I just wanted to show you all my last trade. This was on Friday 10/29/21. My broker is TOS (think or swim). Here are the reasons I chose a PCS (put credit spread), which wins if price stays above the strike price I sold.

Price had been rising in the hours prior to my trade, so I chose a strategy to capitalize on a continued move up. I entered my PCS as I win the full credit given to me when I sell, as long as price stays (ends up) anywhere above my sold strike price.. so if just keeps climbing, then it's all good.

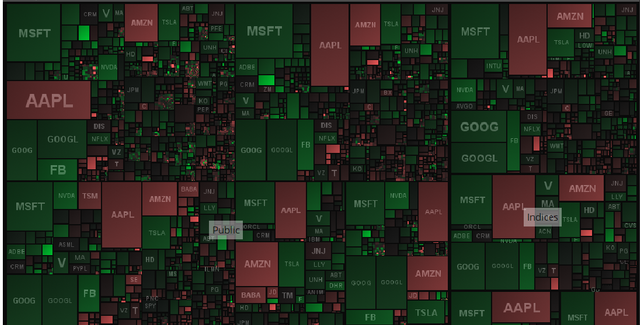

this is a heatmap (an indicator from TOS) that shows the direction that the different stock companies are going. I saw a lot of green, and that means it's going up.

Here's my actual trade ticket..

I sold 4 contracts X .50 (which is $50) and made a stop limit order for 3x (or 3 x .50, or 1.50)

The trade did what I wanted and price did go up after I entered the trade, but then it fell back down a bit and moved in a range, until it's big move at the end of the market.. not really what I expected, but I'll take it!

I hope my luck continues this week.