In our society today, most Americans are behind when it to comes saving money. Most people are not ready for retirement because they haven't been saving for years and they simply are not good with money. If you trying to have a great shot at having money when you get older you must learn how to manage your money. There are several ways you can do that and that is to save and invest. Most Americans who get to 40 years old have at least $10,000 save or even less. I know this might question you because you are wondering what that person was doing for all of those years. If you want to get good at money you must make smart decisions and get support. Always think about your future and how you want it to be, because that is the most important thing at the end of the day.

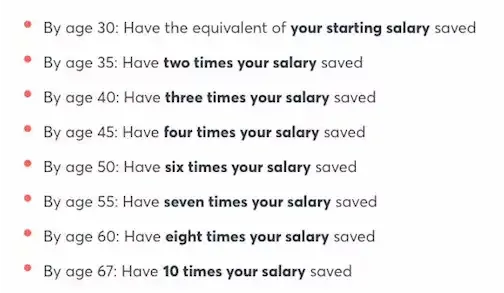

According to Fidelity investments by the time you reach you 30 you should have the equivalent of your annual salary saved. For instance if you make $55,000 each year, by the time you reach 30, you should have $55,000 saved. By the time you reach 40 you have 3 times your income. When you turn 50 you have six times your income. I now most people this is very scary, but I'm going to teach you how to fix this problem.

This chart is extremely because its going to show how to avoid traps and make better choices. I suggest if you are young start you retirement plan early as possible when you are in your 20's because it would save you a lot of headache. I suggest you work two jobs while you can so that way one income you can live off and the other its just for saving. You always want to be prepare as possible. I say you should save at least 10% of your income and then pay the rest of your bills. Make sure your track your expense because you know how to much to spend and save. Saving 10% of your income is go because by the time you reach your 40's you would have a lot of money and you would have not to worry about. When you reach your 40's you don't want to be worrying about bills and payments because it would cause stress, pain and heartache. I want things for you to be smooth.

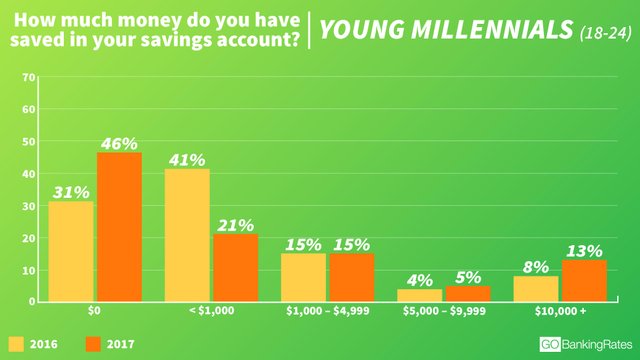

I'm showing this because when you reach 40 years old you don't want any debt because debt would ruin everything. I recommend if your are in debt get rid of that soon as possible because it can take years to pay off. I recommend you get financial support so it can be easier to address. I recommend you track your expenses I said earlier because a huge reason why people fall behind because their spend more what they save. I f you do this you would be in a world of trouble. There are a lot of tracking tools like mint or you can write it out. I use mint.com because its one of the best tool you can use for saving, they track every penny and receipt you put in the system.

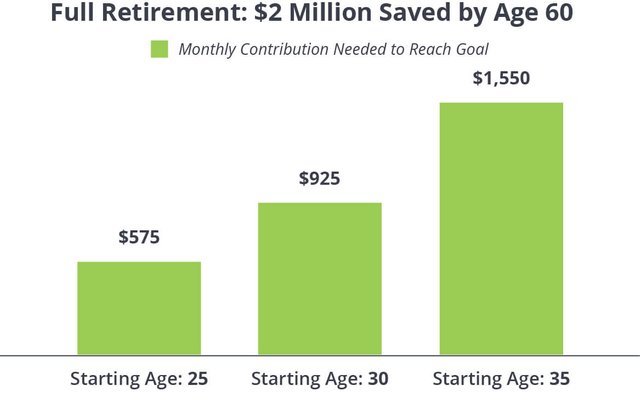

This chart is for people who are on a strict budget and they have difficult time for saving because I know right we are in rough times because of the corona virus and depending on your financial situation you have to be smart. I suggest if you save $400 a week or you can save $500 a month then you that. Based on your financial situation do what suits you and feel right. I normally save about $600 a month based on my income and my financial situation. Sometimes I save more or less depending on the month due to my expenses because sometimes it fluctuate. If you want to reach 40 years old and have like 20k to 30k you better start saving much as you can so that way you don't have any worries.