Whole Life Insurance, as a financial tool to build your own “Mini-Bank” was well know and used by multiple generations of farmers in America for over 100 years.

Today we review an illustration.

The name “Whole life insurance” is the name a life insurance policy that a farmer took out when he was very young and he used it for his “entire or whole life”, thus it earned the name “whole life”.

A “Whole Life” life insurance policy contains as an integral or core component, a savings account called the “Cash Value” of the policy, upon which the insurance company pays the Policy owner a guaranteed rate of compound interest. The guaranteed interest paid is “compound interest” and it accumulates within the savings account portion of the “Whole Life” insurance policy and it is called the “Cash Value” portion of the policy.

The farmer or policy owner is allowed to apply and receive “loans” against the cash value, for which he pays a “pre-agreed upon” and “fixed rate” of “simple interest” for the life of the policy. Which by design is in effect for his whole life, by design.

Because the loan was secured by the cash value the farmer didn’t need to submit to a credit check or provide tax returns or paystubs. He simply requested a loan in writing and he could receive the money in 1-2 days. Sooner if he went to insurance office in person, that way same day service was possible. The farmer used the cash value portion of his whole life policy as a financial instrument to finance his needs for purchases not unlike the way the modern individual uses financing from a bank to finance his purchases of things he needs every day. The farmer used this financing tool called cash value to finance the purchase of seeds and other essential equipment on a yearly basis while running his business, which was his farm. And this financial toll was an essential part of his financial ecosystem.

The whole life insurance policy allowed him to function to various degrees as an individual financier, independently of the banking system because he provided his own financing for his daily needs. Then when the farmer died he left to his wife and children the knowledge of this financial system which allowed him to function as an individual independently of the banking system because he provided his own financing for his needs and he left to them a death benefit which allow them to purchase the farm and pay off his debts when he died. Thus he created a personal debt facility with the loans collateralized by the cash value portion of the policy, which was essentially a personal bank. It is an independent financial system which basically financed his life and business and at the end of his life he made sure that his children were better off then he was financially by eliminating their main debt “the mortgage on the farm”, which was paid off by the death benefit of his whole life insurance policy.

These ideas and concepts were well known in America, but appear to have been lost in our transition from a largely farm based economy to a largely industrial one. Ironically, the only part of this knowledge, which remained widely distributed in our culture was the association of dying with the phrase “bought the farm”. But it is totally stripped of its financial ramification and financial achievement. The current understanding of the phrase is simply that someone died.

New Signature May 6th, 2020

Written by Shortsegments. ✍🏼

Shortsegments is a blogger or writer on social media application or platforms, some of which are running on blockchains.

Please follow @shortsegments Twitter Feed Here

Please upvote, resteem and consider leaving me a tip in BAT to support my blog

Thank you

BAT Basic Attention Token

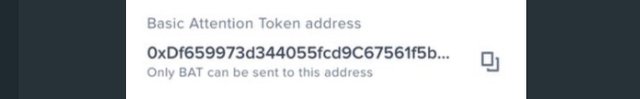

Send BAT tips to this BAT wallet:

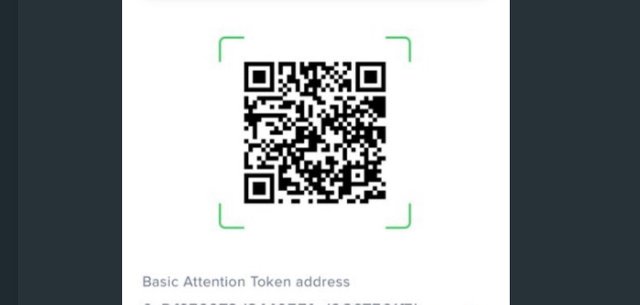

Or use QR reader to scan this symbol to send me BAT via QR scanner equipped wallet.

Thank you for supporting my content.

Shortsegments

@shortsegments

Please check out these Communities:

Banking and Finance

Flowers Pictures

Steemit Explained

Good explanation. I will refer to this post often,. Thank you very much

!giphy good+job

!popcorn

!beer

!ENGAGE25

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

giphy is supported by witness untersatz!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is really awesome. I keep searching for avenues of investments and was unaware that an insurance policy could actually benefit an individual and their family. I often read your articles on investment. Thank you for the knowledge you provide.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the kind words, I am happy you find the blog helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!ENGAGE50

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good information on the agents.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!giphy it’s+great

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit