This report examines the growing relationship between real assets (RWA) and blockchain technology.

It provides a comparative analysis of various blockchains, including Bitcoin, Ethereum and Tron. Relevant data and statistics are also provided to provide a comprehensive understanding of this growing area.

Introduction

Over the past few years, blockchain technology has evolved significantly, moving from a small technology primarily associated with cryptocurrencies such as Bitcoin to an important tool used in various industries.

Decentralized, secure and transparent, blockchain technology is particularly suited to representing and trading real assets (RWA).

Real assets and blockchain: an overview

Real assets are physical or tangible assets such as real estate or goods. With the advent of blockchain technology, the concept of tokenizing these assets is gaining attention.

According to forecasts, by 2022, about 10% of global GDP, amounting to $8.6 trillion by 2027, will be stored in the blockchain (World Economic Forum, 2022). This diagram demonstrates the huge potential of integrating PBA into blockchain platforms.

Current state of the real assets segment

The Real Asset (RWA) sector is very diverse and includes many projects, especially in the field of decentralized finance (DeFi). For clarity, these projects can be divided into three different groups:

- Fixed income projects based on offline assets such as US Treasury bonds, stocks, real estate and art.

- Public loan projects based on assets traded on the open market.

- Trading platforms based on intangible assets such as carbon credits.

Infrastructure projects are also emerging, such as first-level (L1) industry blockchains.

In fixed income, there are projects that provide loans to both individual and institutional investors, especially in the US bond and equity markets.

What sets these initiatives apart from other DeFi lending platforms is the collateral infrastructure that can include tangible real-world assets.

In turn, government funding projects aim to distribute the investment funds of the cryptosphere among cryptocurrency users, mimicking the path of US Treasury bonds and other similar instruments.

RWA's top seven lending protocols — Centrifuge, Maple, GoldFinch, Credix, Clearpool, TrueFi, and Homecoin — have collectively lent about $4.38 billion, according to RWA.xyz.

Since the borrowers were mainly developing countries, the average annual interest rate on these loans was 10.52%. These lending protocols tend to offer higher returns than most DeFi lending platforms.

However, there are potential risks to consider, as evidenced by Maple Finance's $69.3 million default during the 2022 corporate turmoil.

Growth of Tokenized Assets: The Case of Tokenized Gold

Tokenization is the process of transferring ownership of tangible assets such as precious metals to a blockchain. It eliminates the need for traditional brokers and provides the convenience of buying and selling these assets 24/7.

In its 2023 report, Bank of America noted the rising momentum of RWA tokenization and stated that the value of the tokenized gold market has exceeded $1 billion (Coindesk, April 2023).

Prior to tokenized gold, investors looking to enter the gold market bought exchange-traded funds (ETFs), futures, or purchased physical gold through dealers. However, these traditional investment vehicles have disadvantages related to cost and liquidity.

Tokenized gold offers access to physical gold, 24/7 real-time settlement, no management fees, no storage or insurance costs.

Low minimum investment facilitates access, and fractionation allows ownership and value of physical gold to be transferred in ways that were previously not possible (Coindesk, April 2023).

Comparative analysis of various blockchains

Cryptocurrency revolution - in our mailing list. Subscribe right now and become one of the millions of subscribers (that's right, millions of people love us and we help them).

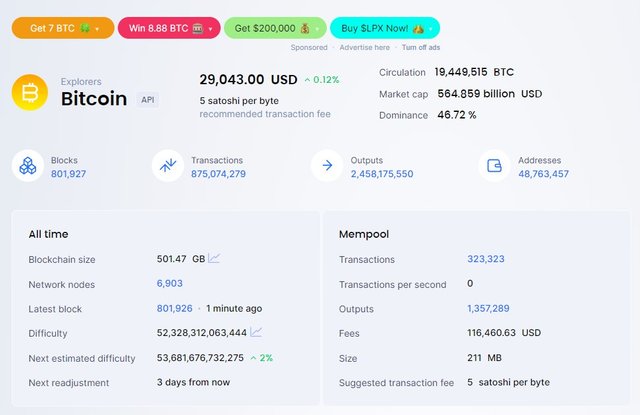

Bitcoin

The Bitcoin blockchain became the ancestor of the concept of a distributed digital ledger. It is mainly used to transfer native cryptocurrency, but is also used for "colored coins" that can represent RBC.

However, Bitcoin's limited scripting language and lack of built-in support for smart contracts limits its usefulness for complex RWA representation; as of 2023, only a few projects are considering using Bitcoin for RWA tokenization.

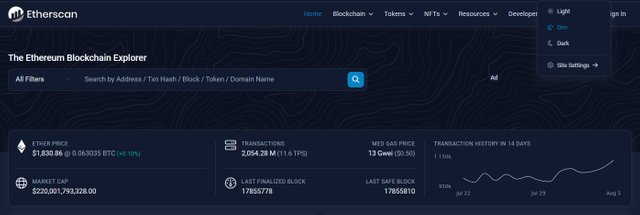

Ethereum

Ethereum has become the leading platform for RWA tokenization due to the functionality of smart contracts: As of Q1 2023, there are about 250 active projects on Ethereum related to RWA tokenization (Etherscan, 2023).

The Ethereum smart contract allows you to create tokens, which are respectively ERC-721 tokens (non-functioning tokens, NFT) and ERC-20 tokens (unique assets, fungible assets). These assets range from real estate to works of art and intellectual property rights.

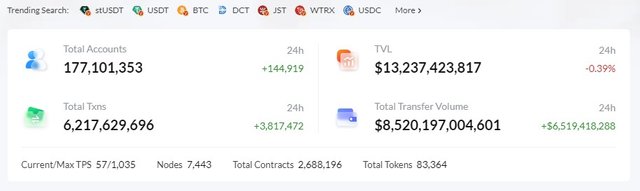

TRON

Tron is a newer and scalable blockchain platform that is also seeing a rise in RWA tokenization projects. As of Q1 2023, there were 120 active RWA tokenization projects on Tron (Tronscan, 2023).

Tron smart contracts are similar to Ethereum smart contracts and allow the creation of TRC721 and TRC20 tokens for unique and fungible assets, respectively.

The advantage of Tron over Ethereum is faster transaction speeds and lower fees, which could lead to more projects using the platform in the future.

To earn TRX I use the service Feee.io is a TRON energy trading platform, you want to receive income from 50% APY. Join our friendly team!

https://twitter.com/RollercoinTron/status/1688164683541344258?s=20

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have shared an interesting post on real asset and blockchain technology.

Thanks for sharing with us 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Real Assets and Blockchain Technology is a great content

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Tron ecosystem is dynamically developing and every day pleases us with new features.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great discussion about Real Assets and Blockchain Technology. Thank you very much.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit