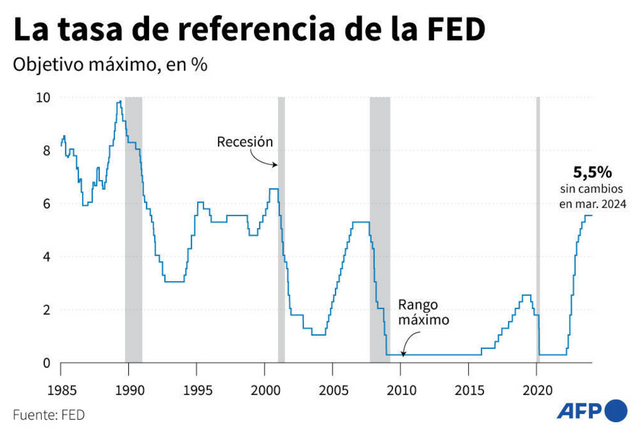

Bitcoin price for 2024 could benefit significantly if the US Federal Reserve cuts interest rates, which would increase the attractiveness of high-growth assets like cryptocurrencies. Some analysts project that with a potential rate cut and other favorable factors like institutional adoption and pro-crypto legislation, Bitcoin could reach $100,000 by the end of 2024.

In addition to the expected impact of interest rate cuts, there are several key factors that will influence the price of Bitcoin for the rest of 2024:

- Federal Reserve Rate Cut: Lowering interest rates tends to make alternative investments, such as Bitcoin, more attractive due to lower yields on bonds and other traditional assets. This could drive increased demand for Bitcoin, pushing up its price

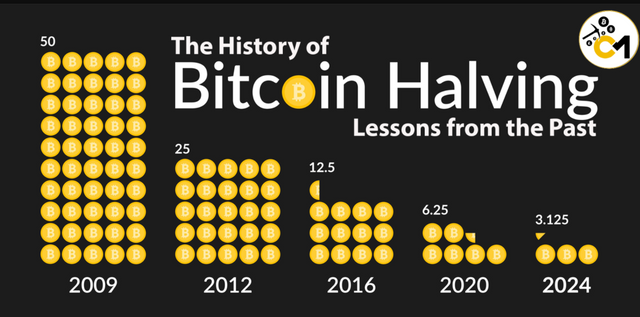

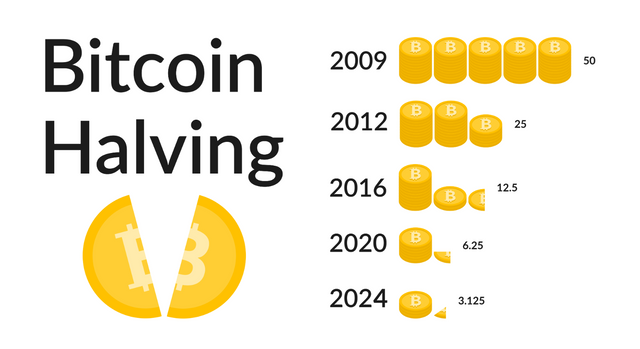

- Bitcoin Halving: In 2024, Bitcoin will experience a halving event, which will cut the reward for mining blocks in half. Historically, this type of event has been followed by significant price increases due to the reduction in the supply of new BTC

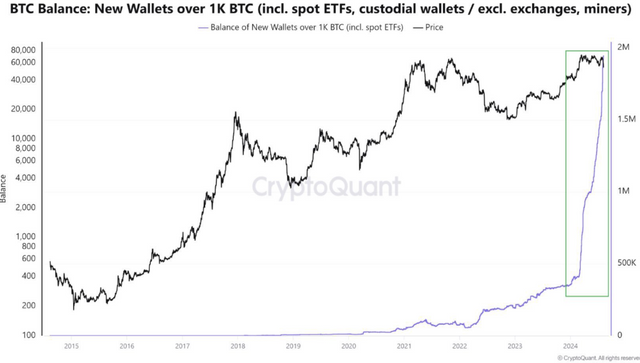

- Institutional Adoption: Bitcoin adoption by large financial institutions is expected to continue to grow, which could further increase demand and push the price higher. The approval of Bitcoin and Ethereum ETFs is attracting more institutional investors, which is generating greater confidence in the crypto market

- Favorable Legislation: Bipartisan support for cryptocurrency legislation in the United States, such as stablecoin laws, could improve the regulatory environment. This would increase market confidence and make it easier for more investors to participate

Taken together, these conditions could cause the price of Bitcoin to reach new all-time highs, with some forecasts placing the value of BTC close to $100,000 by the end of the year. However, market volatility remains a key factor to consider

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit