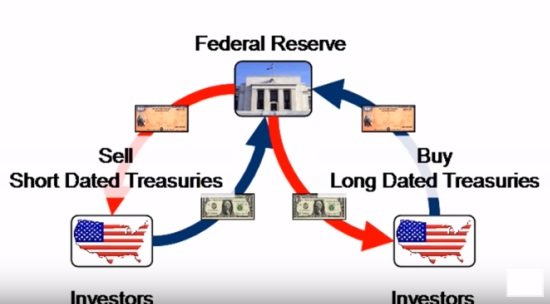

What is Operation Twist-simultaneous purchase and sale of government securities under Open Market Operations(OMO) that is known as operation twist.

Operation twist used by Central banks to revive the economy by selling short term securities and buying long term securities through Open Market Operations(OMO) in order to bring down long term interest rates and bolster short term rates.

What is Open Market Operations (OMO)-in this Bank sell the government securities or buy the government securities in the open market this is called OMO so it can be either purchase or sale. But in Operation twist, both purchase and sale are done simultaneously.

What will happen with the sale of government securities and the purchase of government securities? What will happen to liquidity?

When Bank sells the government securities public will buy it and this will suck the excess liquid from the market.

When banks purchase government securities from the public Bank will inject liquidity.

How long term interest brought down?

When there is excess liquidity in the market the interest rate will come down.

When the demand for money is high- the interest rate will also be high and

When the demand for money is low- the interest rate will be less.

When the supply of money is high- the interest rate will be less.

When the supply of money is less- the interest rate will be high.

So I hope you can understand that Bank will try to bring down the long term interest rate by increasing the supply of money.

Operation Twist was first used in 1961 by the US federal reserve(Central Bank)as a way to strengthen the US dollar and stimulate cash flow into the economy.

Under this mechanism, the short term securities are transitioned into long term securities by selling short term securities and purchasing of long term securities.

Impact of Operation Twist-

As the central bank buys long term securities the demand for long-term securities increase and the prices will also increase because whenever demand is high the price is also high.

However, the bond yields come down with an increase in prices because of the inverse relationship between bond yields and bond prices.

Yield is the return an investor gets on his (bond) holding/investment.

The interest rate in an economy is determined by yield. If the yield is low interest rates decrease because the interest rate is directly related to yield. So this is how the interest rate will be brought down in an economy. When the interest rates are low people will avail more long term loans such as housing loans, vehicle loans, or financial projects.this will lead to a boost in consumption and spending in the economy which in turn will revive the growth.

If you have any questions or doubt plz comment

down below if you liked my explanation you can give me upvote.