The whales aggressively bought the falling cost of Bitcoin, however that does not imply that BTC has marked a floor.

Source

The stream of negative news regarding the regulation of Bitcoin (BTC) and cryptocurrencies has not stopped in the last 2 weeks. A Chinese government assertion revealed its plans to crack down on the conduct of Bitcoin mining and trading.

While retail traders are scared straightforward by this kind of news, whales and market makers know how to identify a buying possibility, which has been the situation of the fall.

The Asian territory banned Bitcoin business in 2017

The minutes of China's Financial Development and Security Committee presented guidelines in general on various issues, including the reform of medium-sized financial institutions and the crackdown on securities squatting. Accordingly, it has not been a targeted attack on Bitcoin, nor was it distinguished from the occupations and discourse of recent years.

On May 18, China's Exitosa Bank trade associations warned financial institutions and other member companies not to engage in cryptocurrency trading transactions.

Source

However, cryptocurrency trading in China is banned as of September 2017 and concerns regarding carbon emissions from Bitcoin mining operations were expressed well over 3 weeks ago.

Even market maker platforms were targeted by Chinese authorities as of 2018. Certain sites dedicated to cryptocurrency trading continued to operate illegally in the territory, however most were located and shut down by the authorities in 2019.

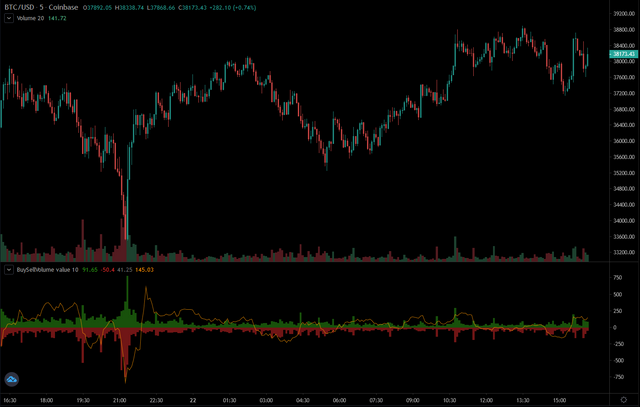

Trading volume of btc

Trading volume is the best indicator to confirm whale activity, and those peaks have to match the lows of the cost. Even though every trade has a customer and a seller, extreme volatility can happen with low trading volumes, so it doesn't exactly involve expert traders.

Source

Looking at the above data, there should remain no doubt that the whales and market makers aggressively bought the dip. Spot volumes on the exchanges exceeded USD 5.6 billion in 4 hours, which is incredible even for a 12% cost shift.

To put things in perspective, the average daily volume over the last month is $11 billion. Therefore, when combining such data with the interplay of long and short positions on the derivatives exchanges, it should be taken for granted that certain heavyweights were brave enough to market the current drop.

Although no one can know exactly whether the USD 35,000 level will be maintained over the weekend, one should expect those strong hands to maintain their positions for a long time to come.

Bitcoin falls again and sinks altcoins to previous costs

Another round of FUD helped push the cost of Bitcoin back below USD 34,000, putting more pressure on altcoins currently trading below multi-month lows. On May 21, the cryptocurrency market has been hit by a totally new wave of fear, uncertainty and doubt (FUD) that unleashed another, even if quieter, massive trade in the cost of Bitcoin (BTC) and the biggest part of altcoins.

For the second time in less than 3 weeks, China has once again been to blame for rumors that regulators were attempting to find crackdown on Bitcoin mining and trading. The media further reported that Hong Kong authorities proposed to ban retail trading of cryptocurrencies.

Source

Bitcoin (BTC) bulls were holding the USD 40,000 support degree prior to China's announcement, however they lost it immediately and have had to regroup at the USD 36,000 support prior to the cost continued to fall.

While the turnaround seen in the market on Thursday helped to dampen fears of a new Crypto Winter, some analysts correctly assessed that we are not out of risk ahead of Friday's drop.

Still in this way, there is room for hope that the cost of BTC manages to remain firm and move higher, as activity seen on the whale wallets demonstrated monumental inflows at the USD 39,931 degree, suggesting a viable new degree of support.

Activity on exchanges soared along the selling wave

Cryptocurrency exchanges played a key role in Wednesday's cost action. This marked the highest volume day for all DEXs in history, led by Uniswap (UNI) which moved nearly USD 6 billion in transaction volume once retail traders sold in a hurry.

Around USD 9 billion in cost was liquidated throughout this week's correction in a cleanup similar to March 2020. Historical levels of Bitcoin withdrawn from exchanges on May 19 compared to net outflows from exchanges in recent years, highlighting the produced that this has been the highest portion of net outflows called in dollars in history and is drastically bullish.

Source

To better understand the present excitement of traders in the market, that retail wallets have continued to grow in numbers despite the market turmoil with the drop being bought up swiftly by retail investors, which is a sign of steady increase and adoption.

The altcoins were crushed, again....

The pressure on Bitcoin spread to the altcoins market, causing most tokens among the top 100 tokens to fall further into the red. The total cryptocurrency market capitalization currently stands at USD 1.4 trillion and Bitcoin's dominance rate is 44.3%.

It is also healthy that cryptocurrencies take a correction in prices as it is the opportunity for investors to buy, that is the sense of all this, I really do not worry because the price of bitcoin and other alcoin, rather I see it as an investment opportunity, that if you know how to make a correct reading of the corresponding technical analysis.

Greetings and thanks for sharing this excellent publication.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @suanky

I don't know what is going to happen with BTC, most likely Chona, Europe, USA will keep attacking and the price could go down, however, we know this is not going to be forever, there will come a point where they won't be able to control anything. This is still an immature market, unfortunately, so we have to continue with hopes, but backing profits. At least that's how it is for me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @josevas217, indeed my friend, they started attacking and saw that they can knock down the price and will continue to do so, but sooner or later they will not be able to control the market and it will consolidate more, just as you say. Thanks for commenting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @suanky

Anyone who has the ability to handle the current stage through which the market passes very smartly will surely be able to follow once this correction is over.

Excellent information, thank you for sharing it

Happy weekend

Regards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @janettyanez, that's right, I see on social networks many people throwing hate to Elon Musk for the fall of the btc, of course it pollutes and damages the environment but well, on the contrary, many wisely and economically have bought in the fall and that's the good thing that later will boost the market more. Thanks for your comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

irrespective of what's happening in the crypto world, i believe it's going to rise again. green on green!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Of course, my friend, if it goes up, it goes up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I believe the whales of BTC, are just manipulating the price of BTC at their will because they have the ability to crash the market or pump, but there are doing anything but watching the market. Nice article @suanky

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit