Today there are so many ways you boost your 401 or IRA, there is so many ways where you can let it grow and make a fortune out of it. Today in our society about 32% of americans have some form of retirement plan. I believe this is horrible, I believe every person should should sign up for an IRA through one of your local banks or get one from your job. This is important because when you get old you want to make sure you are financial stable for the long run.

When I turn 20 years old I open up IRA and I have to say its one of the best thing I have done because I'm 28 years old and I save so much money. The ROI has increase dramatically over the past 8 years. In addition my main goal is to become a IRA millionaire. I have to tell you guys it takes a lot of saving to do. If you serious about this the best thing is whenever you get paid throw about 2% of your pay check in there. Most people who put their money in IRA, when they turn 75 when they retire about 40% become millionaire. Some retire with 6 figures, however that is better than retiring with nothing.

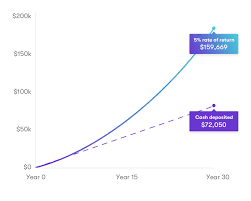

This chart explains if you put in the work you can reap the benefits of becoming successful with your IRA. If you really serious I suggest you go to banks such as TD Bank, Chase, Capital one or wells Fargo. They would help you and set everything up for you right there. The max you can put in IRA is $5,500 between ages 18-45. When you are a little older you can put like $6,000. I think that is great because sometimes you want to invest more when you are older. Another thing to be careful about doing this is don't withdraw your money before 59 because if you do, the government will tax you and you would have to pay a penalty. I suggest you let it grow and get when your are old. I believe that is the best thing you should do.

Most people in America they have 401k that are doing good and some are not. If you want to reap the the rewards out of your 401k, I suggest putting more into it. Most Americans should be putting 15% to 20% of their earnings in their retirement. The most you can put in your 401k is $19,500. This is great because if give you the opporuntity to invest more. The goal is to invest much as you can and not take it out.

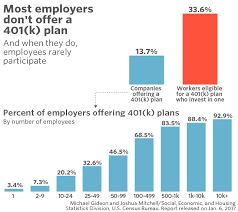

Make sure when you work for a job that your job offers a 401k and they match it. The reason why I say that because there is a lot of jobs that don't do that and when people want to retire they don't the like the money they have. They tend to be upset and they feel like they work for nothing.

This chart explains it all, you must be smart when it comes to investments. If ever unsure of anything make sure you seek financial help and support. The problem nowadays everyone is trying to figure out everything on their own, when you don't have to. We all need help and guidance every once in awhile, even myself. When I started on this retirement journey I read books and I ask for help I didn't try to figure out everything on my own because I knew I would make mistakes and have problems later on. What I did was read books, go on You tube and spoke to a financial advisor who guide me in the right direction.

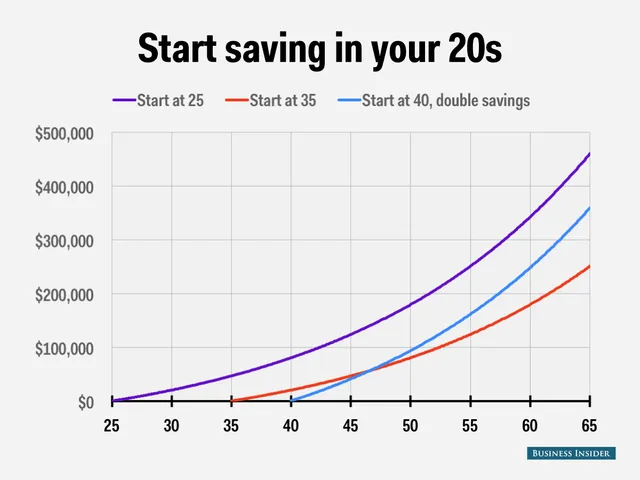

I highly suggest if your in your 20's start saving money fast as you can because don't wait until you in your 40's and 50's it would be difficult. The reason why I say that because there is a lot of people in society who are in their 40's and 50's and don't have a dime in retirement. They are not even ready or they haven't started at all. Please don't be those people. As soon you get your paycheck at your job throw something in their right away. The most terrifying thing is getting towards retirement and having nothing to retire with. Most people they began to panic and become crazy because they know they messed up. I made the decision not to fall into that situation when I get older because I don't want to be like those people.

you can see the growth and expansion of doing this when your are in your 20's because when you get older you really don't have to worry about anything. Your life is set and you have no worries. The only thing you have to worry about is protecting it from crazy people. This is my goal someday to reach a level like that inside this chart.

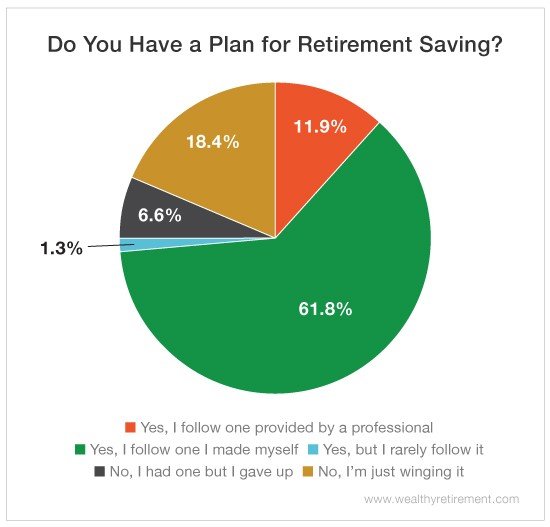

In America 21% people don't have retirement and that is very scary. You need a retirement account because if you don't have one you are going to be screw. Make sure you jump on board, the numbers are pretty high because people don't care about it.

I hope you gain something out of what I'm talking about and be smart when it comes to investing money and opening up to you get started on your retirement journey.