It is really so fascinating to witness how fast the world of the Decentralised finance has really grown rapidly. Decentralised finance which is often times referred to as DeFi is actually one of the most transformative innovations that has taken place in the financial sector. It has its main root in the Blockchain technology as far as one is actually concerned.

One of the major thing DeFo aim to actually target is to help to improve the traditional financial systems and that helps by actually making use of the Decentralised networks. This helps to offer transparent financial services.

Understanding DeFi

DeFi actually works in a way whether it comprises of a whole lot of range of financial applications that is actually available in the Blockchain. This helps to remove the traditional financial intermediaries. This makes use of the smart contracts that operate on the blockchain platforms that we are actually familiar with like Ethereum.

Like I actually said earlier, the primarily goal of DeFo is actually to help to facilitate finances by actually removing the central authorities like the banks in the transaction taken place on the blockchain. Well thank God for the nature of the Blockchain technology that is built on Decentralised nature. This helps users to actually control their assets and even have access to financial services which they are also in control of.

Core Principles of DeFi

There are actually some core principles that really helps DeFi to run and to operates on. I will be discussing some in this post today.

- Transparency.

The first one definitely will be the transparency. I will say it is all the platform build on the blockchain that have this nature of transparency. In this way, every of the transactions are actually recorded on actually a public ledger that enhanced transparency and even trust. Because this will help users to actually verify transactions and helps to reduce the risk of fraud.

- Permissionless Access.

The second on the list I will like to mention will be of course the Permissionless Access. What do I mean by that?, compared to the financial systems that we are aware of, DeFi work in a way whereby it is open to anyone as far as you have internet connection. This helps to give access without stress permission compared to the traditional financial systems that we are aware of.

- Interoperability:

The second on the list I will actually talk about is also the interoperability. Now, there is actually a way that the DeFi Application or which is called the dApps can actually interact with each other and this helps to create an ecosystem where we can make use of a whole lot of services together and with ease.

- Programmability.

The last core principles I will like to talk about is the programmability of the DeFi World. In this particular section, I will be talking about Smart contracts. Smart contracts actually helps to enable what we called the complex and difficult financial transactions. They are programmed and at the end of the day are executed automatically even without the human help. This actually goes a long way in increasing efficiency and also reducing the cause for errors.

Key Components of DeFi

There are actually some key components that are involved when it comes to the world of DeFi and which I will be talking about briefly.

- Decentralized Exchanges (DEXs).

The first one I will like to mention is definitely the Decentralised Exchanges. DEXs as many of us know actually operates in away whereby it does not need a central authority. This actually allows the peer-to peer trading of actually Cryptocurrencies and this actually comes with lower fees. Examples like the uniswap.

- Stablecoins.

The second key components is definitely the stablecoins. What are stablecoins actually? They are cryptocurrency which are design to have the value of a fiat currency in order to reduce Volatility. We have stablecoins like DAI and USDC. These types of coins actually help to provide what I call the stability that is needed for transactions and even for savings.

- Lending and Borrowing Platforms.

Not only that, but DeFi helps to create the Lending and Borrowing Platforms. I believe we must be familiar with platforms like Compound helps to create this platform where users can actually lend tokens and assets to other users in need and also in return make them to earn interest. This helps to remove the banking intermediaries also away.

- Yield Farming and Staking.

The other key components is what I call the Yeild Farming. Yeild Farming actually works in a way whereby it helps to actually provide liquidity to other platforms and in return helps to earn rewards in return also. Staking in the other hand actually deals with users to actually participate in the network Security whereby they lock their assets for a certain period of time and they earn rewards for it also.

10% beneficiary to @tron-fan-club

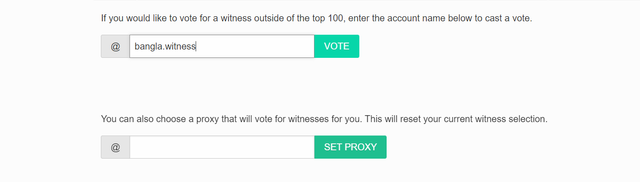

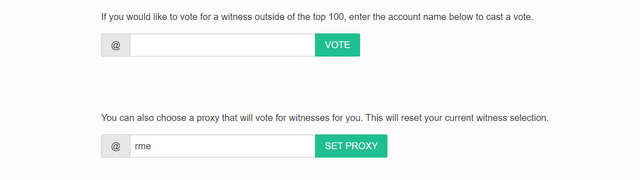

VOTE @bangla.witness as witness

OR

https://twitter.com/tough12355/status/1793362936183812439?t=zK8tewObVFxSGznJIJuEFw&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please join our community discord server and create a support ticket. Please verify yourself.

Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit