I am a retired private sector employee. In our country, only government employees receive pensions; private-sector employees contribute to the Employees Provident Fund (EPF) and the Employees Trust Fund (ETF).

For this EPF, each employee needs to contribute 8%, while employers should contribute 12% of the employee's total monthly salary. For ETF, employers are required to remit 3% of the total earnings of their employees to the Fund, monthly. Thus, employees’ EPF and ETF contributions are invested in secured investments. Therefore, every month, each employee receives a high interest rate on their fund balance, which is then added to their fund. Once the employee reaches retirement age, they can withdraw the entire amount.

Because my service lasted 34 years and I earned a six-figure wage, I received a large fund when I retired. In addition, I received a large gratuity for my 34 years of service.

After receiving a lump sum from my EPF, ETF, and gratuity, I made a smart decision to distribute the money among six different banks as a fixed deposit. So, after my retirement, the interest income from these deposits became my primary source of financial support.

When you started your first primary source of income: |

|---|

According to our company's manual of procedures, any employee should retire at the age of 57. Therefore, my primary source of income began when I retired from my position in the year 2021.

How do you manage your income? |

|---|

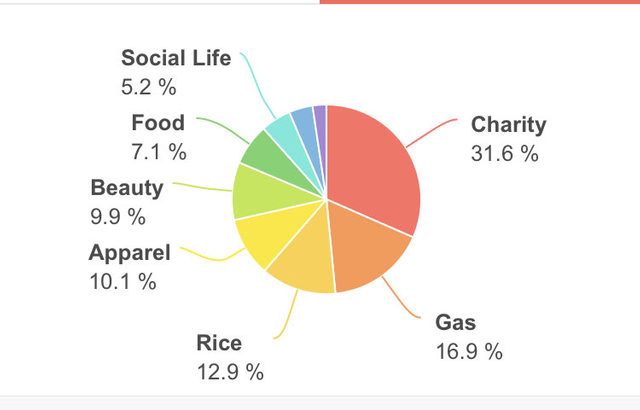

To manage our income, we plan how we spend it carefully. Even under our objection, both of our sons contribute a considerable amount to our monthly expenses. This additional income we receive from our sons is sufficient to cover our usual expenditures. Therefore, we use both my and my husband’s interest income for other needs such as charity work, entertainment, savings, and larger, one-time expenditures.

Furthermore, we maintain a budget to monitor our spending. For this, we use the Money Manager app on our phones. In this method, I can control our income by cutting unnecessary expenditures. This plan not only secures our money but also helps us to live a pleasant and stress-free retirement life.

Invite to

@jyoti-thelight

@ruthjoe

@pelon53

10% beneficiary to @hindwhale.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post has been rewarded by the Seven Team.

Support partner witnesses

We are the hope!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good write up @senehasa

Keep it up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are welcome.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit