According to the latest reports, an altcoin project has been hacked and hackers made a profit of $ 3.6 million using a bug in the BOG token contract.

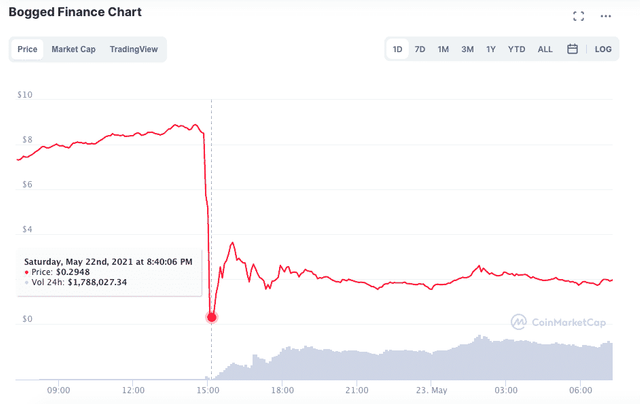

The #BOG token price, on the other hand, dropped to an intraday low of $ 0.29 due to the hack attack. The price has experienced an incredible collapse.

.jpg)

A #DeFi protocol running on the Binance Smart Chain (BSC) platform becomes more vulnerable to flash credit attacks. Recently, BSC suffered a second attack focused on the Defi protocol #Bogged #Finance (BOG). Earlier this week, a similar incident was reported for BSC-based Pancake #Bunny (BUNNY).

Source: CoinMarketCap

The price of the altcoin project Bogged Finance (BOG) fell 98% due to the attack. The coin slid from $ 8.6 to an intraday low of $ 0.29. However, the price of the altcoin project BOG has recovered from a low level and is currently trading at $ 1.8 with a market value of $ 4.5 million.

↘️Hackers made huge $ 3.6 million profit from attack

Blockchain security and data analytics firm #PeckShield reported the attack earlier today. According to root cause analysis, the Bogged Finance Defi protocol was abused by attackers while inflating the BOG balance. The attackers then made a massive $ 3.6 million profit while liquidating BOG tokens. PeckShield's analysis includes the following important statements:

The incident was caused by a mistake that allowed the attacker to increase balance through self-transfer. Although it looks like a flashloan attack, it is a flashswap supported attack.

🔥This Altcoin has been hacked

What was the error that the hackers exploited in the Bogged Finance (BOG) project?

As reported by PeckShield, the incident occurred using an error in the BOG tokeb contract. In reality, the contract was designed to be deflationary, charged at 5% of the transferred amount. 1% of this 5% is burned and the remaining 4% is charged as staking fee. At the same time, the token contract implementation charges only 1% of the transferred amount but still inflates 4% as stake profit. PeckShield's analysis includes the following important statements:

As a result, the attacker can take advantage of flashloans to significantly increase the staking amount and repeatedly self-transfer to claim the inflated staking profit. After that, the attacker immediately sells the inflated BOG for $ 3.6 million #WBNB