we all know, there is always a superman who will save the day with Tax payers money and that is the government.

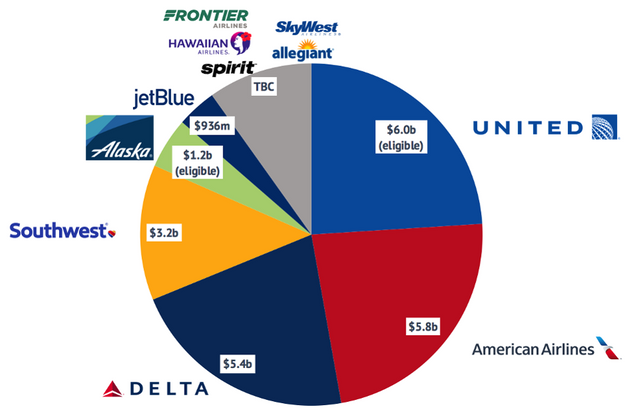

A lot of countries have been giving bailouts to airline companies and even the United States gave airlines a $50 billion bailout and Europe is planning to give out €26 billion (approx. £22.7 billion), but in the midst of this, Warren Buffett sold his shares in United Airline, American Airline, Southwest Airline and Delta Airlines at the rate of $4 billion which he bought for about $8 billion and based his sell on the fact that airlines will not have enough people traveling long miles in the next four years like they did in the past which means they might be running on a loss. In case you do not know, for an airline to make profit, it needs to carry at least 73% of its total seat because either a plane is full or empty, paying for a tank of gas, surcharges, Tax and VATs, Pilot, air attendant and many more. If an airline doesn’t sell above 73% of their seat, then they are not making profit. (Will airlines be having a craft full with passengers in the next 1 year?).

With Warren Buffett selling his stocks, people are beginning to contemplate either to buy airline shares or not because the Oracle of Omaha has always been accurate with his investment decision. Although the United State president called him out and said the Oracle has made his first mistake, this hasn’t really changed the mind of investors except for the fact that the stocks of airlines have been going up because the government has bailed the airline out and they are using the money to buy back their shares. The question a lot of people are asking is “After the government bailout runs out, will the companies still have enough cash and resources to overcome this recession”?

Before you invest in any airline because the stocks are going up, the first thing you should first checkout the financial status of the airlines you are going to invest in, this will help you know if the airline industry has cash or not to survive after the bailout. For example, American Airline has about $20 billion worth of debt which I think is one of the reasons the Oracle of Omaha pulled out his investment.

On another thought, an Airline could be in debt but still be the people favorite so what you also need to look at is the airline people will want to travel with. On this note, people will prefer airlines that can guarantee safety.

Summary

My concern will the airline industry isn’t the government bailout but what happens when this money runs out. Also, Will the airline business be profitable and when will people be confident about safety on a plane? Furthermore, wealthy people started going with private jet instead of first class as well as a lot of businesses now prefer doing a video conference instead of travelling for business meetings. Will companies in the airline industry make it, and if not all, which do you think will not make it?

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 6/9 - need recharge?)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

airlines will have to adapt to the "new normal" if they want to survive. THE bubble is more than the transfer business, the truth is that the FED is betting on buying everything in front of it in order to maintain appearances, tables and numbers in the markets.

You are forcing a demand that does not exist and this will have very negative consequences of continuing at this rate of disproportionate impression.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is easy think that the airline industry is a good place to invest in because they look very lucrative but understanding the market will help us make a better investment option.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have always been skeptical about airline investment but it really looks like a big deal to us here, thanks for the clarification I will share this with my friends.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! I actually never knew this though but I've always thought most airlines are always full with lot of passengers before it can move just like what happens when it comes to car transportation but I actually don't know if the same principle applies to airline too.

If I even want to invest in such cause, I'll prefer investing in more popular and widely used airlines to avoid loosing my investments 😊.

Thanks for sharing this great post with love from @hardaeborla and I hope you have a great day ahead

💕❤️💕💖💕❤️💕💕❤️💖💖💕❤️💖

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit