So much most times that an average crypto trader needs to deal with daily that ranges from different aspects. In fact most of the time it leaves us to confusion and doubt. Some of it most of the time is when we are trying to execute our trading strategy. So many traders have different strategy and trading plan in their trading journey. Some make use of indicators, some make use of charts and some just make use of support and resistance as their trading journey.

In either way, I have actually come to discover that anyone can actually give you a potential of profit and also at the same time loss. I have met my fellow female traders most of the time and one of the constant question they always ask me out of curiosity is they don't even know whether they should still continue using indicators as a trading strategy or not. Well that will lead me to what I will like to discuss in my post actually today so stay tuned and read below.

Looking Into The Cryptocurrency Trading World

Before I even dive into the main discussion about the indicators whether you should use it or not. Let's briefly look into how the world of crypto trading operates. Cryptocurrency as many of us is aware of are actually digital or should I say virtual assets that works on Decentralised networks created on Blockchain. Before you can actually trade cryptocurrency, you should understand that you need to actually chose a trading platform or exchange rather. Some of the list we have are like the Binance, Coinbase, Uni swap and many more. There is also a trading platform like Trading view that helps to actually analyse your trading strategy.

Like many of us is also aware, we need to understand that it is very important that we actually conduct a well detailed market analysis. Some use the market trend, some keep up with the news and some use different strategies just to keep up with how the market actually works. Some make use of indicators tools like rsi, Bollinger Bands, Macd and many more to mention depending on your preference.

Every trader in the crypto world and looking at how the market is so volatile, it is very important that you actually practice risk management. Risk management is you putting structures in place that will help you to control your risk decisions. Structure like stop-loss, diversification of your portfolio and many more. Well that is enough, let's look deeply into the indicators topic.

Should I Use Indicators For My Trading Strategy In The Crypto World?

That is really quite technical question that in my own case I will not give a direct yes or no answer to it because question like this can only be answered based on the preferences of the traders involve and the crypto market structure that is involved.

Like I actually said earlier, there are a lot of traders who used indicators to execute their strategy and win. There are also who didn't make use of it and they also win. At the end of the day, it depends on the preferences. Now to make things easy for you to judge whether you should make use of it or not, I will briefly discuss majorly 3 advantages and disadvantages of Using Indicators and at the end of the day, leaves you to decide which one to go for.

Advantages Of Using Indicators

- Insight into Market Trends.

The first advantage that indicators offer to you as a trader is the fact that it help to provide you insights into the market trend. They help you analyse the movement of the market by giving your representation of the price movements. By doing so, you can be able to interpret whether a market is in the bullish trend or in the bearish trend or probably is in the ranging level so that it will aid you to make more wise trading decisions.

- Identification of Entry and Exit Points.

Not only do the indicators help you to analyse market trend but it also helps you to know the entry and exit points of your trading decision. Indicators like RSI can help you to know the overbought and the oversold region so you can actually know when to exit the trade and when to enter the trade also.

- Risk Management:

Then the last advantage I have on my list is the fact that it helps you to actually implement proper risk management. By applying those two advantages I discussed earlier, it will be easy for you to set your stop loss orders and know the position size you are planning to enter the market with. With that, traders can better manage their risk exposure and minimize potential losses.

Disadvantages Of Using Indicators.

Now having look at the three advantages of using indicators, let's look briefly into the disadvantages of using Indicators as we all know, everything that have advantage have disadvantage.

- Lagging Indicators:

For many indicators lovers who will be reading this, you will definitely agree with me that most of the time, indicator's actually lag. Yes they do lag. Many indicators lag behind real+time market movement which can even lead you to miss out on some opportunities while trading or even cause loss due to late entry or exit also.

- False Signals.

I think this should actually be on the first in the list but nevertheless, it is still part of the golden disadvantage of indicators and in fact why I stopped using indicators to trade at one point. A lot of times, indicators can give you false signals most especially when you are in a market that is so volatile. And that is why it is advisable not to rely only on indicators as it can lead you to poor trading decisions.

- Over-Reliance.

The last one I will mention of is over-reliance which can really be quite dangerous. What do I really mean by that? Some traders because they so much depend on indicators, they might not be willing to explore the trading world or even learn more new things about how the market works limiting their knowledge about how the market and trading world generally works.

Now that I have listed out both the advantages and the disadvantages, I will say I will leave you to actually decide whether you should go with indicators or not depending on your preference.

10% beneficiary to @tron-fan-club

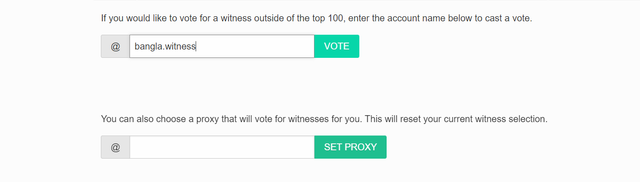

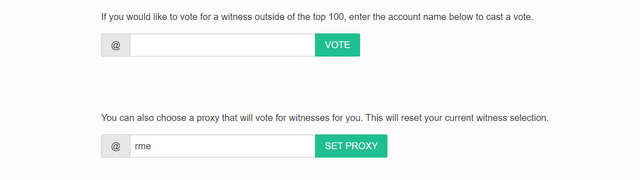

VOTE @bangla.witness as witness

OR

https://twitter.com/WayShola84156/status/1790335225404244135?t=idR_5UbnKc-g0FKQudHR6g&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In fact, I saw your post and understood how it should be used. Should You Use Indicators For Your Crypto Trading Strategy. I enjoyed reading this relationship. Looking forward to your next post, thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea thank you so much. I always make sure that I present my post in a very simple way so that my readers can actually understand and at the end of the day, they can also take something home from it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not into the trading but I know some people who are using the different indicators to make their trade more profitable and it is part of their strategy while trading in the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea there are some people who actually make use of indicators to trade and there are actually some who doesn't not. I think at the end of the day just as I said, it depends on preferences

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for explaining the indicators well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you much more for stopping by to read

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't use indicators to buy crypto coins or anything else, in fact I didn't get rich. hahaha

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

😂😂 but definitely someday you will get rich

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wow great tricks mentioned though i have no experience in these matters thanks go ahead,

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea even though you don't have any experience about it. I am so sure that you will be able to actually learn a lot from my post today. Do you also trade crypto or you are a holder

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, because nice comments inspire me to come up with something better later, love

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit