I trust everyone is good! As for me I'm great and it's my delight to kick-start my lectures today as you've already noted are today's lesson will anchored on Finance Policy. Accepted all functional area of an organisation is vital but there is one functional area though in which every other activities hinges on, and it is no other than Finance. Truly without fund there will be no machines, no equipment and materials for production to take place, there will be no marketing and personal functions because this also need funds to recruit, remunerate and advertise. Indeed "Money is a lubricant of the wheels of business"(Madu, etc al., 1999:196).

.png)

The finance function deals with the efficient and effective use of organisational financial resources to accomplish organisational objectives and goals.

The major objective of Financial management are to:

- obtain adequate supply of funds

- manage financial resources wisely

- provide Management with financial information on its operations.

it is believed that the financial strategies of a firm is important because the public, financial institutions, and investors used to look at the financial structure of a firm in order to access it viability and the general tool used for this is known as financial ratio and Ratio is classified into 4 namely:

- activity ratio:this is measure by the assets turnover, inventory turnover, and receivable turnover.

- liquidity ratio: this is also known as the current ratio; it is a type of financial ratio used to assessing the company's ability to pay its short-term debt within a year.

- The leverage ratio: includes debts, interest earned and fixed charge ratio

- profitability ratio: this includes return on assets, return on dividend, return on networth, profit margin etc.

.png)

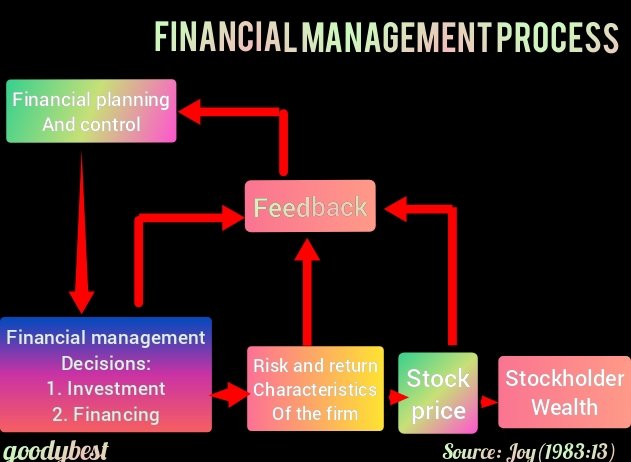

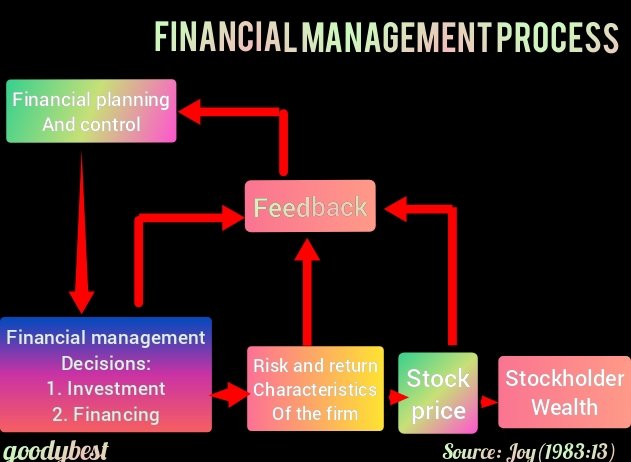

FINANCIAL MANAGEMENTS PROCESS:

diagram to demonstrate financial management process

Financial Management has its own process and it's normally start with planning as depicted in the figure above. Finance decision are always geared towards actualizing organisation objectives. There are two types of fundamental decisions that must be taken, and this are:

(A) Financing decision:

which are concerned with how fixed and current assets of the firm should be finance

(B) investment decisions:

to determine the type of investment firm should make.

This decisions fashion the financial image of the firm. The risk and return characteristics are mirror through the various ratios just mentioned. These characteristics influence the firm's stock price resulting in the well-being or otherwise of the owners. Notice Also that there are feedback provisions. The firm monitors itself as part of its control function, and this activity includes supervision of financial management decisions and observation of the firm's risk-return characteristics and price.

we shall now have a closer look at the policy decisions issues inherent in the two fundamental financial management decision areas - financing, and Investment. We will conclude with an examination of policy issues in credit management.

.png)

FINANCING DECISIONS:

Once the management decided on the type of equipments, materials, machines, infrastructure etc. needed for its operation then financing decision are embarked upon.

Two Factors Impinge Upon Financing Decisions:

(a) form of business organisation, and

(b) duration of financing.

LONG-TERM FINANCING:

long-term capital is the money invested in fixed assets over a long period of time. Fixed assets include land, building, equipment, machinery etc. all of which are items or property used in the business and not intended for sale, they are needed for the business to take off and to continue operations. They are variously called long-term assets, fixed assets, long-term capital, fixed capital. There are several sources of funding long-term assets but the choice will depend on the form of business ownership. Let us examine them.

1.Owners Saving:

most sole proprietors and partners finance their fixed asset from their personal savings. This is to say that most people who start businesses on their own do so with their own money which they have saved over a long period of time. The major advantage of this source is that interest is not paid by the business on the use of such money. But prudent business practice teaches that the business had to pay some interest on the capital procured through the source as if it were borrowed from the bank after when the money was in the owners saving account the bank was paying interest on it.

2. Sale of stocks:

As owners of sole proprietorships and partnerships generate initial long-term capital from their personal savings, so do limited liability companies generate initial long-term capital through the sales of stocks. limited liability company issued two major types of stock the first is a COMMON STOCK. These are shares which have no fixed rates of dividends and are the last to secure a claim in the property of the company in case of dissolution they share their voting rights in the meeting of shareholders in other words common stockholders are the real Risk beares in limited liability companies just has sole proprietors and partners are in their respective forms of business ownership. The other type of stock, PREFERRED STOCK has a superior claim to the earnings and or assets of the company. The rate of dividend payable is usually stated. preferred stockholders may not have voting rights at shareholders meetings.

.png)

3. Issues Of Bonds:

A bond is a written promise to pay the holder a sum of money at certain time (usually more than a year after issue) at a stated rate of interest. Bonds represents direct debt on the companies with mandatory interest and time for the payment of the principal, no matter the profit fortunes of the company. Unlike stocks where the principal does that have to be repaid at the specific time.

Where the policy decision is to raise long-term capital through the issue of bonds a corollary decisions pertains to the type of Bond to be issued. A clear answer to the question is vital because bonds are usually attached to some assets of the issuing company this is to say that a bond can be issued with any of the assets of the issuing company (or even a new one for which the fund is being sought for it's purchase) as collateral. This gives the bond-holder the right to claim the affected asset(s) should the issuing company failed to perform in accordance with the provisions of the bond. where an asset other than real property such as a building is used as a collateral the bond is called COLLATERAL TRUST BOND but where real property is used we talk of MORTGAGE BOND. DEBENTURE BOND on the other hand is that which is not backed up by any assets but the general CREDIBILITY of the issuing company they are generally riskier than secured bonds and are consequently not very attractive to won't be investor.

4. Lease Financing:

This involved missing some equipment or even building from their owners with the agreement that the range paid applies to what the purchase are the asset at a later date. This really a big help to business starters. It frees working capital, helps avoid obsolescence and provides needed initial long-term capital. in addition the rent paid for leasing are expenses and therefore tax deductible.

5. Lastly Return Earnings:

Many businesses especially limited liability company makes profit but do not distribute all of them to shareholders in the form of dividends. Some of the profits are retained in the business for expansion purposes and therefore from a ready source of capital for the business.

The only disadvantage of this source is that shareholders may be dissatisfied with the amount of dividend paid to them this may result in some of them selling off their shares in order to reinvest their money in other businesses that pays high dividend. This does not augur well for the affected firm. There is no problem where they shareholders show understanding, but where they insist on large dividends, some company use any of the other strategies for long-term Financing.

.png)

SHORT-TERM FINANCING:

Short-term capital is money invested in current assets which are usually converted into cash within a year these are funds that are used for the purchase of materials and supplies for production and merchandise for resale. It is also known as WORKING CAPITAL and is used to meet daily operations of business. It is relatively easier to finance working capital than it is for fixed capital. Generally the following are the major policy option for short-term funds.

1. Financial Institutions:

Financial institutions Stand as intermediaries between savers and borrowers. They offer short-term loans either secured (with collateral) or unsecured (overdraft) to businesses to enable them wade through short-term financial problems. The institutions include: commercial Banks, Saving Banks, Insurance Companies, Mutual Trust Funds and Cooperative Societies.

2. Commercial Papers:

Commercial papers are the promissory notes of mainly large companies which are for sale to other firms. Commercial papers usually attract less interest than the prime rate because of the credit worthiness of the firms that issue the papers. In fact one of the principal advantages of commercial Papers is that they provide funds at lower interest rates than borrowing from financial institutions.

3. Suppliers:

More often than not, supplies allowed their customers to buy merchandise, materials and supplies, and pay later that is selling to them on credit or an account. When someone sells something to you on credit, it is tantamount to saying that the person lent you money to the value of what you bought. These credit purchases are usually recorded in the books of the purchaser firm as "account payable". In this sense, suppliers have been a major source of short-term funds or working capital for businesses. In fact it may well be the cheapest source in the sense that interest is not usually paid unless repayment terms are violated by the purchaser.

4. Friends and Relations:

Believe it or not, friends and relations are good sources of short-term loans for businesses especially the small ones. It is not uncommon for a sole proprietor, for instance to ask some friends and relations for some money in order to take advantage of a business opportunity. Under normal circumstances, the amount is not very large, and it repaired in short-term period, Most probably without interest.

CONCLUSIONS:

I Would love to stop here today for reading purpose, but we've learned about the financial management process, that it always start with planning. We also learn the financing decision which firms must make started with long term Financing to short term. in our next lecture I will discuss on the second decision that finance management needs to make - INVESTMENT DECISIONS, AND CREDIT POLICY. Feel Free to ask any question where you need more clarity, I'll be at the comment section. Thank you!

Special regards:

Steem Infinity Zone Team

@cryptokraze | @vvarishayy | @suboohi | @arie.steem | @qasimwaqar

Let’s add value to make A Better Steem Ecosystem for everyone

Click Here to Join Official SIZ Discord Channel

.png)

.png)

.png)

.png)

.png)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much @goodybest for this post, I've really learn the process of financial management, their steps are well explained and understood. Keep it up teacher @goodybest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much @eliany dear I really appreciate your effort in going through my lectures, and I'm glad you understand the process. See you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very Informative post. It's great to make a plan before financial management. You describe it well. Good work 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm glad you find the information useful! I appreciate your effort in going through the lectures, and your nice commendations too. Thank you @suboohi ma'am 💕

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is very greater value coumminty.it support all members in this coumminty.I try my hard to become a good student.

@vvarishayy

#sizcomments

https://steemit.com/hive-181430/@siz-official/siz-commenting-contest-2-let-s-encourage-others-by-apreciating-their-work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I couldn't stop smiling 😁 at your comment, thanks to the amazing brains behind this great community. I'm glad you Also find this community interesting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Same too

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow amazing dear friend you make a very good post.

And your lecture is very informative and well detailed.

It is very good course for me.

My best wishes for you.

Remember me in your prayers.

Regards, @faran-nabeel

@vvarishayy

#sizcomments

https://steemit.com/hive-181430/@siz-official/siz-commenting-contest-2-let-s-encourage-others-by-apreciating-their-work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm glad you liked the course, and I will surely remember to pray for you too, I really appreciate your visit to my blog, thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@vvarishayy

#sizcomments

SIZ COMMENTING CONTEST | ROUND 02 | DAILY 5 VOTES by COMMUNITY ACCOUNT

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's a privilege to share with my favorite community and Thanks for your good wishes dear, I appreciate you too 🥰

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very informative post. Keep it up. You put efforts. And you deserve it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really appreciate your nice comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good info.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for nice commendation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its a go for me. I am in deadly need of this course.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm glad you liked the course

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is just so helpful thanks alot.

I have a subject of finance accounting in this semester and your post helps me alot to understand its basic terms clearly. Will look forward to your next post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit