Per l'ennesima volta la Banca Popolare Cinese ha dichiarato illegale Bitcoin e tutto il mondo delle criptovalute.

Perché?

Ufficialmente per contrastare le attività di hype legate al trading di criptovalute che stanno sconvolgendo l’ordine economico e finanziario della Cina, invocando i soliti argomenti: che le criptovalute favoriscono il riciclaggio di denaro sporco, che vengono usate per raccogliere fondi illegali, per frodare i piccoli investitori attraverso gli schemi piramidali e una lista infinita di altre attività illegali e criminali.

Certamente, c'è anche chi fa un uso delle crypto e dei progetti basati su di esse per scopi illeciti, ma in un mercato la cui capitalizzazione raggiunge 1.895 T di dollari a quanto ammonterà mai la percentuale di truffatori per giustificare un tale accanimento da parte del governo cinese?

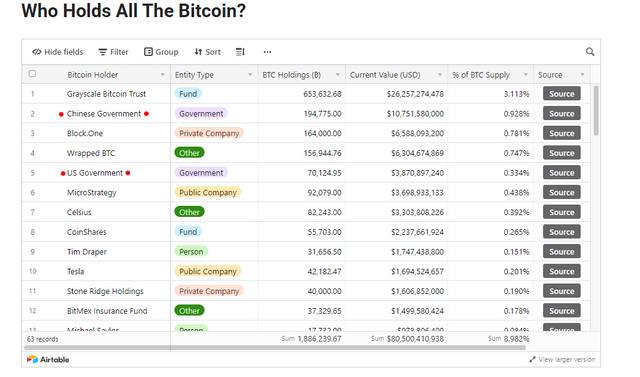

Ma soprattutto, se le criptovalute sono il male assoluto perché il governo cinese possiede lo 0,93% dei Bitcoin in circolazione?

Incuriosisce l'attacco costante alle crypto da parte della Cina visto che è al secondo posto della classifica dei maggiori possessori di Bitcoin, come si può vedere nel grafico sottostante.

Mi viene da pensare che la Banca Centrale Cinese abbia invitato le banche e gli exchange online a disincentivare le transazioni in Bitcoin e le altre criptovalute per spianare la strada allo yuan digitale, che è completamente centralizzato e gestito dalla banca centrale, l'opposto delle valute basate sulla tecnologia blockchain.

Tornando al grafico, oltre alla Cina, salta agli occhi un altro governo che si piazza la 5° posto della classifica come detentore dello 0,33% di Bitcoin totali e che non ha perso occasione nel tempo ad indebolire Bitcoin annunciando continuamente nuove tasse e regole per il settore delle cryptovalute.

Sto parlando del governo USA, proprio in queste ore l'Internal Revenue Service sta proponendo nuove riforme fiscali per regolamentare gli investimenti crypto negli USA. (Rif.)

Nel frattempo, in tutto questo trambusto e clamore per il crollo del mercato delle criptovalute, c'è chi ne approfitta per aumentare la propria esposizione a Bitcoin, come Morgan Stanley la principale banca d'investimento statunitense, aumentando del 105% le quote di GBTC (Grayscale Bitcoin Trust), (Rif.), e come si può vedere dal grafico precedente Grayscale possiede il 3% dei Bitcoin in circolazione, ben 653,632.68 BTC.

Mentre noi piccoli investitori rimaniamo in balia della situazione che molti la definiscono una manipolazione di mercato, altri la vedono una scelta politica, strategica, fatto sta che dal 24 settembre il mercato delle crypto è in profondo rosso.

Cosa fare?

Gli esperti del settore ci dicono di avere le mani di diamante, di non farci prendere dal panico svendendo i nostri asset, perché ottobre è vicinissimo e di solito è un mese favorevole per Bitcoin, e io aggiungo che non può mica piovere per sempre, prima o poi tutte le analisi tecniche e fondamentali che supportano le previsioni di un nuovo massimo storico di Bitcoin si prenderanno una bella rivincita.

Grazie per aver letto il mio post.

.jpg)

- ENG -

For the umpteenth time, the People's Bank of China has declared Bitcoin and the entire cryptocurrency world illegal.

**Why?

Officially to counter the hype activities related to cryptocurrency trading that are disrupting China's economic and financial order, invoking the usual arguments: cryptocurrencies promote money laundering, which are used to raise illegal funds, defraud small investors through pyramid schemes and an endless list of other illegal and criminal activities.

SourceTotal crypto market volume and capitalization, $

Of course, there are also those who make use of cryptos and crypto-based projects for illicit purposes, but in a market whose capitalization reaches $1,895T, how high is the percentage of scammers to justify such overkill by the Chinese government?

More importantly, if cryptocurrencies are the absolute evil why does the Chinese government own 0.93% of the Bitcoins in circulation?

I'm intrigued by China's constant attack on cryptocurrencies since it is second on the list of largest Bitcoin holders, as you can see in the chart below.

It occurs to me that the Chinese Central Bank has called on banks and online exchanges to disincentivize transactions in Bitcoin and other cryptocurrencies to pave the way for the digital yuan, which is completely centralized and managed by the central bank, the opposite of blockchain-based currencies.

Going back to the chart, in addition to China, another government jumps out at you, which ranks 5th on the list as holding 0.33% of total Bitcoin and has missed no opportunity over time to weaken Bitcoin by continually announcing new taxes and regulations for the cryptocurrency industry.

I'm talking about the US government, right now the Internal Revenue Service is proposing new tax reforms to regulate crypto investments in the US. (Ref.)

Meanwhile, in all this hoopla and hype over the cryptocurrency market crash, there are those who are taking advantage of it to increase their exposure to Bitcoin, such as Morgan Stanley the leading US investment bank, increasing the shares of GBTC (Grayscale Bitcoin Trust) by 105%, (Ref.), and as you can see from the chart above Grayscale owns 3% of the Bitcoins in circulation, a whopping 653,632.68 BTC.

While we small investors remain at the mercy of the situation many call it a market manipulation, others see it as a political, strategic choice, the fact is that since September 24 the crypto market has been in deep red.

What to do?

Industry experts are telling us to have diamond hands, to not panic by selling off our assets, because October is very close and is usually a favorable month for Bitcoin, and I add that "it can't always rain", sooner or later all the technical and fundamental analyses that support the predictions of a new Bitcoin all-time high are going to have a great rematch.

Thanks for reading my post.

.jpg)

With this post I am participating in Penny4Thoughts. Read more here.

I'm part of ITALYGAME Team

together with:

@girolamomarotta, @sardrt, @mad-runner, @ilnegro, @famigliacurione

.jpg)

👉

👉

I cinesi si stanno chiudendo.. perderanno di valore le loro azioni .. la loro economia subirà un calo nei prossimi mesi. Gli investitori non hanno voglia di investire in Paesi così chiusi al mondo. Questo è quello che penso.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

E' quello che spero, paesi del genere non possono dare garanzie in nessun ambito, figuriamoci nel mondo della finanza. ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just found out now, it turns out that the People's Government of China and the United States hold large amounts of BTC. This is important information, so that we small investors are not trapped in their political economic strategy. Even if in very small amounts, I will continue to hold BTC until I get a good profit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Unfortunately, it's always us small investors who lose out if we panic. But cryptos are here to stay. ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's right bro, if we are as small investors be panic, we will be destroyed.

Meanwhile, the whales will keep their investment until they reach high profit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it looks like China and America made that policy to drop the bitcoin exchange rate. After Bitcoin falls, they will buy and hold. Then make another policy that seems to support bitcoin, when the price goes up they sell it again. Fuck Them, I'll keep my bitcoins until I get a good profit. LoL

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Unfortunately, so many people new to bitcoin fall into the FUD trap and sell their cryptos at a low price and lose their money. Instead we need to hold every last satoshi. ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with you. As a trader I think we must be brave to take risks, without the courage to take risks there will be no profit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

money laundering is done even with dollars, this is not new, I think what they want is to spread fear and continue to buy BTC at lower prices, and they succeed, if we are used to all this, I do not understand why some people sell , this is a strategy that has been applied for many years, I think otherwise. I buy when the market bleeds.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I feel exactly the same way. We need to hang in there and see crypto as a long term investment, only then we never lose. ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It shows that all this they are doing for their own profit (digital yuan), which is already being used to pay taxes, services, among others, they care little or nothing about the rest. The BTC will say: Next stop Texas.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're right, they create FUD to drive the price down and then grab BTC at the lowest price. ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I see often china take exceptional decision about cryptocurrency. I understand a little their logic

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

For 12 years China has been trying to sink btc but apart from a few moments of FUD everything goes back as before. ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Whoever prevails overpoweringly even illegally?. The final results will be seen ...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, we'll eventually see the results, but in the meantime they mess up the markets and it's all red candles for a while. Luckily everything passes..;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think they put these measure in place so they can buy the dips and gain more cryptocurrency assets.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm starting to think so too! They stock up on BTC at bargain prices.. ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think one big concern of Bitcoin is that the unstableness of btc

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot for your comment. :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amazing post thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your comment. :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

China government is one of the most important holders of bitcoin in the world

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot for your comment. :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been upvoted by @italygame witness curation trail

If you like our work and want to support us, please consider to approve our witness

Come and visit Italy Community

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit