Do you want to get out of debt faster? If you ask anyone with any sort of loan this question, the answer will be 'yes'. We all get into debt for different reasons, and we all want to get out of it as soon as possible.

We believe that paying off your debts, is one of the best ways to improving your financial circumstances. You'll be amazed at how a small change can help you pay off your loan years faster, and save you thousands of dollars.

Our tips are based on Australian mortgages, but we think they are applicable to all debts. We hope that one or two of them will help you become debt free faster:

1. Make Extra Repayments

When we apply for a mortgage, most of us commit to making the minimum payment. We set up a direct debit, and then the bank takes out their money every month. We don't want to pay more than we have to because we'd rather have extra funds left over for other purposes.

Try Buying Your Mortgage a Coffee a Day

Try putting an extra $100 per month into your mortgage. This would cost about the same as a daily cup of coffee, but provide significant savings. Most of us could put aside an extra $3 a day, so why not try it. Maybe try sending a little each week or each fortnight. All Australian mortgages have a BSB and Account number, and most allow extra payments, so you can easily transfer small amounts over as often as you like.

For Example

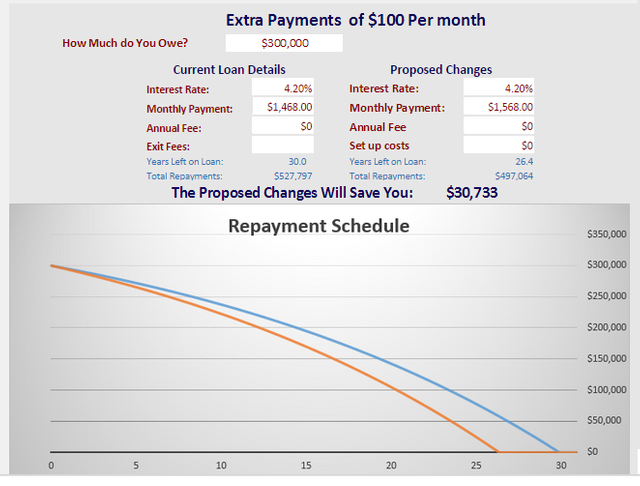

If you had a $300,000 variable home loan the minimum payment over 30 years, would be $1,468. If you chose to pay $1,568, you would pay off your mortgage more than 3 years faster and save over $30,700 in total loan repayments. This is shown below:

Thanks to the magic of compound interest, paying a little extra, makes a big difference over the life of your loan. We took a detailed look at extra loan payments, in our recent post on the topic

2. Have Your Salary Paid Into Your Mortgage

This technique, known as salary crediting, is often used as part of a mortgage professional package. Salary crediting means having all of your income paid into your loan (or offset) account. Next step is to use your credit card for your monthly spending. Each month you pay off your entire credit card within the interest free period (if you don't then credit card interest will be charged). This is shown in the diagram below:

How Does This Help My Mortgage?

By structuring your spending this way, you ensure that you are keeping as much money as possible in your mortgage at all times. Interest on your home loan is calculated daily. For each day you keep extra funds in your mortgage, you are charged less interest

Before you set up a salary credit, you need to ensure that your credit card has interest free days. Call your credit card issuer and arrange for the full payment to come out of your loan automatically every month. The interest free days on your credit card can help you pay off your mortgage faster.

A Note of Caution

This technique takes discipline. You need to make sure that you repay your credit card on time and in full every month. If you go over the interest free period, or have a balance remaining, then the bank will charge you interest on your credit card. The rate on cards is a lot higher than that on home loans so if you are not careful, this could end up costing you more. For this strategy to work, you need to be able to control your credit card spending

We recommend dedicating a credit card for this purpose and reducing the limit so that it is within an amount you can comfortably clear every month.

3. Use A Mortgage Offset Account

If you have a home loan, and you want to keep some cash in a separate account, then a mortgage offset account can work for you. This is not suitable for all loans, and usually beneficial for more complex mortgages such as those used for investment.

How Does a Mortgage Offset Account Work

Rather than earning interest on your savings, an offset account reduces the interest you are charged on your home loan.

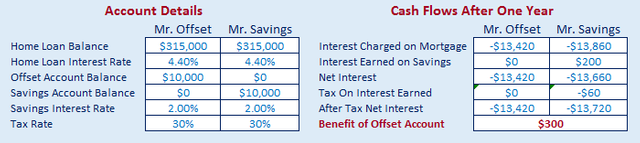

Unlike interest you earn on savings, there is no tax payable on interest you don't pay on your home loan. Added to this, the interest rate paid on savings is lower than what you are being charged on your home loan. When looking at interest and taxes, an offset is a much better place for your surplus cash, as illustrated below:

As we can see from our example above, Mr. Offset is $300 per year better off than Mr. Savings, because he put his $10,000 in an offset account rather than a savings account.

Caution

Depending on your bank, a 100% offset may not be available. There may be monthly fees charged for an offset account. Make sure that your benefits outweigh any costs before you set up an offset account. Remember putting extra money directly into your home loan provides the same benefit.

4. Negotiate Or Refinance To A Better Rate

In the current market, lenders are fighting hard to attract new business, and there is no shortage of good deals. It is a good time to review your loan and see if there is potential to get a better structure and save yourself some money.

How loyal are you to your bank? If you could find a better deal would you refinance to a new lender? Before you do this though it's worth calling your bank and asking them to match the other deal. They may not match some of the rock bottom deals being offered by their competitors but most of them will reduce your rate in an effort to retain your business

5. Consolidate All Your Debts Into Your Home Loan

If you have more than one debt, you should consider consolidation. This means moving your debts into one loan. We recommend moving all your debt to the lowest possible interest rate. If you have a mortgage, then this is usually where your lowest interest is.

How Does Consolidation Help?

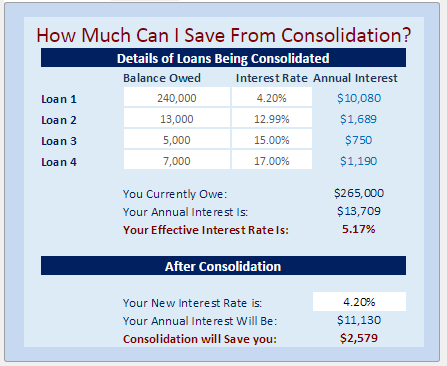

Imagine if you had a mortgage and three credit cards. You'd have the inconvenience of having to juggle four separate repayments. Moving all your debts to one low rate will reduce your overall interest and save you money, as shown below:

In the example above, we saved $2,579 in annual interest by refinancing our credit cards and consolidating them into our mortgage.

Before you Consolidate

Look at all your debts and confirm what interest you are being charged. Make sure that there is no penalty for making an early repayment. Consolidation might trigger fees, make sure that the cost of consolidating any given loan does not outweigh the benefits. For example, if you increase your mortgage so that it goes over 80% of your property value, you may end up paying Lenders Mortgage Insurance, which might outweigh the benefits of consolidation altogether.

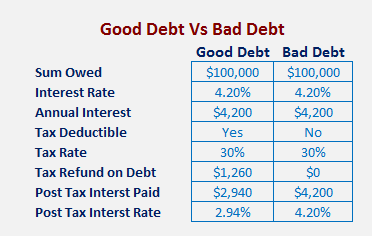

6. Keep Investment Debts Separate

When it comes to borrowing, financial advisers like to separate investment debt from non-investment debt. We call investment debt 'Good Debt' because it is tax deductible. Non-investment debt is called 'Bad Debt' because it is not tax deductible. The difference between the two is shown below:

As we can see, for our hypothetical person, Good Debt is 30% cheaper. This is because they will get a tax refund on the interest paid on loans which were used for investment income generating investments. Speak to a qualified tax professional before claiming a deduction on any loan

If you have a combination of Good Debt and Bad Debt, we think it's a good idea to focus your attention on paying off the Bad Debt first. To do this, you should pay interest only on Good Debt, and then pay as much as possible on your Bad Debt. Once all your Bad Debt is gone, then you can start paying down your Good Debt.

The Logic Behind This Strategy

Good Debt costs less. For our hypothetical case, it was 30% cheaper after tax. Every dollar you use to pay down Good Debt, will be 30% more financially beneficial if it were directed toward Bad Debt. Reducing As Good Debt reduces your tax deductible debt, don't pay it down until you have completely repaid your bad debt.