Introduction

If we can email virtually anybody in the world, why can't we send them money just as easily? Or offer them a loan? These questions are the foundation of Decentralized Finance's (DeFi) beliefs, activities and objectives. In short, DeFi refers to an ecosystem of financial applications that are built on top of a blockchain. Its common goal is to develop and operate in a decentralized way — without intermediaries such as banks, payment service providers or investment funds — all types of financial services on top of a transparent and trustless blockchain network.

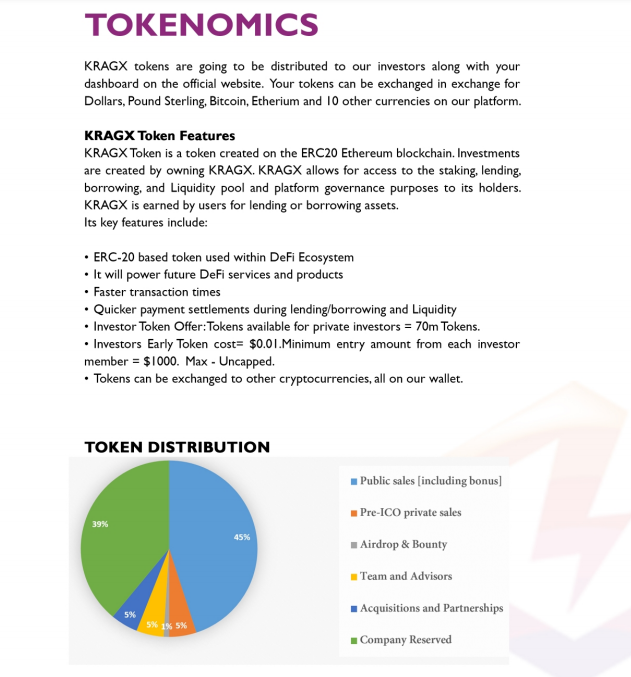

The DeFi field is currently experiencing an incredible surge. More than twenty billion US Dollars (USD) have already been deployed (»locked-in«) across a variety of DeFi applications that offer lending and borrowing services, exchange services, monetary banking services (e.g. the issuance of stablecoins), tokenization services, or other financial instruments such as derivatives and prediction markets. In that sense. DeFi is not a specific thing, but more a loosely defined collection of ideas and projects to reshape financial services through blockchain technology, thereby removing the middlemen. Its disruptive potential has brought DeFi into the spotlight of the blockchain and fintech communities, and increasingly also to the attention of traditional financiers and policymakers. However, it appears that these different parties often lack a common understanding of what DeFi is and is not, and further, of how DeFi can overcome major technical, operational and regulatory obstacles that challenge its further development We firmly believe that DeFi's growth and success is inextricably linked to greater dialogue, cooperation, and integration with political stakeholders, regulatory supervisors, traditional finance, and fintech.

This idea and the importance of additional payments systems, decentralized governance, methods of earning and means of transacting is about what gave birth to KRAGX. KRAG means power in Afrikaans and X is for Xchange.This literarily means that governance has been transferred to the users in terms of exchanges. By owning KRAGX tokens you are entitled to, Invest, lend, exchange and earn interest as the token appreciates.

What is Kragx

KRAX empowers users with access to new decentralized financial products. with a focus on investment and financial health. These new financial products offer compelling value, such as asset-backed money market funds with interest rates that out-perform their traditional finance counterparts. KRAGX uses technology to automate the manual processes of investing in cryptocurrency collateralized loans and aggregates user demand across markets with an approachable but capable hybrid wallet platform

The DeFi field is currently experiencing an incredible surge. More than twenty billion US Dollars (USD) have already been deployed (»locked-ing) across a variety of DeFi applications that offer lending and borrowing services, exchange services, monetary banking services (e.g. the issuance of stablecoins), tokenization services, or other financial instruments such as derivatives and prediction markets. In that sense. DeFi is not a specific thing, but more a loosely defined collection of ideas and projects to reshape financial services through blockchain technology, thereby removing the middlemen. Its disruptive potential has brought DeFi into the spotlight of the blockchain and fintech communities. and increasingly also to the attention of traditional financiers and policymakers. However, it appears that these different parties often lack a common understanding of what DeFi is and is not, and further, of how DeFi can overcome major technical, operational and regulatory obstacles that challenge its further development We firmly believe that DeFi's growth and success is inextricably linked to greater dialogue. cooperation, and integration with political stakeholders, regulatory supervisors, traditional finance, and fintech.

KRAGX DeFi Investment Opportunities.

Now, investment in DeFi isn't a lot different from traditional investment, but a few unique aspects make it stand out. For instance, traditional lending involves the lender giving money to the borrower — with them (the borrower) making the promise to return the money with interest This is how decentralized lending works as well, except this time, blockchain-based smart contracts lock in collateral from the borrower and automatically delivers interest to the lender periodically according to the terms of the contract.

Then there's staking. In traditional finance, individuals usually deposit money to institutions such as banks and credit unions and these institutions use this money to maintain liquidity and sufficient cash reserves. In DeFi. this process of buying and depositing digital assets into a platforms account is known as staking. Such platforms need the funds to lend out to other users (borrowers). and to help maintain and secure the network.

Investing into KRAGX is practically owning KRAGX tokens.This token can be acquired with almost any cryptocurrency.As we have seen, the defi world is already the next big bomb in the crypto market. The value of the tokens continuously is built by others investing therefore creating liquidity, staking. ability for users to lend, deposit funds. The more funds locked into our protocol and use of our exchange. the more its value increases. For example Uniswap which is also in the Defi space but offering another service has 2bn$ locked in and the trading volume per day of more than half its market cap and current token price is increased with over %I000.

How can one invest into KRAGX?

Investing into KRAGX is simply owning KRX token.This will be done with the

use of smart contracts and Dapps.

Smart contract is a computer program or a transaction protocol which is intended to automatically execute, control or document legally relevant events and actions according to the terms of a contract or an agreement

A smart contract is an agreement between two people in the form of GZCI computer code.They run on the blockchain, so they are stored on a public database and cannot be changed.

The transactions that happen in a smart contract are processed by the blockchain. which means they can be sent automatically without a third party.

0 The transactions only happen when the conditions in the agreement are met — there is no third parry, so there are no issues with trust.

Once a smart contract call has been initiated on our Dapp, KRX tokens will be allocated and you'll receive instructions on how to set up a secure wallet to store your tokens which will be sent to your wallet.

More Information

Website: https://kragx.io/

Whitepaper: https://kragx.io/whitepaper.pdf

Telegram: https://t.me/kragx_chat

Twitter: https://twitter.com/kragxk

Reddit: https://www.reddit.com/user/kragx_defi

YouTube: https://www.youtube.com/channel/UCQXzubCYqUb6dNMp3NEoW9w

İnstagram: https://www.instagram.com/kragx_/

Etherscan: https://ethplorer.io/address/0xd13b3dce37e116f29cadece4f20c13694935bffc

Bounty: https://www.altcoinstalks.com/index.php?topic=190428.0

Author

Bitcointalk Username: tokensairdrops

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2735849

ETH Address: 0xbEC1C812170e8Ca567b567efb967b0713f10bB6b