Welcome to the daily crypto news :

Chainlink (LINK) Surges 39.5% to a New All-Time High — Here’s Why ;

Top 5 Cryptocurrencies to Watch This Week: BTC, LINK, ATOM, XLM, BNB ;

G20 Lays Regulatory Groundwork for Accepting Digital Payments ;

Japanese Residents Have Cash to Spare, But is it Going into Crypto? ;

Chainlink (LINK) Surges 39.5% to a New All-Time High — Here’s Why

Surging volume, price discovery, and new partnerships pushed Chainlink price to a new all-time high at $8.48.

Today the price of Chainlink (LINK) soared by more than 34% to reach a new all-time high at $8.48 and also notch a market capitalization of $2.5 billion.

Three key factors that likely pushed the price of LINK to a new record high were: high-profile partnerships, price discovery, and the strong momentum that currently drives the altcoin market.

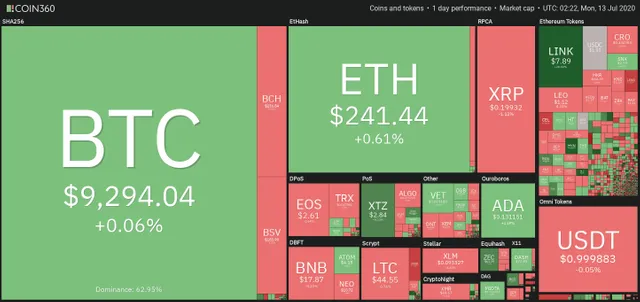

Crypto market weekly price chart. Source: Coin360

Price discovery drives LINK price higher

On July 6, the price of LINK surpassed its previous record high at $5.31 and officially entered a price discovery phase, which typically leads to a “fear of missing out” rally among investors.

Once price discovery occurs and the asset begins to rally to a new peak, the probability of an extended uptrend rises.

Within seven days of LINK recording a new historic high, its price rallied by more than 40% from $5.31 to $8.48.

LINK’s trading volume also rose to levels unseen since April 2020, when the price of Bitcoin (BTC) was recovering from an intense drop to $3,750. At the time, demand for cryptocurrencies from retail investors on Coinbase was surging.

In regards to LINK’s momentum, Cointelegraph contributor Michael van de Poppe said:

“Personal target here at $7.10-7.25 reached since the tweets earlier. Such a beast. Just a matter of time until it reaches the next one at $10. I think that's doable this year.”

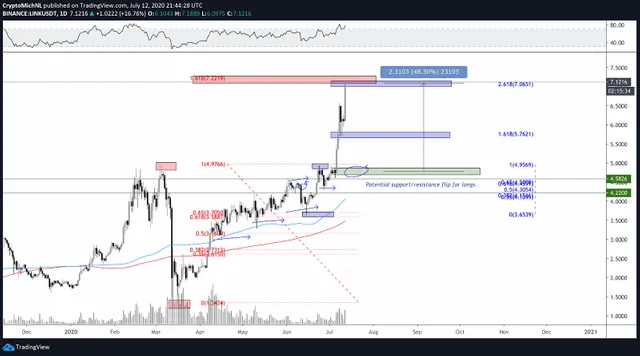

LINK-USDT reaches a new all-time high. Source: TradingView

New high profile partnerships

Throughout 2020, Chainlink has secured several high-profile partnerships with companies within the cryptocurrency sector.

On July 8, Chainlink partnered with Nexo, a crypto lender with reportedly 800,000 users, to deploy its oracle solutions. Chainlink co-founder Sergey Nazarov said:

“We’re excited to bring Chainlink’s secure and reliable oracle solutions to Nexo’s popular lending platform to enable users to independently verify on-chain the interest and collateralization rates they should receive.”

In the past two months, Chainlink has collaborated with blockchain projects and companies including Hedera Hashgraph and Matic Network. Chainlink was also mentioned in a blog post released by Google entitled Building hybrid blockchain/cloud applications with Ethereum and Google Cloud.

Source.......

Top 5 Cryptocurrencies to Watch This Week: BTC, LINK, ATOM, XLM, BNB

The rally in altcoins is likely to continue if Bitcoin holds at its current levels but a breakdown below $9,000 could lead to aggressive profit booking by altcoin traders.

At various points throughout 2020 Bitcoin (BTC) was correlated with gold. During these phases BTC was acting as an uncorrelated asset, but now it has become highly correlated to the S&P 500.

This suggests that the top-ranked cryptocurrency on CoinMarketCap has been finding acceptance among various groups of traditional investors during different stages of the current coronavirus pandemic induced economic crisis.

Crypto market data daily view. Source: Coin360

Bitcoin’s volatility has dropped in the past few days but select altcoins have been rallying sharply, prompting analysts to predict that a new altcoin season has arrived.

If Bitcoin shakes out from its slumber and rallies higher, it is likely to be a positive sign and several altcoins may continue to outperform BTC. However, if the volatility expands to the downside, it could result in profit booking in several altcoins. Therefore, traders should keep a close watch on Bitcoin’s price.

BTC/USD

Bitcoin’s (BTC) volatility has dropped sharply as it has been trading inside the $8,900–$9,500 range since June 25. This volatility squeeze is likely to end soon with a sharp breakout in either direction.

BTC/USD daily chart. Source: TradingView

LINK/USD

Chainlink (LINK) broke above the critical overhead resistance of $4.9762 on July 6 and embarked on a strong up move. While a retest of the breakout level usually happens, some times, when the breakout is too strong, the price only consolidates for a few days and then resumes the up move.

LINK/USD daily chart. Source: TradingView

ATOM/USD

Cosmos (ATOM) broke above the overhead resistance at $3.20 on July 7. That attracted aggressive buying and the altcoin quickly rallied to $4.466, suggesting the start of a new uptrend.

ATOM/USD daily chart. Source: TradingView

XLM/USD

Stellar Lumens (XLM) has formed a complex inverse head and shoulders pattern, which completed on a break above the neckline at $0.088777. This bullish setup has a target objective of $0.151491 but the bears are likely to mount a stiff resistance at $0.13 and then again at $0.14.

XLM/USD daily chart. Source: TradingView

BNB/USD

Binance Coin (BNB) has been range-bound between $18.20–$13.9129 for about three months. Today, the bulls had pushed the price above the resistance of the range but they have not been able to sustain the breakout.

BNB/USD daily chart. Source: TradingView

Source.......

G20 Lays Regulatory Groundwork for Accepting Digital Payments

G20 officials announced on July 11 that they would begin laying the regulatory groundwork for the group to accept digital payments.

Digital currency payments may become a reality for G20 members before the next summit in Saudi Arabia.

As reported by Kyodo News on July 11, officials revealed that the G20 summit compromising representatives from 19 countries and the European Union will be laying the groundwork to accept digital payments. The changes are expected to begin in October, presumably at the G20 Finance Ministerial and Deputies Meetings in Washington DC and before the next summit in Riyadh in November.

According to the Japanese news outlet, G20 officials enacted the policy change in response to China’s progress on creating a digital yuan, and Facebook’s anticipated release of Libra. Cointelegraph reported in June that the People’s Bank of China’s National Council for Social Security announced the completion of the backend architecture development for the country’s central bank digital currency (CBDC).

Changing positions on digital currency

During the 2019 G20 summit in Osaka, leaders stated that cryptocurrencies did not constitute a threat to monetary stability, and that technological innovation could deliver significant benefits to the economy. However, in October members said stablecoins posed a serious risk to public policy and financial regulations.

Source.......

Japanese Residents Have Cash to Spare, But is it Going into Crypto?

The Bank of Japan reported the supply of money stock in circulation increased 6% in June following the receipt of economic relief payments.

Investors in Japan increased their crypto holdings during the early stages of the pandemic before the government issued economic relief payments.

According to a July 13 report from Japanese news outlet Nikkei, the Bank of Japan revealed that the supply of M3 in the country — a measure of various money stock in circulation — increased 5.9% in June to $13.5 trillion.

The amount of liquid assets available to residents of Japan has increased following the government issuing 100,000 yen — roughly $936 — stimulus payments to individuals, 300,000 yen to some households, and other payments to companies in response to the coronavirus outbreak.

The Nikkei reported that such payments have made the cash flow in Japan “abundant” with fewer increasing their spending habits. If this money were to go towards any number of asset markets, it could form a bubble as quantitative easing continues while inflation is limited.

Stimulus payments going into crypto?

Cointelegraph reported in April that the number of purchases for $1,200 on crypto exchange Coinbase increased fourfold in March. The data suggests that Americans may have been using the government-issued checks intended for economic relief to invest in cryptocurrency in the midst of major nationwide shutdowns.

Source.......