Hello and welcome to my blog . I hope you all are doing well and enjoying this season of engagement challange . Today's publication is regarding Ponzi Schemes.

Had you heard about Ponzi schemes? Have you been offered to invest in any of these schemes?

Yes, I have heard about Ponzi schemes, and I have even been offered to invest in a couple of these schemes. The most recent Ponzi scheme that I was attracted to was a few months ago. It was a centralized scheme that wanted users to invest 5000 INR as a one-time investment and keep on earning 100 Rs per day for a minimum period of 2 years. So for an investment of 5000, users were offered 700000 INR, which is 140 times the investment. The company had also established offices in our state and hired local youth as employees to recruit new users. The employees themselves used to invest in the same company. It even paid its investors for 2 months and later, all of a sudden, the company escaped with laundering of 59 crore Indian rupees.

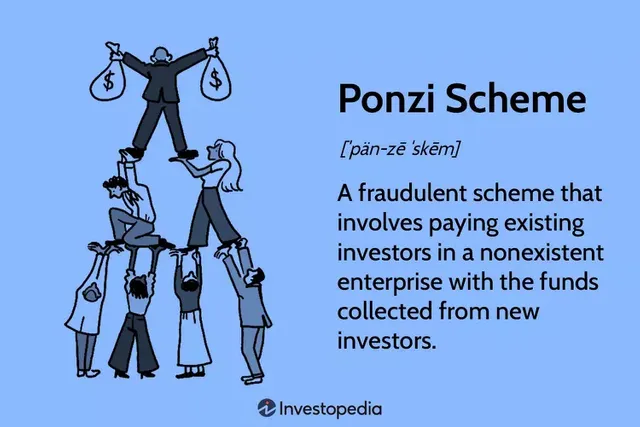

Ponzi schemes are named after an Italian swindler, Charles Ponzi. These schemes are fraudulent in nature and often attract users by offering high returns over a short period and with minimal or no risk. As humans, it is natural to be attracted by offers of heavy returns.

Ponzi schemes are not sustainable and collapse shortly after being launched. The Ponzi schemes use the funds of new investors to pay the older ones to give a perception of genuineness and attract more and more investors. As these schemes do not have any business model behind them, they are not sustainable. As long as new investors keep on investing, they keep on running, even by paying good returns to old users to attract more users. As these schemes do not have sustainable model , they are bound to collapse.

Do you know how to detect Ponzi schemes?

There are some red flags to identify Ponzi schemes, and they are as follows:

High Returns: The primary operation for investors is the promise of short-term high returns by the operators of the schemes, often with minimal or no risk.

Lack of Transparency: The Ponzi scheme operators do not provide information about the investment strategies, or they provide vague information, making it difficult for the investors to understand the revenue generation mechanism.

Illusion of Legitimacy: Scheme operators provide fake documents, testimonials, websites, and references to seemingly legitimate sources to attract investors with the illusion of legitimacy.

Low Entry Barrier: These schemes do not require complex entry processes like document verification in the form of KYC or 2FA, etc.

Do you think Steemit is a Ponzi scheme?

No, Steemit is not a Ponzi scheme as it doesn't fall into the basic definition of a Ponzi scheme. There are no new funds used by investors, which are otherwise paid to old investors in Ponzi schemes. Moreover, it is a decentralized blockchain-based platform where every transaction is verifiable and recorded immutably on a distributed ledger. So, the transparency of Steemit differentiates it from Ponzi schemes.

The native token of Steemit is Steem, which is used to incentivize users for creating content. So, users are not required to invest in it, but they are paid for creating quality content on this platform. Moreover, the tokenomics of Steem, including the price of Steem, is well regulated through market dynamics, unlike Ponzi schemes where profits are promised without any logic.

The rewards mechanism on Steemit requires users to demonstrate proof of brain and create and curate quality content to earn author and curator rewards effectively. There are no hidden or vague reward distribution mechanisms.

The decision-making on Steemit is decided by stakeholders based on the delegated proof of stake algorithm. So, the users are empowered for staking the Steem, and there are clear-cut guidelines for selecting witnesses and other developers, unlike Ponzi schemes where transparency is grossly lacking.

For new users, Steemit has a proper verification protocol, unlike Ponzi schemes where verification is least paid attention to. Moreover, Steemit has been in the market for about eight years now, unlike Ponzi schemes, which are bound to collapse and do not last so long.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello friend is good you are able to detect this people through their red flag, it takes grace to run away from this people because with their empty promises one can easily fall for them, for me I have val never to fall for them again because my eyes are wide open and i know more now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice to hear that .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit