hello, back again with me today, and on this occasion I want to share the news about Bitcoin Price Could Jump to Half a Million Dollars in Four Years, do you believe it, and I will share this news, hopefully it can be useful and encouraging for users digital currency for our future, more on this issue.

Bitcoin (BTC) has had an incredible journey in the world of finance, attracting huge attention, especially with its value projected to reach incredible heights in the near future. On-chain analyst PlanB made a bold prediction that Bitcoin price could reach US$524,000 in the next four years.

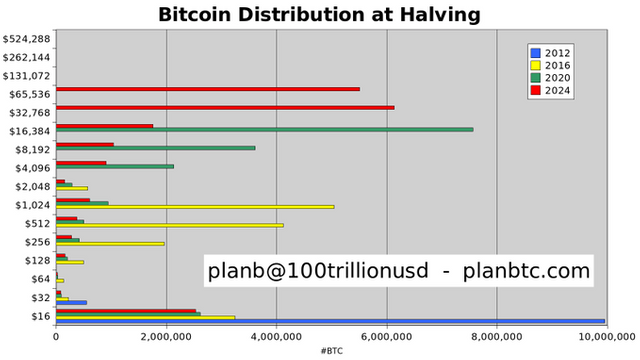

This projection is based on its historical performance during the Bitcoin halving cycle, a phenomenon that occurs approximately every four years and reduces the reward for mining Bitcoin in half. This reduction in supply has historically led to a significant increase in Bitcoin's value.

The halving event in 2012 saw the price of Bitcoin less than US$16. Subsequently, the 2016 halving witnessed a substantial increase, with Bitcoin prices ranging between US$256 and US$1,024.

Bitcoin Price Prediction

The upward trend in value continued through the 2020 halving, where Bitcoin was valued at between US$4,000 and US$16,000. From this pattern, PlanB predicts that by the 2024 halving, Bitcoin will likely be worth in the range of US$16,000 to US$65,000

More surprising, PlanB suggests that in the next four years, the majority of Bitcoin transactions could occur in the US$65,000 to US$524,000 range, indicating a violent increase in Bitcoin prices.

This optimistic view of Bitcoin's future is in line with growing interest in Bitcoin-related investment products, such as ETFs. In the US, approval for a spot Bitcoin ETF is highly anticipated by investors.

A look at the Brazilian market, where Bitcoin ETFs have been trading for more than two years, reveals strong demand for such investment vehicles.

Coindesk reported that, such ETFs in Brazil collectively managed US$96.8 million in assets as of November 21, with Hashdex's Nasdaq Bitcoin Reference Price FDI (BITH11) leading the way with US$57.8 million in assets under management, accounting for about 60 percent of the market share.

By comparison, Brazil's largest ETF, iShares Ibovespa Index (BOVA11), has assets under management of US$2.41 billion, and the second largest, iShares BM&FBOVESPA Small Cap (SMAL11), has US$1.19 billion. To put things in perspective, the largest ETF in the US, the SPDR S&P 500, has about US$430 billion in assets.

Hashdex CEO and Founder Marcelo Sampaio attributes the success of Bitcoin ETFs in Brazil to pro-market regulation of the digital asset and growing interest from large institutions in the product.

"There is growing positive sentiment among sophisticated investors, with many large institutions allocating funds to crypto or considering adding it to their portfolios," said Sampaio.

Since its inception on August 1, 2021, Hashdex's spot Bitcoin ETF has been part of this trend. Additionally, Hashdex offers a crypto index ETF that includes Bitcoin (BTC), Ethereum (ETH), and other crypto assets, which attracts more investments than a BTC ETF. Assets under management for the Hashdex crypto-linked ETF are currently around US$500 million.

Bitcoin's trajectory and growing interest in Bitcoin ETFs globally marks a key moment in crypto's evolution.

As the regulatory landscape adapts and more institutional players enter the crypto space, the potential value of Bitcoin and its integration into the mainstream financial system seems more possible than ever. Let's see, in the future, whether this really happens or is it just news that makes us continue to invest in crypto, and hopefully it really happens because the price of BTC has a big influence on digital money and so on, thank you, best regards.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post has been upvoted by @dsc-r2cornell, which is the curating account for @R2cornell's Discord Community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article from you with bold predictions, hopefully we will see such price heights

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for coment @favrite

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit