The world of cryptocurrencies is evolving daily. There are always new project fighting their way to be the next Bitcoin or Ethereum. But not all of these projects are great, and not all of them are worthy of an investment. This is why you need to investigate all altcoin projects before you invest in them.

Today’s altcoin spotlight is a cryptocurrency known as OlympusDAO or Ohm. This cryptocurrency is unique in that it functions like a federal reserve for the decentralized world. Although this sounds a bit weird, this technology truly has implications which could change the shape of the DEFI world.

If you’re ready to know more about Ohm and what it means for the future of cryptocurrency, then keep reading, because what you are about to find out may just knock your socks off.

What is Ohm?

OlympusDAO, often referred to by its trading symbol Ohm, is a unique cryptocurrency protocol which is based on an all-new algorithm. This algorithm combines the ideas behind both alt coins and stablecoins to invent a sort of federal reserve cryptocurrency.

Basically, when you buy Ohm, an equivalent amount of assets, normally DAI, is put into a vault. This money is held there until an equivalent amount of Ohm is burned. This makes Ohm a backed cryptocurrency similar to a stablecoin, but unlike a stablecoin, the value of an Ohm can change depending on how much cryptocurrency is currently stored in the vault.

There is a floor however, and this floor is 1 DAI. This means the value of Ohm will never fall below 1 DAI, and if it does, the protocol will burn tokens until the floor is once again reached. You also need to note however, that while the value of an Ohm depends on the vault, the value is not pegged. This means you could purchase an Ohm for $700, but there would only be the DAI equivalent of $24 backing it in the vault. If you want to know how much your coin is backed by, all you have to do is take the current vault amount, and divide it by the circulating supply (find this info on the Olympus website), this will let you know how much USD is behind one Ohm. The “vault” used in this calculation is also often referred to as the treasury.

But the true use and value of Ohm goes far beyond a stablecoin currency protocol. And this is because Olympus can actually lend out it’s protocol to other DEFI exchanges to assist with their liquidity pools. This means that an exchange like SushiSwap or PancakeSwap could use Ohm liquidity pools instead of having to make their own.

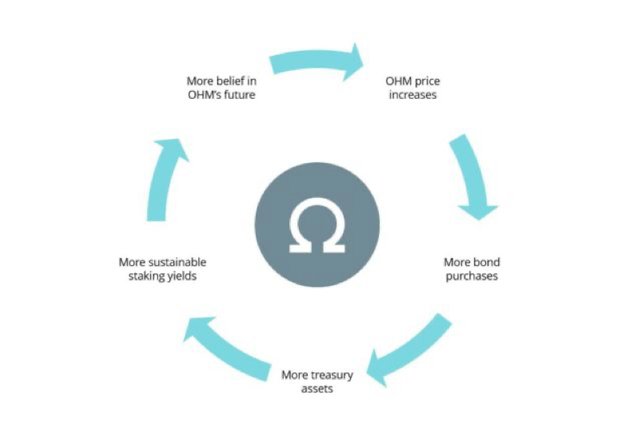

Ohm can do this because it owns its own liquidity. It does this by selling something called bonds. There are currently two types, and the ones that have to do with liquidity pools (which will be referred to in this article as lp bonds) are what allow Olympus to own and lend liquidity to other protocols in its partner program. The way you get lp bonds is by putting your money in a liquidity pool on a site that uses Olympus. When you deposit, you receive the lp bond. Then, you can take the lp bond to Olympus, and exchange it for discounted Ohm. This is a no risk process as you are given the exact value of Ohm that you deposited into the liquidity pool. You actually even make a bit of money because remember, you’ll get this Ohm at a discount.

Placing money in a liquidity pool isn’t the only way to get Ohm bonds however, as you can also get them by placing an asset in the Ohm vault. This asset can be of a variety of cryptocurrencies, with DAI being the most popular one that people deposit in exchange for these bonds. These bonds incentivize users to deposit their cryptocurrency in liquidity pools as well as purchase the token.

Staking Ohm

There is one more aspect of Ohm that hasn’t been discussed yet. And this is that you can stake the coin. When you want to stake Ohm, it works very similar to staking any other coin that runs on a proof of stake protocol. You will deposit your tokens into a dapp, and the protocol will use it to execute transactions. As a reward for staking your coin, you will be given Sohm, or staked-ohm. These rewards of Sohm are delivered quite frequently, every eight hours, and there is no lock up, meaning you can withdraw at any time. This makes Ohm a very rewarding token to stake.

Who Created Ohm?

Like many of the great cryptocurrency projects in the world, the creators of Ohm are shrouded in mystery. Ohm was created by a group of anonymous accounts with the names Zeus, Apollo, Unbanksy, and Wartul. The only named engineer on the project is Jeff Extor.

Ohm is a self-operating protocol (DAO) meaning there is no company behind the cryptocurrency, just people who work on it voluntarily. You can find out more information via the Olympus website, and by joining their discord channel.

Should You Buy Ohm?

If you haven’t noticed by now, Ohm is essentially a form of currency to be used within the cryptocurrency world. There are many projects already in this space, but none quite like Ohm as there are very few that maintain their value and incentivize users in the same way. Not to mention that Ohm has the partner program allowing it to be integrated into many DEFI exchanges. But here’s the problem, because Ohm is unique and the first of its type, it’s difficult to gauge whether or not it will be successful.

So, like any other cryptocurrency project discussed on this blog, you have to consider how you feel about the Ohm before you invest. Do you believe that Ohm has a purpose in the cryptocurrency world? If so, then it is probably a good buy for you. If you have your doubts however, then an investment in the Ohm token may just be too risky for your portfolio.

Overall, like any other investment in cryptocurrency, an investment in Ohm should be considered carefully. But you should also add this cryptocurrency to your watchlist, as it truly does have quite a bit of potential in the cryptocurrency world, especially if it its partner protocol program with DEFI exchanges takes off. And who knows? It could just be the next big thing.

This article was brought to you by Bitcoin Dice played on MintDice. Originally posted on the MintDice Crypto Blog.