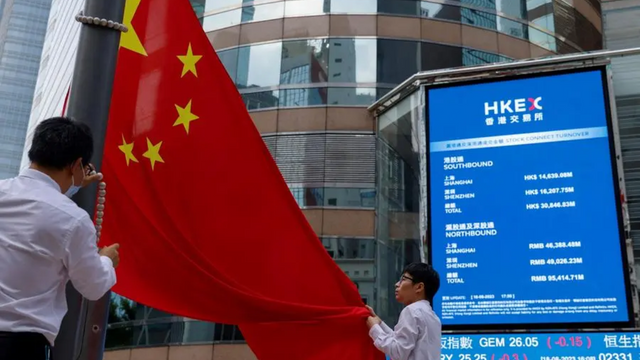

Global stock markets experienced a surge this week, fueled by increased expectations of interest rate cuts by major central banks and China's pledge for fiscal stimulus. The Stoxx 600 index in Europe reached a record high, while US futures and Chinese stocks also saw significant gains.

The Federal Reserve and European Central Bank are anticipated to continue their easing policies, bolstering market sentiment. Traders are keenly awaiting a pre-recorded address by Federal Reserve Chair Jerome Powell and crucial economic data releases later in the week.

"The communication from monetary and fiscal authorities across the globe has been obvious and unmistakable," stated Michael Brown, a strategist at Pepperstone Group Ltd. The simplest path seems to show an upward trend in both the short and medium term.

China's commitment to support fiscal spending and revive its economy has further fueled the rally. The stimulus measures have invigorated local assets and heightened overall risk tolerance.

Money markets have shifted their bets, now favoring a half-point cut by the Fed in November. This shift reflects growing optimism about the Fed's willingness to ease monetary policy in response to economic data.

On Friday, the U.S. central bank's favored price measure and a glimpse into consumer demand will offer additional insights regarding the state of the economy.

"The Federal Reserve is more focused on growth than they publicly acknowledge," stated Joe Davis, Chief Economist at Vanguard. "We believe they will take more assertive actions in the short term."

While China's stimulus package has boosted the CSI 300 Index, questions remain about its long-term impact. Some analysts believe that the market may experience a short-term pullback as investors assess the effectiveness of the measures.

Elsewhere, the Swiss National Bank made a 25 basis-point interest rate cut to address the strength of the Swiss franc. In the commodities market, oil prices fell for a second day due to increased Saudi Arabian production and a deal in Libya that could boost crude supply.

Israeli assets rallied following a proposed cease-fire between Israel and Hezbollah in Lebanon, brokered by the US, European Union, and major Middle Eastern powers.

Key Economic Events This Week:

ECB President Christine Lagarde's speech

US jobless claims, durable goods, revised GDP

Fed Chair Jerome Powell's pre-recorded remarks

China industrial profits

Eurozone consumer confidence

US PCE and University of Michigan consumer sentiment

Market Movements:

S&P 500 futures rose 0.8%

Nasdaq 100 futures rose 1.3%

Dow Jones Industrial Average futures rose 0.5%

Stoxx Europe 600 rose 1%

MSCI World Index rose 0.3%

Bloomberg Dollar Spot Index fell 0.2%

Euro remained relatively unchanged

British pound rose 0.2%

Japanese yen was little changed

Bitcoin rose 0.5%

Ether rose 1.6%