Hey, steem tron-fan-club friends, on today's occasion I want to share about Crypto Market Signals Confirming the BTC Bear Market is Over, A number of crypto market signals confirm that the BTC bear market has ended and is in transition to a bull market, based on three popular indicators , namely Net Unrealized Profit/Loss (NUPL), MVRV Ratio and Puell Multiple.

Crypto Market Signals Based on NUPL Indicator

Net Unrealized Profit/Loss (NUPL) is a measurement tool that is used specifically in the context of the crypto market, especially Bitcoin. NUPL provides an overview of the unrealized profits or losses of all Bitcoin holders.

“Unrealized” refers to gains or losses that exist on paper but have not yet been actualized through sales. The NUPL value is calculated by subtracting the realized capitalization (the cost basis of all Bitcoins at the last moment of movement) from the market capitalization (the current market value of Bitcoins), then dividing this difference/ratio by the market capitalization. This calculation produces a ratio that can range from negative to positive values, indicating whether the market is in profit or loss.

Crypto market signals based on NUPL can be interpreted as sentiment indicators. When the NUPL number is high and positive, it implies that the market is in a state of significant unrealized gains, indicating that most investors are holding their Bitcoin, expecting further price appreciation.

This situation is often associated with investor optimism and bullish market conditions. Conversely, a low or negative NUPL indicates that the market is experiencing unrealized losses, reflecting bearish sentiment and a lack of confidence in future price appreciation. This scenario often leads to increased selling pressure as investors try to minimize losses or exit the market.

Source

Analyzing NUPL trends over time provides valuable context for understanding Bitcoin market cycles. For example, historically high NUPL values often precede market peaks, as investors eventually realize profits, leading to increased selling and market declines. Likewise, a low or negative NUPL value often indicates a market bottom, signaling a potential buying opportunity. Investors and analysts use NUPL along with other indicators to assess market conditions, identify potential trends, and make informed investment decisions. However, like all market indicators, NUPL should be used in conjunction with other data points and market analysis, as it is imperfect and can be influenced by various external factors.

According to analyst Tarekonchain at Cryptoquant on Thursday (14/12/2023), the NUPL trend shows an increase from neutral to "greed" scale. “This reflects a growing market in profitable conditions typically associated with bullish market sentiment. "Currently, the NUPL data shows market optimism, which in terms of data is the beginning of a bull market," said the analyst.

.webp)

Source

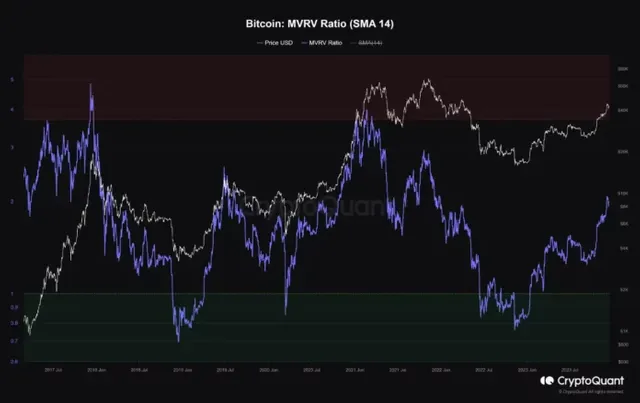

MVRV Ratio Indicator Meanwhile.

crypto market signals based on the Market Value to Realized Value (MVRV) ratio are a metric that compares market value (the current market price multiplied by the number of crypto units in circulation) with realized value (an aggregate measure of the value at which all crypto units in circulation last times moved on the blockchain).

Essentially, market value represents the current market capitalization of the BTC cryptocurrency, while realized value provides an estimate of the average cost base among investors. The MVRV ratio is calculated by dividing market value by realized value.

Essentially, market value represents the current market capitalization of the BTC cryptocurrency, while realized value provides an estimate of the average cost base among investors. The MVRV ratio is calculated by dividing market value by realized value. The MVRV ratio functions as an indicator of market profit or loss and helps in assessing whether cryptocurrencies such as BTC are overvalued or undervalued at any given time.

If a high MVRV ratio indicates that the current price is high relative to the average price at which the crypto was acquired, it indicates that the market may be overvalued and needs a correction. Conversely, a low MVRV Ratio implies that the market is undervalued, because current prices are low compared to average acquisition prices. This scenario can be seen as a potential buying opportunity or a sign that market sentiment is bearish.

Analysts and investors use the MVRV Ratio to make decisions and generate precise crypto market signals about market trends and potential turning points. For example, an MVRV ratio that is much above 1 may indicate a bubble, with prices driven more by speculation than the underlying value. On the other hand, an MVRV ratio below 1 may indicate that the market is undervalued, providing a favorable entry point for investors.

Still according to Tarekonchain, the latest MVRV ratio shows an upward trend which illustrates the shift from undervaluation to anticipated growth. “This could potentially mark the start of a BTC bull cycle,” he wrote. However, like all financial metrics, the MVRV Ratio should be interpreted with caution and in conjunction with other market indicators and broader economic factors, as it does not provide a complete picture of market dynamics alone.

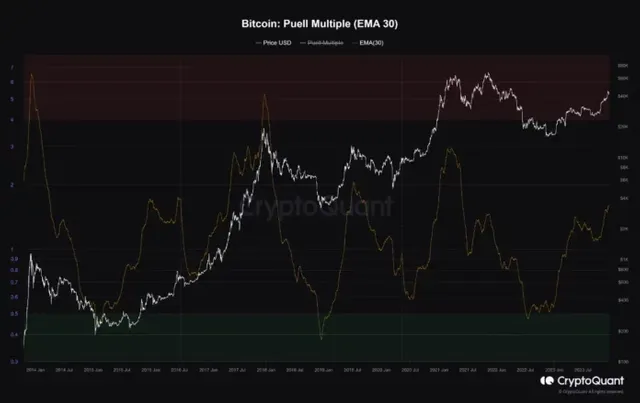

What is Puell Multiple.

Based on the Puell Multiple indicator, according to Tarekonchain, historically low values mean that the market is at the bottom which indicates a number of buy points and market expectations towards a bull run. “The upward trend in the Puell Multiple indicator from lower levels, signals reduced selling pressure and increased earnings for BTC miners, in line with expectations of a bull cycle,”

The Puell Multiple is a unique and insightful metric for crypto market signals used in Bitcoin market cycle analysis. Named after its creator, David Puell, this indicator focuses on the supply side of the Bitcoin economy, specifically miners. The Puell Multiple is calculated by dividing Bitcoin's daily emission value (the total value of newly mined Bitcoins on a given day, in US dollars) by the 365-day moving average of daily emission values. This approach provides a long-term view of the revenue generated by miners and helps understand how mining profitability can affect market conditions.

Source

When the Puell Multiple is high, it indicates that the daily value of Bitcoin mined is high relative to the historical average. This situation often occurs during market peaks when Bitcoin prices are high, leading to increased profitability for miners. However, high values can also indicate that the market is “hot”, with a signal that the crypto market has the potential to correct if miners decide to sell newly mined Bitcoins to realize profits.

Conversely, a low Puell Multiple indicates that the daily value of Bitcoin mined is low compared to historical averages, often occurring during market bottoms. This scenario could signal that miners are under pressure, possibly leading to a reduction in selling pressure as miners hold their Bitcoin in anticipation of higher prices in the future. In short, according to the analyst, the crypto market signals based on these three indicators, contain that the Bitcoin bear market has ended and the first stage of the bull cycle has begun,thank you, hopefully it's useful

Very nice post. Good to see your article....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for coment bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

amazing analysis however there are still people who waiting for BTC to come to 20k. But the reality is that moment will never come.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your comments. I enjoy reading your comments, which have provided almost correct responses

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post has been upvoted by @dsc-r2cornell, which is the curating account for @R2cornell's Discord Community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article, I truly wish the bear market is over as I for one is tired of the bearish trend and hope the market will keep going up from here on out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your comments. I enjoy reading your comments, which have provided the response I wanted

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's good to know that we're not in bear market anymore but I think the bull run has not started it because there are not enough volume in the market which is surely a requirement to say it's a bull run.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your comment. I enjoy reading your comments. I also have the same opinion as you said. Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit