Many people think that their current financial struggles are the most important and urgent problems that they need to take care of. Financially sensitive people believe that since the future is uncertain, the present is the most important thing to take care of.

People must therefore use whatever strategies they can to deal with their current problems. This holds true for both fiat money and cryptocurrencies. I had planned to sell my Steemit share during the bear market last year and utilize the proceeds to deal with personal matters, but I soon realized that I also needed to help the Steem network grow.

There is no getting around the fact that in order to improve your liquidity, you must buy at a specific level. You might do this either out of your own money or by exchanging one token for another. Whatever the reason, completely swapping, holding, and powering up is the same as having grand plans for your coins. This could be to earn some passive income at a specific APR/APY, to power up to earn curation rewards, to farm or to earn compound interest.

When you buy, swap, or exchange your tokens to Steem and power up, you earn two different tokens. TRX earns on a curation rewards at a ratio of 1:1 of the SP has demonstrated how crucial having liquidity is (Steem and TRX)

My assets are worth more than their present market value, especially in times of scarcity, which is one of the reasons I never think about selling them to meet my immediate needs.

Despite the fact that many individuals might not find the future to be alluring or optimistic, I think this is a significant factor in why so many people are exposed to so much at once, only to be left with little liquidity the following time since they liquidated their assets on FUD.

Being intelligent is always important at some time in one's life. Almost all cryptocurrency owners want to be able to sell their holdings at the perfect moment, price, and liquidity, but getting there can be challenging because good judgments must be made.

Growth does not occur by mistake; in the crypto world, you must be very realistic while also being highly accurate in all you do. Due to the fact that cryptocurrency has shown to be practical in its ability to amass value, people need to grasp how crucial it is to always have the right liquidity.

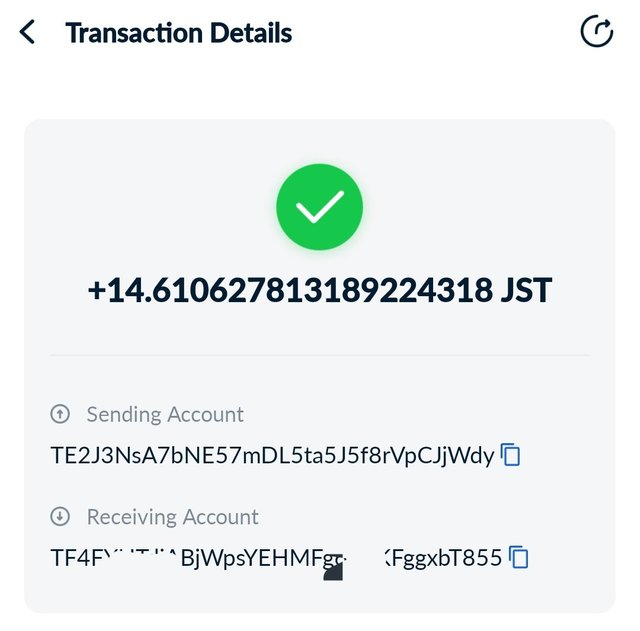

A few days ago, I supplied my TRX token to JustLend and received 14 JST in return. I didn't pay attention to how long I would receive the JST or whether it would rise or fall.

I could supply more TRX and increase my JST earnings, but the truth was that if I sold the TRX, I would not be able to increase my JST earnings. TRX's value can decrease over time, so think about supplying additional TRX and then utilizing the JST you earn to buy more STEEM or TRX—or perhaps just supply the JST itself to get some passive income.

Thanks for reading...

https://twitter.com/Changeyouseekk/status/1575565836957483010?s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a well written article but you can make use of #fintech to get more support.... thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've made a great post about some Decentralized protocols on Tron blockchain. Thank you for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Staking is one of the good ways to increase ones port folio.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit