Welcome to the daily crypto news :

Cryptocurrencies Have ‘No Way’ to Comply With US Anti-Encryption Bills ;

Japanese Government Set to Include CBDC in Official Economic Plan ;

Even the IRS Admits Some Crypto Tax Regulations Are ‘Not Ideal’ ;

Testnet Results Suggest Matic Could Power Ethereum to 7,200 TPS ;

One Millionaire Really Is Giving Away Bitcoin — But Is That a Good Thing? ;

Cryptocurrencies Have ‘No Way’ to Comply With US Anti-Encryption Bills

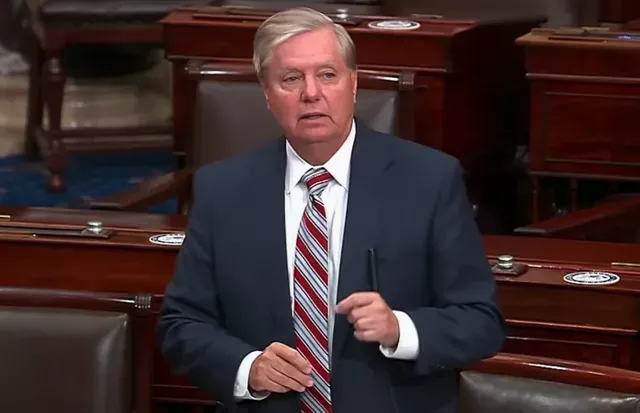

Multiple bills that threaten encryption are moving through the U.S. Senate and could pose a threat to technology that protects users’ privacy, industry pros say.

These bills include the Lawful Access to Encrypted Data (LAED) Act and the Eliminating Abusive and Rampant Neglect of Interactive Technologies (“EARN IT”) Act. While the LAED was only recently introduced to the Senate, the EARN IT act has been in the works for months, and has been amended a number of times.

Privacy advocates and product designers say such legislation would also curtail people’s privacy to a huge degree, fundamentally change existing technology and have an impact on everything from messaging and file sharing to privacy coins.

“The government basically would have mass surveillance powers into all of our communications,“ said Zcoin Project Steward Reuben Yap, referring to the LAED Act. “It’s saying, ‘Let’s drop the pretense and let’s just go for it.’ I think it’s really scary. It’s not just about cryptocurrencies as a whole though, it’s really about freedom.”

The bills in question

Sponsored by three Republicans, the LAED Act seeks to end encrypted communications by building in a backdoor for law enforcement to use. The bill lays out a legal framework for law enforcement to access encrypted data with a court order.

The explicit goal of the EARN IT Act is to curb the spread of child exploitative content online, such as child sexual abuse imagery, though its impact could be far wider. In an initial draft, this was going to be done through stripping tech companies of liability protections for the content that is posted on their platforms. These protections currently exist in Section 230 of the Communications Decency Act, which prevents social media companies such as Facebook, Twitter and Reddit from content liability.

Under an earlier draft of the EARN IT Act, companies would lose Section 230 protections if they didn’t follow the recommendations of a federal commission on child exploitative content. This could render companies like WhatsApp, which offers end-to-end encryption, liable for communications on the platform, unless they revoked end-to-end encryption.

“They communicate using virtually unbreakable encryption. Predators’ supposed privacy interests should not outweigh our privacy and security,” said Attorney General William Barr at an event the day the bill was introduced.

"There is no way for Ethereum, Bitcoin and other cryptocurrencies to comply. "

Source.......

Japanese Government Set to Include CBDC in Official Economic Plan

The Japanese government is getting serious about a CBDC.

The Japanese government is expected to include consideration of a central bank digital currency (CBDC) in its official economic plan. The news comes 10 days after the Bank of Japan’s announcement that it will start experimenting with the digital yen to check its feasibility from a technical perspective.

According to Nikkei, the consideration of CBDC will be included in the Honebuto Plan for Economic and Fiscal Revitalization. The Honebuto Plan is the basis for Japan’s economic and fiscal policy and the report says the Japanese government “will consider a CBDC while coordinating with other countries”.

Japan and CBDC

After China began testing its CBDC or digital yuan, the Japanese government has accelerated preparations for its own CBDC. In March, in an exclusive interview with Cointelegraph Japan, Kozo Yamamoto, Liberal Democratic Party (LDP) Member of the House of Representatives and a former official at the Ministry of Finance urged Japan to implement CBDC fast:

“If Japan doesn't issue a digital currency and people in the world use other digital currencies, the Japanese yen will be forgotten and lose its sovereignty”

The turnaround in attitudes has been swift. In July 2019 the Bank of Japan maintained that “they had no plan to issue CBDC”. Yet, in a report this month it announced it would begin experimenting with a central bank digital currency.

According to Nikkei, the Japanese government, and not the Bank of Japan, has the ultimate right to judge whether or not to issue CBDC.

In February, the central banks of Britain, the eurozone, Japan, Canada, Sweden and Switzerland reportedly announced a plan to collaborate on researching issuing digital currencies.

Source.......

Even the IRS Admits Some Crypto Tax Regulations Are ‘Not Ideal’

Roughly four hours into a phone call with a TurboTax representative, during which she had to sort through the company’s own internal resources to answer my questions, I found out I probably didn’t owe any taxes on my admittedly meager bitcoin holdings. It should have been obvious: At no point did I sell for fiat or convert into another crypto.

In reporting this article, I was also reminded I should check my Blockchain account to see if I ever received the XLM it was airdropping because that might also result in me owing taxes on crypto (I did not). Do I need to report the $15 in bitcoin I sent to a hardware wallet I can’t access anymore? (I don’t think so.)

U.S. taxpayers have until Wednesday to file their 2019 returns if they haven’t already, or to otherwise request an extension. I’ve been covering taxes around the crypto space for most of the past year and have talked to more than half a dozen certified public accountants, tax lawyers and other professionals about what the Internal Revenue Service’s (IRS) issued crypto tax guidances are actually telling us. If a reporter who’s been embedded in the space is having this much trouble, imagine how hard it might be for a complete newcomer.

This is going to remain one of the biggest barriers to mainstream adoption.

Crypto and Taxes 2020: Wednesday is this year's deadline for Americans to file their tax returns, and cryptocurrency users' obligations are as confusing as ever. This series of articles explores the complex issues facing digital asset investors.

Even the IRS admits the guidance leaves questions unanswered. An IRS official said taxpayers should take advantage of both the forms that exchanges are issuing to list taxable events and the different software tools that have been built to help simplify the process.

Source.......

Testnet Results Suggest Matic Could Power Ethereum to 7,200 TPS

Matic Network may be closer to a scalability solution for the Ethereum blockchain after a test run showed it could handle 7,200 TPS.

Blockchain scalability solution Matic claims the network can supercharge the Ethereum ecosystem, after a two-month testnet run revealed it was able to process 7,2000 transactions per second (TPS).

In a July 14 blog post by Matic Network, the project reported it had stress tested its Counter Stake CS-2008 testnet, which could “reliably handle a performance level of 7,200 TPS.”

The blog stated that this performance could be extrapolated to the Matic mainnet, which employs the same architecture. According to Matic, “the network was truly decentralized,” with 122 active validators running validator+sentry nodes:

“The current performance capabilities of the network as it stands means that Matic can be instrumental in helping the Ethereum ecosystem to overcome its performance constraints and reach its full potential.”

Bringing scalability before ETH 2.0 launches

The “performance constraints” referred to are the scalability issues facing the current iteration of Ethereum, which can only process a handful of transactions per second. Ethereum 2.0 will fix the scaling issue, however Phase 0 looks like being delayed until early 2021 and it will take years to get up to full speed. There is an urgent need for a scaling solution in the interim.

The network has dealt with significant congestion in 2020 due to the popularity of Tether (USDT) and the growth of DeFi projects, resulting in higher transaction fees. Recently, Ethereum increased the maximum amount of gas allowed per block on the blockchain to allow the network to process more transactions.

[Source.......](Matic Network may be closer to a scalability solution for the Ethereum blockchain after a test run showed it could handle 7,200 TPS.)

One Millionaire Really Is Giving Away Bitcoin — But Is That a Good Thing?

Bill Pulte has been giving away thousands in cash, crypto, and cars for months now, but he could be inadvertently helping scammers.

Millionaire philanthropist Bill Pulte has given away close to $150,000 this year in an attempt to promote the mass adoption of cryptocurrency. However, some critics are concerned that he may inadvertently be providing legitimacy to the masses of scammers who use fake giveaways to con new users out of crypto.

Others believe it’s a ‘self serving’ attempt to build his public profile. Pulte has nearly 3,000,000 Twitter followers, up from the 10,000 he had in July 2019.

In a July 9 post on Pulte’s Twitter account, the millionaire said he would be donating funds through CashApp to users who retweet or comment on his posts. By the following day he had given away $625 to six of his followers to buy Bitcoin (BTC). According to Pulte, the donations must be used to purchase the cryptocurrency because it “will be higher in the future.”

In total, Pulte has given away $5625 so far this month and more than $18,000 last month. Many of Pulte’s gifts over the last several months have been in cash — and free cars for some — but the millionaire has come out in favor of giving away crypto as a means to “strong arm more adoption.”

“The crypto community is missing out big time. If they want mass adoption, they got to give it out on Twitter and social media [...] Cryptocurrency can help the world’s poorest, especially those who are ‘unbanked.’ As a philanthropist, I therefore want to promote adoption.”

Source.......