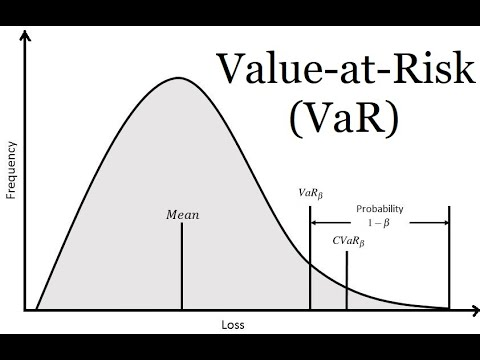

Finance are very useful today, in current times when COVID-19 did take capital markets and tipped over quotes around the world. This financial issue is not new for financial proffesionals in the sense some losses can join into portfolios. In this way, around the planet some people thought about how can we get some measure of prices risk. Some years ago, the world got an idea about it. The quetion that people answered is a measure that let us to measure the highest loss into a likelihood level. I am talking about value at risk measures. I said "measures" in plural, because this metric has some variations, which have been developed for many assupmtions about the market prices movements.

I do not want to talk specifically about this measures, because I don´t know how many technical people reading this post are. But I need to say the most of market risk measures are based on statistical methods. Having clearing that, I can underline some of them, as:

- Parametrical VaR: with assumptions in prices distribution

- Historical VaR: which take and ordered historical prices. This is the most easy way to measure price´s risk.

- MC Simulation VaR: using montecarlo simulations to get the quantile desired

- CVaR: Conditional VaR or expected shortfall

- mVaR: a modified VaR or Cornish Fisher Var, that take a Cornish-Fisher expansion to shape a normal distribution into another, to take into account the fat tails, that normal distributions doesn´t have.

About last one I want to share with you, in my github repository. I need to be clear, about this repository. I am a fan of quantitative finance, and I am working on it currently, and I do like to share some knowledge. I am a fan of coding algorithms too, in this example I did write the code in Python, one of the most used programming language to data science. I hope this can help you to get an idea about market risk ... this is just one of all tools to measure and manage risk in capital markets, and of course it can be useful to your investments, taking into account the risk and return you are adopted when you set a position in your finances.

If you want to learn about this risk measures, just let me to know with your comments or votes.

Regards.