.png)

The chart presents a symmetrical triangle formation, usually signifying a phase of consolidation and indecision in the market. This pattern reflects a struggle between buyers and sellers, neither of whom takes total control, which results in narrowing price movement as the chart progresses toward the apex of the triangle. Such formations often act as harbingers of significant price movements, with a breakout in either direction likely to set the tone for the next major trend.

The top resistance line shows consistent selling pressure, as evidenced by multiple failed attempts to break above it. Each rejection has highlighted the strength of sellers at higher levels, suppressing any bullish momentum. On the other hand, the support formed by the bottom ascending line is strong; buyers have stepped in to defend the price, which forms a series of higher lows. This dynamic somewhat reflects a balance between bullish and bearish forces.

This indecision is further reinstated in candlestick behavior. There are many candles showing big wicks, especially up towards the resistance line, revealing failed attempts from the buyers. Their presence will further indicate hesitation and uncertainty, reflected through a tag of war amongst the market players, which is natural and expected for such a pattern-one that also decreases volatility within price action as the chart plays out.

The moving averages further add to the analysis. In this, the shorter-term moving averages have slid below the longer-term average, pointing toward a bearish sentiment of the prevailing market. However, the proximity of the price to these moving averages depicts struggling moments to reassume the upward course. If the price succeeds in a clear break above the moving averages, this could indicate the change in market sentiment, and continued rejection at these levels will likely reaffirm bearish dominance.

What one does not show is that as price action starts to consolidate into a triangle the trading volume tends to start decreasing. That is the nature of triangles altogether: traders and investors alike sit and wait for a breakout to take their position. Confirming this directional move is usually, if not a surge, a pronounced increase in the volume.

Given the structure of the pattern, along with the dynamics of the market, two scenarios are most likely to develop. A breakout above the resistance line can trigger a strong bullish rally, with its potential targets taken from the height of the triangle at its widest point. However, a breakdown below the support line is likely to trigger a significant decline where bearish targets are calculated from the height measured at the wedge's widest spot. Its direction and time will likely be determined by more general market timing factors, or news catalysts.

The price is supposed to range-bound within the resistance and support lines in the trading zone during the period. Confirmations for the breakout or breakdown in one direction would have traders taking their positions, while investors who are possibly more risk-averse could wait for the establishment of the direction of the breakout. Therefore, this chart represents a no-trading phase but a very important one because the market is coiling up for the next important move.

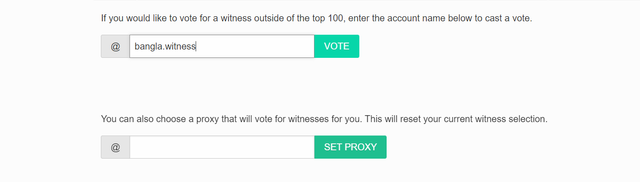

VOTE @bangla.witness as witness

OR

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really liked this analysis and to be honest, the concept of support and resistance is also clearly visible on the chart.

I have a question, both Hive and Steem are based on the same fundamentals and till last year their prices used to move almost together despite a slight difference. Then what happened in the 2 months that now the price of Hive has been maintained at two times more than Steem and the price movement in Hive is also many times more than Steem, like right now Hive is almost 25% up and Steem is less than 10% ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

At this moment, Hive will go ahead with its marketing strategy. But if Steemit team can do same thing, obviously Steem also runs much better than Hive.

Let's see, what will happen in the future. Justin Sun has a unique idea for Steemit. They need to implement that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit