Hello friends hope you are doing well.I am also very well . I am going to share this post with you today with lots of love and congratulations to all members of the @tron-fan-club community.

Every country wants to control the money outflow from the country because if it does happen on the scale then it is going to affect the country's economy. Any money that is coming to the country is good for the economy but if that money goes out then it is not good for the economy and this is the reason why probably the Indian Government has increased the percentage of this taxation.

There is no clarity that this tax is going to apply to crypto as well however some people are talking about it but surely more clarification is needed on this. This has been introduced with a higher percentage recently but clarifications are not available on the online portal so we need to wait for some more time to get more clarity on this change.

They also provide some limit under which there is no tax applicable but if it is applicable on the crypto then that limit is not much since trading consumes a lot of trading volume. There are multiple questions if it applies to Crypto then how decentralised financing will work and how the people from India be able to trade on international exchanges because all of these should be coming under this tax category? If that happens then it is going to make things difficult for the traders and probably investors who have been investing a lot in foreign countries.

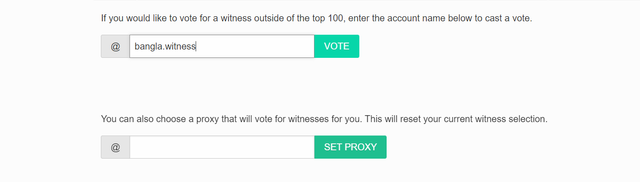

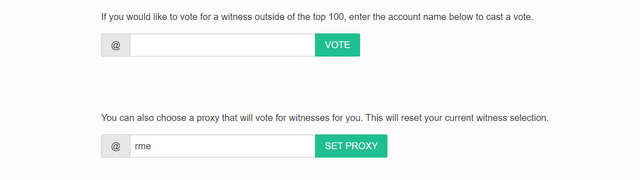

VOTE @bangla.witness as witness

OR

https://twitter.com/faruk0228311492/status/1716047898000216104?t=0n1DmkPVm2tn3KEN_s-ODg&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit