hello, steem #tron-fanclub friends, how are you, I hope you are all in good health and success, and on this afternoon's occasion I would like to share information about the development of BTC, the price of Bitcoin (BTC) has consistently recorded pleasant growth, and some analysts see that this will not stop and will continue. In a recent analysis conducted by leading derivatives exchange Deribit, an optimistic view of Bitcoin price movements in early 2024 was revealed. This optimism is based on an examination of Bitcoin's put-call option ratio, an important metric in the options market.

For your information, options, as one of the financial instruments, give traders the right (but not the obligation) to buy (buy option) or sell (put option) the underlying asset at a specified price within a certain time period. The put-call ratio, a key indicator in options trading, measures market sentiment. A lower put-call ratio indicates a greater tendency among traders to bet on asset price increases rather than decreases.

BTC Price Potential to Soar

#NewsBTC reports that Deribit's analysis revealed a significant trend where the number of buy options is surpassing the sell options in the Bitcoin options market. Chief Commercial Officer at Deribit Luuk Strijers, noted that the put-call ratio for Bitcoin has consistently been between 0.4 and 0.5 throughout 2023.

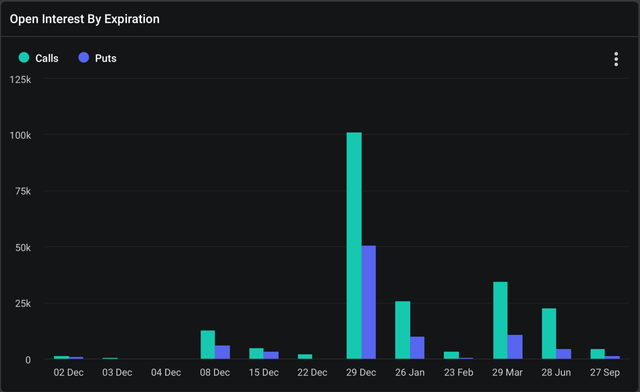

Notably, the data shows increased interest in call options, especially those expiring in March and June 2024, indicating investors are bracing for potential BTC price appreciation during this period.

A put-call ratio falling below one is considered a bullish indicator, indicating that buying volume, representing bets on a price increase, exceeds sell volume, representing bets on a price decrease.

According to Deribit's latest findings, Bitcoin's put-call ratio currently stands at 0.42, reinforcing the bullish sentiment in the market.

The crypto derivatives market has seen significant activity in November, driven by high levels of implied volatility (DVOL), according to Strijers. This surge in market activity has provided opportunities and increased overall market volume.

Upcoming option expirations, especially the big one on December 29, are expected to keep interest and activity high in the market. With US$5.7 billion in Bitcoin options and US$2.7 billion in Ethereum options expiring at the end of December, the market is poised for a significant move.

Bitcoin continues to experience positive momentum, recording an increase of 1.8 percent in the last 24 hours. Trading at around US$38,344, the asset has maintained gains achieved at the end of the previous month. The significant increase in trading volume, from around US$11 billion at the start of the week to more than US$21 billion in the past day, indicates increased investor involvement and increased buying pressure in the market, according to today's update on btc's problems hopefully the future will be even better BTC price and do you still want to invest in BTC, comment below, if you like today's BTC price issue, thank you, I hope it's useful.

Congratulations, your post has been upvoted by @dsc-r2cornell, which is the curating account for @R2cornell's Discord Community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article, I hope this brings a rapid pump in bitcoin 🙂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit