Hello!

It's with great pleasure. I am excited to be putting my entry in this community. Quite an interesting topic which caught my attention, I am ready to participate in this engagement challenge and share my thoughts on the topic raised.

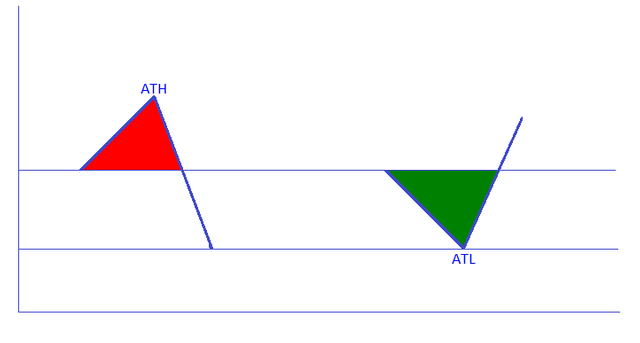

The shark 🦈 fin Is a key aspect used in trading comparison. When viewed from above, the shark fin possess a typical V shape, Which normal people see it as a v-shape, but from a traders perspective It represents certain portions on the price chart.

These points on the price chart either high sharp inverted V at the top of the price chart or Normal v-shape pattern form at the bottom of the price chart. The highest end are designed a name "peak(ATH)" while the bottom charts are designated the name "trough(ATL)".

Explain the concept of the Sharkfin model. What is a Sharkfin pattern and how can it be identified on a price chart? Describe its main visual characteristics.

The concept of the Sharkfin model

In the introduction, I did mention of the shark fin And it comparison to the price chart, but then I didn't go into detail On how it could be applied on the price chart. To begin with, let's define a shark fin model from a trader's perspective.

The Sharkfin model is a technical analysis pattern that often identify a potential trend reversals. From its name, it characterize features the shape of a shark fin on a price chart. It typically identify a sharp, rapid price movement in one direction, followed by a quick reversal back towards the original price level On the price chart. This sharp movement often pushes the market into overbought or oversold conditions.

The topmost part of the chart representing an over bought is called the peak, while the down part representing an over sold is called the trough.

Sharkfin Pattern and how can it be identified on a price chart.

Basic key concepts should be put in mind when identifying a shark fin model. Just as previously explained, on a price chart, we are going to notice overbought or of over sold conditions on the price chart.

The following should be considered identifying a shark fin model.

Well then

Sharp Price Movement: watch out for rapid, strong price increase or decrease. Here the market move Sweet in One direction and holding at a certain point.

Quick Reversal: Look out for a rapid reversal of the price back towards the original level. As previously explained in the first point, when the market moves in One direction, really quick, in the next few minutes or hours, it might retrace itself to its original direction or back to its original point. There is possibly a shark fin to look out for

Resemblance to a Shark Fin: using the concept of technical analysis which is based on resemblance and repetition, if the overall shape of the pattern resemble a shark fin, then it's likely a confirmation.

Often Associated with Overbought/Oversold Conditions: by definition, we discuss on the point that a shark fin typically indicates a sharp price movement, pushing the market into extreme conditions. This can either be identified in an uptrend or downtrend.

Using just visuals to confirm the shark fin is technical as sometimes false signals might arise. A few key concepts should be considered when looking out for a shark fin such as;Volume: Watch out for the volume of the asset during the sharp price movement, it can strengthen the pattern. The volume is either higher or lower.

Indicators: you might want to employ indicators such as RSI (Relative Strength Index) which can help confirm overbought or oversold conditions.

Confirmation: As we all know, The market is not 100% of the time going as perceived. So it is wise to wait for additional confirmation, such as a candlestick pattern or support/resistance level, before executing a trade.

Main visual characteristics.

Already mentioned, The the shark fin indicates overbought or oversold condition in the market. This is e that identified on an uptrend or downtrend. Two types of shark fin features we will be looking out for a price chart.

We are going to consider a fin for an uptrend (bullish) or The case on a downtrend (bearish).

Uptrend: Bullish shark fin.

For an uptrend, There are 3 keys feature we should look out for.

sudden rise in the overall trend of the market

The peak value of the market And

A sharp decline In the overall trend of the market.

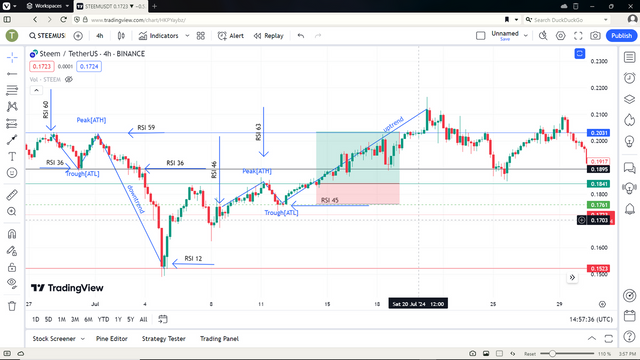

All these features characterize the visual confirmation of a bullish shark fin. Incorporation with the RSI. I will do a chat analysis on a bullish shark fin chart. Watch out for the value of the RSI ad indicated points.

Downtrend: Bearish shark fin.

Contrary to the uptrend, the bearish characterize opposite of a bullish shark fin. What you might want to watch out for is this.

A sudden decline in a direction by the whole Mass of the market.

Formation of a trough Point. And

Is sharp rise Back in the usual direction of the market.

This are the basic key concepts we can use to describe a shark fin model on a price charts.

Explain how the RSI (Relative Strength Index) indicator can be used to identify Sharkfin patterns. Give a real-world example of RSI metrics (like overbought and oversold levels) and explain how these metrics help spot Sharkfins.

Using RSI (Relative Strength Index) indicator to identify Sharkfin patterns.

The RSI is a widely known indicator used by traders in the crypto market field. It is praised for its ability to point out overbought or oversold conditions. Most traders use this indicator As it is able to signal out Sharp changes in the market.

The RSI is Scaled 0 to 100, and between this range we have the lower low which is between 0 to 20 or 20 to 30 depending on your chart. And a higher range which is between 70 to 100 or 80 to 100. The meter range is from 30 to 70. Price auctions are able to demonstrate some characteristics in these listed range.

I will discuss sharkfin formation on overbought or oversold conditions. Using RSI.

RSI indicator in overbought conditions.

With the RSI indicator added on your chart, We should be able to spot some particular changes when the market reaches a particular scale on the RSI section. There are key points to note note when this happens.

keeping an eye on The RSI section, We will observe that the Line moves above the 70 scale, which is considered a strong uptrend Mark.

At this point, the peak value Is obtained. The market trend might resist At this point And continue moving upward or otherwise.

Should in case the trend direction reverses and falls around The 50 to 60 scale on the RSI, a resistant point will be formed at this point, To push the market upward to breaking the peak value again.

At this point the cycle is complete and the RSI helps a lot to confirm this movement.

RSI indicator in oversold conditions.

The reverse happens in the case of an oversold condition . The RSI plays the opposite rule here instead. Here are a key points to watch out for.

first, The trend line Is going to play below the 30 scale. For some cases the market might continue to sell till it hits the ATL level.

why the ATL is hit, a slight might occur bringing the markets trend to 40 to 50 scale before readjustment.

from here the market direction reverses again and continue to sell long. This will occur in the case of an over sold. While the sharkfin is formed, the cycle is complete for oversold.

Give a real-world example of RSI metrics (like overbought and oversold levels) and explain how these metrics help spot Sharkfins.

Equally we discuss on RSI as a major tool to identify Strong by and strong sell, analyzing this with a real life chart, It will come steady incase of overbought by followed by oversold

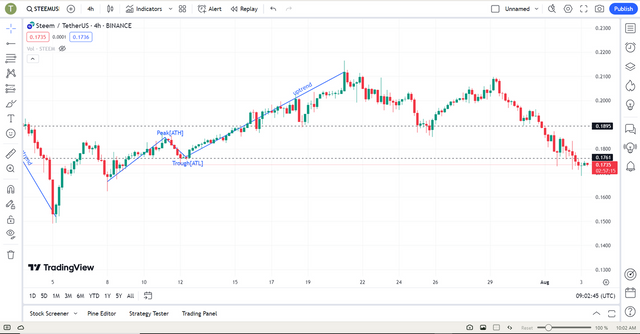

- RSI in overbought.

From the image above. We can see that using Steem/tether US pair, when observed. The price of steemit was currently trending at 0.1761$, at this point the RSI was at 46. When the steem price move now to 0.2012$, the RSI value move to 70.

At 0.2012$ previewed as our peak value, the market is seen to retest it strength, falling back to a previous high of 0.1759$. the RSI then reversed and drop to a value of 45. At this point our sharkfin is fully visible and in case of any execution should don here.

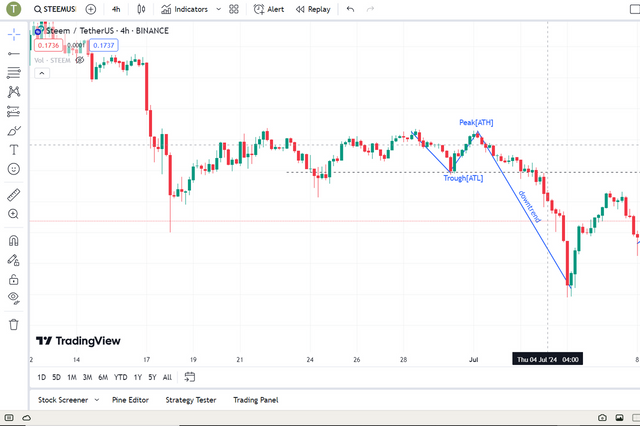

- RSI for oversold.

Still using the same pair. Steemit price was pictured around 0.2124$. at this point, the RSI was pictured around the 65 value. The trend then reversed to a short distance and at this point, the steem value was pictured at 0.1786$. equally the RSI reading was recorded at 36.

At this point the ATL is considered to exist at this point. The Market then reversed to a previous point in as initially it was. 0.2120$ and here, the RSI is seen at 59. At this point our sharkfin is fully visible.

The trend then reversed and continued in a continuous sell off which is a now a a strong sold as previewed before.

What are the trade entry criteria when using the Sharkfin model applied to the Steem token? Describe the specific signals you are looking for before entering a position, using example price setups and indicators.

As a trader the are key things we need to consider certain criteria before thinking of executing a trade. First, have risk management in mind. This is taking precautions to ensure that you not risking too much.

It is often advised to invest what you can afford to loose because there is no such things as perfection in trading. However with the help of fundamentals and technical analysis. Professionals can predict the next event in the market using previous knowledge of chart(technical analysis) or current news and events(fundamental).

Using the sharkfin model of analyzing. We all always going to incorporate it with the RSI indicator. Here we can be able to predict the conditions for overbought or oversold in the market.

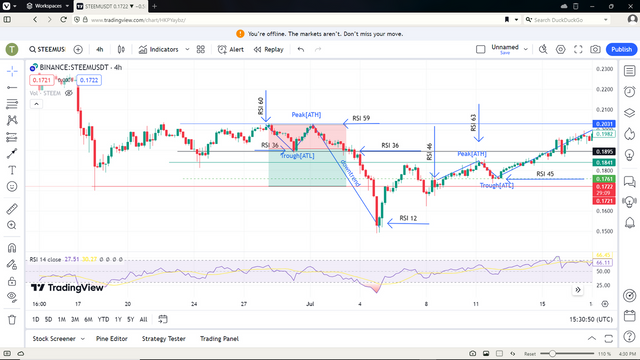

Trade execution criteria for overbought. Sharkfin model.

At the back of the mind of every trader, the aim is to maximize profits. It now depends on what mode and strategy the trader is willing to perform. Using the sharkfin model for bullish market, the are a few key points to note before execution.

A chart illustration will help us understand into detail the point following the chart present.

The first thing I want to do is visual confirmation. I'm set to buy short. in case a possible scenario arise on the market which is looking an opportunity to me.

I will be fishing out sharkfin when I suggest its about to form. On my chart. The Steem price is currently trending at 0.1761 $. The Forest green line. At the instant, the RSI reading is 45.

The market moves up to a point when the price is now 0.1841$, at this point, the RSI reading is currently at 61. At this point, the market makes a unique reversal. I suggest this point to be my ATH.

I simply wait till the the market settles at 0.1766$ and RSI 46 . It resist for while and finally reverse it direction. Here my sharkfin face is complete and confirmed. I wait till the market retest it previous height.

I noticed a serious resistance at this point. What I want to do is wait patiently. Immediately, a breakout finally happened. I will wait till the price is above 0.1866$ per steem.

I then can put my entry at this point and wait patiently to see if it's respect the trend. I suspect the market should go to a point of 0.2031$ which was the previous high before it reversed.

As we can see, the market finally reaches the point and reverse. I will put my take profit at 0.20000$ to minimize my chances of being caught up in a reversal.

Trade execution criteria for bearish market. Sharkfin model.

They might be slight changes but then I will likely look and perform the same observations in made in the bullish market. Let analyze the chart below.

I began monitoring the market when the price of steem was currently trending at 0.2031$. at the instant the RSI value was 60. It began to drop and finally make a sharp reversal when it was currently trending at 0.1895$ while the RSI value reads 36. I suppose this should be where my ATL should exist.

Waiting patiently and watching the RSI. The market reverse to a previous high after some hours.

Point to note. We're are working on a 4H TF.

Returning to 0.020001$ for steem. The RSI equally reads 59. Few minutes later a market retest is observed. And it now I down trend again. Not be get too excited executing I waited till the price was one 0.1761$ again.

A slight resistance is observed here. Not safe to enter at this point, I waited further till a break out final occur. If executing, this is where I will put in my sell. My target will be the previous low in the market.

So I will be expecting the market to hit my take profit at the point where it's 0.1761$. although the Market continue to trend. I initially intended to buy short depending on my capital.

Describe the specific signals I'm looking for before entering a position, using example price setups and indicators

There are a key factors I will always check for before entering an point in the market.

First I start by preparing my chart with a set-up. While my setup Is complete, I make use of my RSI. In corporation with the sharkfin model. I'm ready to begin monitoring or possibly executing my trade.

For a quick recap, starting bullish if a shark fin is form at my ATL and the previous price exceed the initial price, there is likely an uptrend.

Here I will be looking out for key features. If say for instance the market price is at 0.20000$ and the RSI is currently trending around 20. I will be looking for a break out above 30 value of RSI.

Equally for when the price Serge around 0.3400$ to 0.4000$. I will be looking a point to topic. Here the RSI will currently be trending around 70 to 85. A reversal is likely to be witness at this point.

Now if for instance I was hope to execute in a bullish market, I first thing I will be looking out for the ATH. While hoping for a sell. The market position will currently be trading in the 75 to 85 RSI value.

What I'm expecting is the market to drop to May be 50 value. Then follow by my sharkfin. I expect the market to take off and trade around 75 again. Then a sharp reversal. By the time that Market just surpassed the support. That's my ATL, then I will be moved to sell at this point.

Let say the price was initially at 0.3000$, I retest will likely occur at 0.2500$ and back to 0.3000$. from here the price might go as far as 0.1500$. below the ATL.

For possible take profit, I will look out for the RSI trading at 30 to 20 value. Here a reversal or a sharkfin Uptrend is likely to occur.

Describe briefly the trade exit criteria using the Sharkfin model when applied to the Steem token. What signals or conditions tell me it is time to exit a position?

There's this say, a" good dancer must know when to leave the stage", staying too long in trades might lead to losses. So let's discuss on the exit criteria.

The sharkfin model works for both bearish and bullish markets. A lot has been discussed previously on stop loss and take profit.

Supposed the market is currently trending at 75 to 85 RSI value and price value is 0.3000$ to 0.4000$ for an uptrend. If my entry was 0.2000$ , I will possibly keep an eye on the movement in RSI value. Between 70 to 85 I will have my first exit point at 75 and second at 80. This minimize the risk of me being caught up In a reversal.

Now if the opposite happens and supposedly I was In a sale position. Watching out the RSI value around 30 to 20 is the goal.

If at the point of entry, the price was 0.4000$ and by the time I'm hoping to exit, it's currently serging between 0.2500$ to 0.2000$, I will be exiting at 30 first RSI value and second 25 to minimize risk of reverse.

****note: ATH and ATL could not follow the suggested direction at a time. So watch out for false signals. This context explains simply the strategy and not a financial advise.****

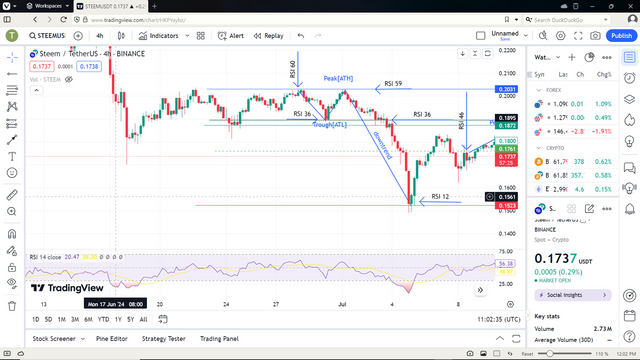

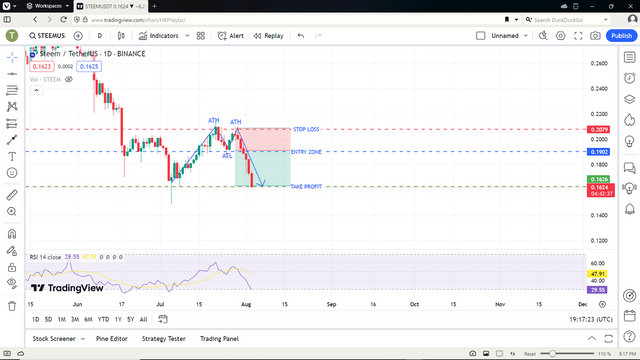

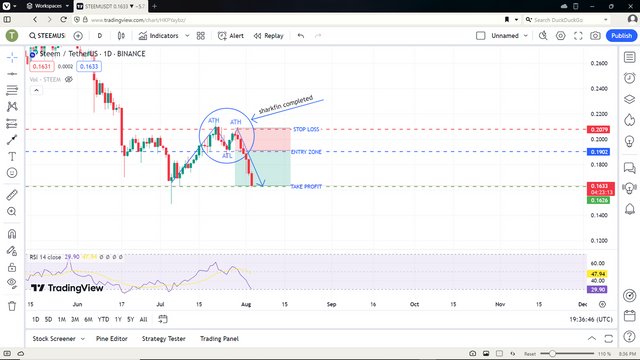

Show a detailed example of a transaction based on the Sharkfin model on the Steem token. Use real charts and historical data to illustrate your trade, including entry and exit points, and the reasoning behind each decision.

A lot has been discussed on the sharkfin model and it application in trading. I suppose it's time I demonstrate some practice work which is going to be details. I will demonstrate on the Steem/tether US token.

As a trader the first thing I do when entering a trade is a plan, analysis, observing and execution. After examining my pairs the Steem token was a favorite due to it volatility.

After picking my token, I proceed to the chart section to Carry out my technical analysis. This process involves setting up my chart to a possible outcome expectation and watching the market behavior towards this point.

I will be using the 1D time frame as it favorite for me when I plan on going long. After picking my time frame, I then prepare my chart as shown.

What draw my attention is the ability to spot a sharkfin Uptrend. Now I'm curious on what's going to happen next in the market. At the instant the RSI rated 65 when the steem price was 0.2079$.

It then fall to a value of 49 when the Steem price drop to 0.1902$. the market then retract to 0.2070$ when RSI value was 63. This is the previous high and my sharkfin has be completed. I then wait for a retracement which happens right after it hit the ATH.

Now I wait patiently for the market to surpass it previous low. A resistant is observed at this point If we open it on a small time frame. Once the point is broken, I made my entry and watch the market skyrocket.

Once the previous low have been reached, Immediately take my profile in other not to get distracted with the ATL point which might form at this point. Possible diverting market direction.

Take profit happened when the RSI trend below 30 and the current price drop was observed at 0.1633$. this is a perfect point to get out of the market.

The sharkfin model is really an amazing tool use in trading. Every trader should have a basic knowledge about it in order to minimize losses and read the market properly. Nevertheless watch out for false signals as the market doesn't respect the rules 100%.

I am invited @witness.report

#Regarda

@socialreport