Paytm IPO rating is reasonable and fair despite the top options on the table, One97 Communications founder Vijay Shekhar Sharma Shares on November 8-10 Paytm IPO will be offered a band worth Rs 2,080-2,150 each.

One97 Communications, operating under the Paytm brand name, will launch India’s first major Indian public offering (IPO) on November 8th.

Shares in the Paytm IPO will be at Rs 2,080-2,150 each, meaning a value of approximately Rs 1.48 lakh crore (approximately Rs 20 billion) Offer of Rs 18,300-crore will be the largest since Coal India Ltd. IPO in 2010 when a state-owned company earned Rs 15,200 crore.

At a pre-IPO conference on Thursday, One97 Communications Director and CEO Vijay Shekhar Sharma said he had received personal messages from investors seeking to invest in the country for the first time and insisted "this is the time for India".

The IPO - which closes registration on November 10 - includes the issuance of new shares worth Rs 8,300 crore and one for sale by existing shareholders at a cost of Rs 10,000 crore.

“The price target set at Rs 2,080 to Rs 2,150 per share means business value ranging from $ 19.3 billion to $ 19.9 billion,” said Sudarshan Ramakrishna, MD of Goldman Sachs India Securities, while launching the IPO. At current exchange rates, the transaction amount is approx. in the range of Rs 1.44 lakh crore to Rs 1.48 lakh crore.

The company has skipped the pre-IPO funding cycle to accelerate the launch of initial stock markets.

"If we can say that 2010-20 was for all of Asia, China and Japan, and other countries, then 2020-30 is 100% for India. Now This is the perfect time for India is," Sharma said. . "Whether you're a private company, young people who have just started or are likely to be listed or a listed company. This is the time when the world will give you money."

In addition, Alibaba.com Singapore E-Commerce will sell shares of up to Rs 78 crore, Elevation Capital V FII Holdings (Rs 75.02 crore), Elevation Capital V Ltd (Rs 64.01 crore), Saif III Mauritius (Rs 1,327.65 crore) , Saif Partners (Rs 563.63 crore), SVF Partners (Rs 1,689.03 crore) and International Holdings (Rs 301.77 c according to the transcript.

"Interest has been very good for Indian investors and blue-chip investors around the world since we introduced DRHP (red herring prospectus). We have always had a high level of sharing base that has benefited us," Paytm President and Group CFO Madhur said Deora.

Paytm revenue from operating increased by 62% annually to Rs 890.8 crore in the first quarter of 2021-22. In FY21, the company reported a total sale price of Rs 4 lakh crore.

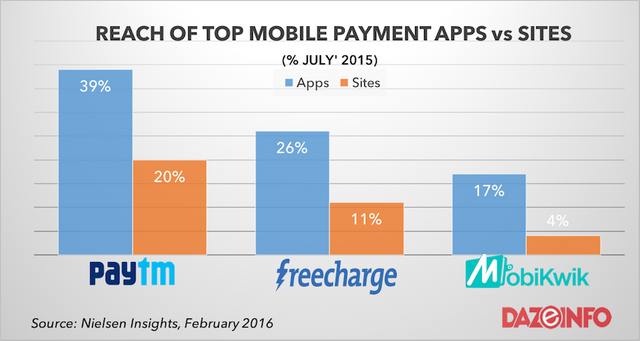

According to research firm Redseer, Paytm has a portable share payment market of almost 40%, and a market share of 65-70% wallet payments in India since FY21.

Like the Oler document, the demonstration in 2016 also played a role in pushing retailers to accept digital payments and led to the growth of products such as QR and wallets. With a few factors, including government efforts and reforms, technological advancement, increased access and awareness, digital payments are expected to more than double from $ 20 trillion in FY21 to $ 40-50 trillion by FY26.

Thank you for reading ...

Regards,

@Winy

Note: 20% beneficiary set to @ph-fund

Greetings @winy 💕

This is really a good news for the Paytm company and it's really quite impressive seeing different investors developing special interest in the project. That's really great and I just hope the company may also adopt cryptocurrency as a means of finance in future too just like PayPal did.

Thanks for sharing this great post with love from @hardaeborla and I hope you have a great day ahead ❤️❤️💕

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @hardaeborla,

Thank you so much for appreciating, I hope you have a lovely day ahead : )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello @winy,

This is a great time for India and for cryptocurrency investments, the constant sanctions implemented by China make cryptocurrency investors move to other countries like India, that is why I strongly believe that India will be a determining factor in the growth of the whole coin ecosystem in the near future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings @trabajosdelsiglo,

Thank you for appreciating : )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Paytm is the biggest ipo of India. If it is successful Paytm will be the first big unicorn to get this big amount of ipo. We just need to wait for the opening.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit