.png)

Background Image Source- Canva.com/Location

Assalam-o-Alaikum Steemians !

I'm @moneyster, a professional level Cryptocurrency investor and an analyzer. As usual, today I thought to share another Crypto-related experience with you. I hope this article will be considerably beneficial for all the Steemians in this community

.gif)

|

|---|

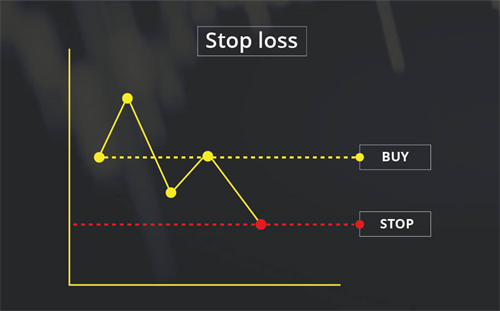

I think we all have heard the word Stop-Loss those persons who are Trading Cryptocurrencies as well as other Major Trading methods such as Forex. If we are Cryptocurrency traders, we should need to focus more on these Stop-Loss as all the Cryptocurrencies are highly volatile as compared to other Currencies.

With the help of placing a Stop-Loss perfectly, we have the ability to manage our risk at a certain level. At the same time, we can prevent from sudden large market movements. The best example for demonstrating the value of this Stop-Loss, we can take look at the Traders who had invested in Luna Project. Those Traders who had not set a Stop-Loss, lost their entire investment within a few days

The majority of retail Traders don't focus on Stop-Loss even if they don't have enough capital. Sometimes, they don't have sufficient knowledge to place the Stop-Loss correctly. That's why they don't focus on Stop-Loss as the Price movement triggers the stop loss and continues its movements on the opposite side.

The best solution for placing the Stop-Loss correctly, we can easily use the Average True Range (ATR) Indicator to identify the exact location to set our Stop-Loss. This Average True Range (ATR) Indicator looks at the past candles perfectly and measures their volatility of them using the exact sizes of those candles. Then, we have the ability to place our stop loss with the help of this Average True Range (ATR) Indicator signal.

.gif)

With the help of this Average True Range (ATR) Indicator Concept, we have the ability to place our Stop-Loss point in a suitable zone. Those Traders who don't have much knowledge to identify the exact volatility in the market, they can use this Average True Range (ATR) Indicator to identify the exact volatility at a certain level. This indicator really forces Traders to place the stop-loss after showing the real volatility and it minimizes the risk of the Trading. If don't have a large capital to invest, we have to divide the capital we already have and we can focus on this Average True Range (ATR) Indicator and easily place our Stop-Loss in a suitable entry.

.gif)

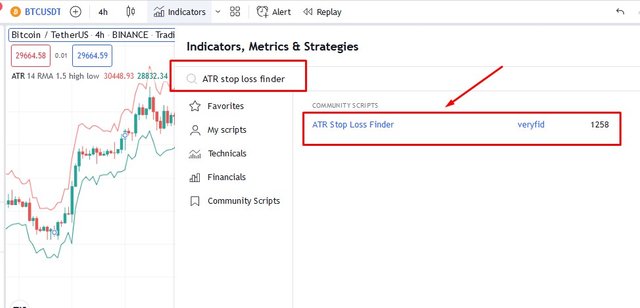

First of all, I will add these Average True Range (ATR) Stop Loss Finder to my Crypto Chart using the TradingView platform. Then we can go to "Indicators" through the tool panels and search "ATR Stop Loss Finder" in the giver search bar. Below I have included a screenshot to demonstrate adding the (ATR) Stop Loss Finder Indicator to our chart.

|

|---|

Now I have demonstrated some good zones provided by this Average True Range (ATR) Stop Loss Finder to place our Stop Loss. Here we can see a Band from the above and below the price movement. Here we can easily place our Stop Loss from the below band for a Long order. At the same time, we can use the above band for a short order.

|

|---|

In this way, we can use this Average True Range (ATR) Indicator Concept for getting better and easy risk management opportunities. However, we can try to combine this strategy with some other indicators to minimize our risk.

At the same time, as I said in my previous article, we should remember that all the indicators and strategies are not efficient completely as nothing we can find 100% efficient in the world. So, we should depend only on these strategies and indicators to confirm our trading opportunities and manage our risk at a certain level.

.gif)

I have studied the below-sourced articles to further study these topics and I have explained all the above facts in my own words and experience.

10% benificiary set for @tron-fan-club

Twitter Shared

https://twitter.com/moneyster12/status/1532945635888009216?s=20&t=EBbVvb7zo1zpKUhQh5TI2w

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post was upvoted by @hustleaccepted

Use our tag #hustleaccepted and mention us at @hustleaccepted to get an instant upvote.

Also, you can post at our small community and we'll support you at Hustle Accepted

Visit Our Website at

Hustle Accepted

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Setting stop-losses is very vital in trading because what differentiates a good trader from a bad one is the ability to manage risks.

You have done well in your explainations.

Keep it up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for your valuable comment brother. Especially you have increased the value of my article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Note: You must enter the tag #fintech among the first 4 tags for your post to be reviewed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much @fredquantum for your support. I really appreciate it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have explained very nicely how important stop-loss is to trading. It an effective risk management took and every trader should know how to use it. Thank you for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for your valuable comment on my article. It means a lot to me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I was hurt when I saw a candle like this because after I cut the coin it went up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, that's the worst situation. I hope you will recover from your loss and you can be a very successful Trader soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing with us on how to set our stop loss. It is indeed a great lesson. Greetings!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are most welcome my friend. It's really a pleasure to hear that it was useful to you. Hope to write more related articles here. Stay with me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing with us on how to set our stop loss. It is indeed a great lesson. Greetings!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Gradually, I’m learning a lot from your post

I believe that you are a trade guru

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really a pleasure to hear that. Thank you very much for visiting my article brother. It means a lot to me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Setting stop-losses is critical in trading since the ability to control risks distinguishes a smart trader from a bad one. You did a good job with your explanations.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are correct my friend. Thank you very much for adding additional details to my article. It really increases the value of my presentation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit