If forex trading is a game of buying and selling? Why then do trades, most especially, beginners still lose money? Many forex traders, especially beginners, think forex trading is like gambling. No, please I beg you not to think in such a way, it will only result in losses.

Forex trading is a difficult business, and if you want to trade forex, you must have to outsmart others in the market. This is simple, just to get more information than the other guy. "Information is the power they say".

Most forex traders have trading experience of more than 20 years. Thus, to make money as a beginner in forex trading, these are some knowledge and tips that will limit the learning curve in forex trading.

Tips For Beginners In Forex Trading.

Have a trading plan.

A trading plan is like a guide or event that must happen before you buy or sell. Here is an example of a trading plan for beginners in forex trading. For EURUSD a want to buy at 1.23455, with a stop loss of 70pips, for 0.01 lot size, I will lose 7 dollars if this trade those not go in my direction, RSI must be, below 30 and MACD is above zero levels. This is an example of a trading plan.

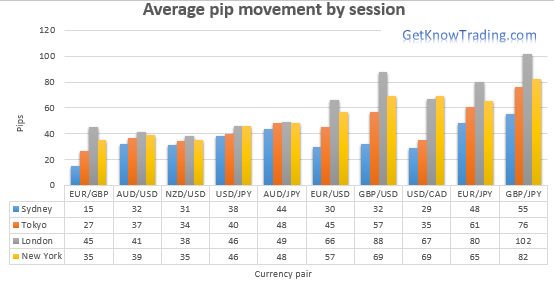

Have good capital, currencies can move 250pips of 120pips per day. And some days it might be more than. That means one must be prepared for the wave, be ready to swim with the sharks. Beginners can achieve this by using a small lot size.

Use a smaller lot size.

Setting of Stop Loss and Take Profit.

Your stop loss should be set just above the previous low when you are buying and just above the previous high when selling. If you use support and resistance as I do, then in a situation for selling, your stop loss must be some amount of pips above resistance if it is a sell and some amount of pips below support in a buy condition.

Using Pending orders As a beginner.

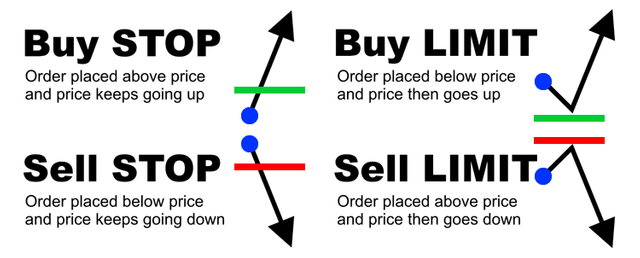

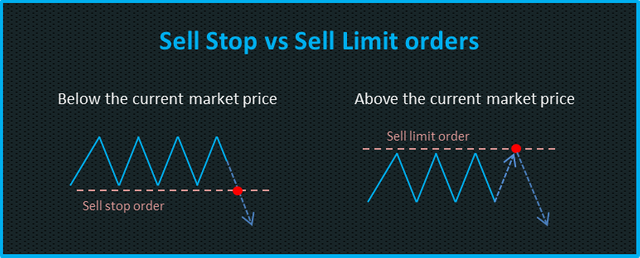

I had many losses when I started because of pending orders. A pending order is an order set by you on your trading platform, for the market to take you in at a particular price. Here are examples of pending orders: sell stop, sell limit, buy stop, and buy limit.

Sell limit: If the market is moving up and you fell, at so and so price says 1.2546 the market will start to fall or reverse.

Sell stop: This is my favorite. If the price is moving up, and feel the price will reverse back down. Instead of sell right at that price, you sell below that price. Hope I did not confuse you here.

I use it because what if I sell at a price and price goes above that price significantly, I will lose money, instead, I just sell below that price.

Thus if I am right price will fall through that level I set my sell stop like a stone thrown up.

Please follow me and share if you find this useful. Also, comment on any question below.

I want to tell you the story of choosing a broker - a funny story, I’ll start with the fact that I decided to plunge into the world of trading. Already at the start I realized that choosing a broker is like choosing a direction on a treasure map. So, I started with various reviews and reviews. And here it is fbs trading – like a bright light in a dark tunnel. I started delving into the system and discovered that they were not only reliable, but also technically cool. It’s like being at a real fair of opportunities – different instruments, currency pairs, crypto. Even analytics and educational resources are like a school for a trader.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit