Ethereum ($ETH) has been the subject of intense speculation and analysis, and despite mixed forecasts, an optimistic outlook is emerging. The cryptocurrency is undergoing a notable transformation driven by increased network activity and innovative projects. In this analysis, we take a comprehensive look at Ethereum's overall development, shedding light on opportunities and challenges.

Ethereum's Performance und aktuelle Marktsignale

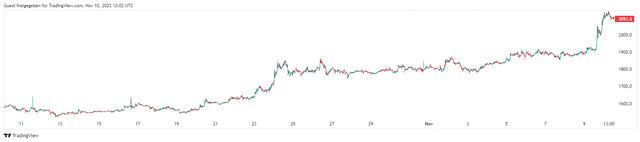

Despite revised price predictions, current market trends are showing promising signals for Ethereum's potential. The formation and confirmation of a bullish flag pattern indicate a positive market sentiment, while Ethereum's current price demonstrates resilience to short-term fluctuations, showcasing an overall positive trajectory over the past four weeks.

Positive Signals Despite Forecast Adjustments: Examining the Bullish Flag Pattern

The confirmation of the bullish flag pattern, despite previous uncertainties, suggests a potential upward movement. Ethereum's recent performance indicates a positive trend.

Current Ethereum Price and Resilience: Considerations for Long-Term Growth

Despite a temporary dip in the last 24 hours, the current Ethereum price reflects a respectable increase over the past week. We analyze Ethereum's resilience to short-term market fluctuations and discuss how this supports long-term growth prospects.

Ethereum's Resilience Amidst Rising Transaction Fees

Rising Ethereum fees raise questions but also provide insights into a vibrant platform. This section explores the significance of increased network activity and how Ethereum-based ETFs could add further dynamics to price development.

Network Activity and Development: Drivers Behind Fee Increases

Increased transaction fees reflect heightened network activity and growing developer interest. This trend is considered an indicator of confidence in the Ethereum blockchain and could suggest a positive price surge.

Ethereum ETFs: Potential Impacts on Price Development

The introduction of Ethereum-based Exchange Traded Funds (ETFs) could usher in a new phase of price volatility and investment opportunities, as institutional investors now have more avenues to invest in the cryptocurrency. Demand for $ETH could experience a significant uptick.

Ethereum's Future Outlook and Technical Indicators

Despite mixed forecasts and current market dynamics, there are promising signs for Ethereum's future. This section analyzes specific factors that could support these positive outlooks and takes an optimistic view of recent developments in the Ethereum ecosystem.

Network Fees as an Indicator: What Do 30% Higher Transaction Fees Mean?

The recent 30% increase in Ethereum transaction fees has sparked discussions. However, this section not only addresses the fee hike but also delves into what it signifies about network activity and growing developer interest. It emphasizes the importance of network fees as an indicator of user behavior and network health.

Network Activity and Development: Drivers Behind Fee Increases

The increased transaction fees are not just a temporary phenomenon but result from heightened network activity, particularly due to increased development of decentralized applications (dApps). This growing interest and continuous expansion of the dApp ecosystem in Ethereum are significant factors contributing to the observed increase in transaction fees.

Can Development Activity Predict a Price Increase?

Robust development activity indicates a healthy ecosystem and could attract investors. This section examines the significance of development activities as a potential predictor for a long-term price increase in Ethereum.

Technical Analysis and Key Supports: Impact on Price Direction

Technical analyses provide a framework for understanding Ethereum's possible price development. Identifying key supports and resistances helps recognize potential turning points and entry opportunities.

Key Support and Price Direction: An Overview of Current Technical Analyses

Currently, Ethereum finds support at $1,780 and $1,750, with resistance levels near $1,850 and $1,875 having been confirmed multiple times. This repeated confirmation of resistance zones strengthens confidence in technical analysis and provides clear indicators for potential turning points in price development.

Future Outlook: Is a New Surge for Ethereum on the Horizon?

Despite short-term challenges and technical analyses, fundamental indicators suggest that Ethereum could be heading for a new surge. Investors and market observers will closely monitor key support levels and development activity to plan their next steps.

Conclusion

The recent 30% increase in Ethereum transaction fees has sparked discussions, highlighting a rise in network activity. This signifies growing interest and continuous development in the Ethereum ecosystem, especially with the increased creation of decentralized applications (dApps). The positive outlook for a potential upward trend is supported by concrete drivers such as the development of dApps and the growing interest in Ethereum ETFs.

Technical analysis reveals that Ethereum currently finds support at $1,780 and $1,750, with resistance levels at $1,850 and $1,875 being confirmed multiple times. This confirmation of resistance zones underscores the stability of the price level and provides clear indicators for potential turning points in price development.

Despite initial concerns about increased fees that some investors may have, these developments paint a promising picture. The vibrant dynamics of the Ethereum ecosystem, supported by strong market backing and the potential for a renewed price surge, lay a solid foundation for a sustainable upward trend. Overall, the future for Ethereum appears optimistic and promising, strengthened by active development and growing interest.

Ethereum have been looking strong so far because it has been going up against bitcoin for a while now. Although, Bitcoin recently out perform ETH but still stay strong. I've also been able to earn a lot of alts by pairing them with ETH on Bitget smart portfolio and this has not fee. Maybe I will still keep on with it for while or till the bull market starts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit